Johnson and Johnson 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JOHNSON & JOHNSON 2009 ANNUAL REPORT4

experienced an operational sales decline of . percent in ,

reecting the loss of nearly $ billion in sales due to losing market

exclusivity for

®

(risperidone) and

®

(topiramate).Excluding the impact of generic competition,

pharmaceutical sales increased by approximately percent

operationally.

This growth was driven by larger products, including

®

(iniximab), for the treatment of a number of

immune-mediated inammatory diseases;

®

(methylphenidate HCl) Extended-release Tablets in attention

deficit hyperactivity disorder (ADHD); and

®

®

(risperidone) Long-Acting Injection, an atypical

antipsychotic administered every two weeks for the treatment

of schizophrenia or the maintenance of bipolar disorder.

Promising newer products continued their positive growth

trajectory, such as

®

(darunavir) in HIV;

®

(bortezomib), for multiple myeloma, developed in partnership

with Millennium: The Takeda Oncology Company (we have rights

outside the U.S.);

®

(paliperidone), a once-daily atypical

antipsychotic for the treatment of schizophrenia or acute

schizoaective disorder; and

™

(etravirine), for

HIV combination therapy.

Our pharmaceutical pipeline is one of the most robust in our

history.We launched five newly approved drugs in :

™

(golimumab) and

™

(ustekinumab) in

immunology;

®

(tapentadol) Immediate Release

Tablets for pain relief and

®

™

(paliperidone

palmitate) for the treatment of schizophrenia; and

™

(dapoxetine) in select countries across the world in sexual health.

In addition, we continue to expand our core products with new

indications, a practice we have done well historically. For example,

®

now has FDA-approved indications across a broad

spectrum of immune system disorders.

Our future pipeline is promising. An important product in

registration is rivaroxaban, which we are co-developing with Bayer

HealthCare AG.Rivaroxaban is a novel oral anticoagulant that

may prevent a host of thrombotic conditions, including venous

thromboembolism and stroke in atrial fibrillation.It is being

evaluated in five dierent indications.And we have important

compounds in Phase III clinical trials, including treatments for

diabetes, prostate cancer and Alzheimer’s disease.

Building on our already strong pipeline, we engaged in

acquisitions and innovative agreements and collaborations with

companies that oer potentially significant advances in patient

care.These include a potential first-in-class treatment for slowing

the progression of Alzheimer’s disease (Elan Corporation, plc);

a potential universal monoclonal antibody product for the

treatment and prevention of inuenza (Crucell NV); an HIV

therapy with a single combination pill (Gilead Sciences, Inc.);

and a potential breakthrough in prostate cancer (Cougar

Biotechnology, Inc.).

While strengthening its pipeline, our Pharmaceuticals business

expanded geographically, with a focus on emerging markets.We

have been expanding our sales reach in China; maintaining a

strong manufacturing footprint in China, Mexico and Brazil; and

developing our R&D presence in emerging markets like India and

China by establishing an R&D operation in Mumbai, an R&D head-

quarters in Shanghai and a collaboration with Tianjin Medical

University Cancer Hospital on biomarker research.

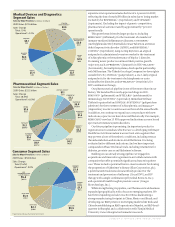

(in billions of dollars)

2009 Sales: $22.5 billion

Sales Change

Total: (8.3%)

Operational*: (6.1%)

LEVAQUIN®/

FLOXIN®

$1.6

(2.6%)

REMICADE®

$4.3

14.8%

PROCRIT®/

EPREX®

$2.2

(8.7%)

RISPERDAL®

$0.9

(57.7%)

RISPERDAL®

CONSTA®

$1.4

8.9%

CONCERTA®

$1.3

6.3%

OTHER

$7.6

6.6%

DURAGESIC®

$0.9

(14.3%)

ACIPHEX®/PARIET®

$1.1

(5.4%)

TOPAMAX®

$1.2

(57.9%)

(in billions of dollars)

2009 Sales: $23.6 billion

Sales Change

Total: 1.9%

Operational*: 4.2%

DEPUY®

$5.4

4.6%

ETHICON

ENDO-SURGERY®

$4.5

4.8%

DIABETES

CARE

$2.4

(3.7%)

ORTHO-CLINICAL

DIAGNOSTICS®

$2.0

6.6%

VISION

CARE

$2.5

0.2%

CORDIS®

$2.7

(10.3%)

ETHICON®

$4.1

7.3%

(in billions of dollars)

2009 Sales: $15.8 billion

Sales Change

Total: (1.6%)

Operational*: 2.0%

SKIN CARE

$3.5

2.5%

OTC

PHARMACEUTICALS

& NUTRITIONALS

$5.6

(4 . 5 %)

BABY CARE

$2.1

(4.5%)

WOUND

CARE/

OTHER

$1.1

9.4%

ORAL CARE

$1.6

(3.4%)

WOMEN’S

HEALTH

$1.9

(0.8%)

* Operational excludes the impact of currency