Johnson and Johnson 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER 3

Our ability to develop, challenge, motivate and reward a diverse

workforce is our cornerstone for sustained growth.

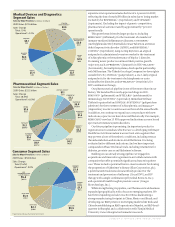

The people in our Medical Devices and Diagnostics, Pharma-

ceuticals and Consumer segments have consistently delivered

against plans for growth.These segments are each market leaders,

with No. or No. positions in many of their businesses.In fact,

percent of sales are from products with leading market share

positions, with approximately one-fourth of sales last year coming

from new products introduced in the past five years.

The Medical Devices and

Diagnostics (MD&D) franchises comprise the world’s largest

medical technology business, with sales of $. billion,

an increase of . percent operationally.Four of the seven

franchises had solid sales gains during the past year.Tougher

competition for drug-eluting stents and tighter out-of-pocket

spending on products like contact lenses and diabetes test strips

pressured sales in our Cordis Corporation, Diabetes and Vision

Care franchises.

Growth products spanned a range of treatment categories,

including wound care products and biosurgicals from Ethicon,

Inc.; energy technology and the

®

Adjustable Gastric

Band-C from Ethicon Endo-Surgery, Inc.; artificial joints, spine

and sports medicine products from DePuy, Inc.; and new products

from Ortho-Clinical Diagnostics, Inc.

Several products introduced new standards of care for the

medical devices industry.

®

from Biosense Webster, Inc.,

gives physicians a detailed three-dimensional view of the heart so

they can treat cardiac arrhythmias, including atrial fibrillation.

The

®

Hemostatic Matrix Kit, our advanced owable

hemostat for use in a broad range of surgical procedures, is the

first product launch from the acquisition of Omrix Biopharma-

ceuticals, Inc. and an example of technology resulting from the

combination of our medical device and biologics expertise.

Our Vision Care franchise continued the global rollout

of ·Day

®

TruEye

™

, the world’s first daily disposable

silicone hydrogel contact lens and an exciting breakthrough in

contact lens technology.We anticipate introduction in the

U.S. in .

MD&D also strengthened its portfolio through several recent

strategic acquisitions.These included Acclarent, Inc. in the ear,

nose and throat surgical space; Finsbury Orthopaedics, Ltd. in

hip implants; and Gloster Europe, a developer of innovative

area-decontamination technologies to help prevent health care-

acquired infections, a growing global concern.

The pipeline is strong with promising new products such as

®

System, the first computer-assisted personalized

sedation system, and the

®

CoMplete

™

Acetabular Hip

System, the first ceramic-on-metal hip replacement.Both products

received favorable recommendations from U.S. Food and Drug

Administration (FDA) Advisory Committees in .

In addition to new product introductions and robust pipelines,

MD&D continually expanded its global reach, particularly in

emerging markets, with research and development centers,

professional training centers and manufacturing facilities.

Our Pharmaceuticals segment, with sales

of $. billion, represents the world’s seventh largest pharmaceu-

tical business and fourth largest biotech business.The segment

STRATEGIC FRAMEWORK

OPERATING MODEL

BUSINESS PRIORITIES

The source of our enduring strength is a fundamental

commitment to Our Credo and an operating model

that has served us well for decades. High-level business

priorities reect the changing global environment and

provide leaders with a common set of growth priorities.

Our strategic framework has delivered enduring

performance and, we believe, will continue to provide

long-term value for our shareholders.