JCPenney 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

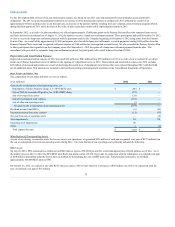

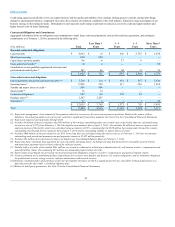

($ in millions)

(1) Represents management’s best estimate of the payments related to tax reserves for uncertain income tax positions. Based on the nature of these

liabilities, the actual payments in any given year could vary significantly from these amounts. See Note 18 to the Consolidated Financial Statements.

(2) Represents expected cash payments through 2023.

(3) Includes $4 million of interest related to the $650 million of borrowings outstanding under our variable rate credit facility that was calculated using

an interest rate of 3.25% from February 1, 2014 through the next maturity date of April 3, 2014. Also includes $8 million of interest expense on the

undrawn portion of the facility which was calculated using an interest of 0.5%, assuming that the $650 million borrowing under the facility remains

outstanding only through the next maturity date of April 3, 2014 and no outstanding standby or import letters of credit.

(4) Includes $600 million of interest related to our 2013 Term Loan that was calculated using the interest rate as of February 1, 2014 for the amounts

outstanding each period and assumes principal payments remain at $5.625 million quarterly.

(5) Includes $91 million of accrued interest that is included in our Consolidated Balance Sheet at February 1, 2014.

(6) Represents future minimum lease payments for non-cancelable operating leases, including renewals determined to be reasonably assured. Future

minimum lease payments have not been reduced for sublease income.

(7) Standby letters of credit, which totaled $481 million, are issued as collateral to a third-party administrator for self-insured workers’ compensation and

general liability claims. The remaining $25 million are outstanding import letters of credit.

(8) Surety bonds are primarily for previously incurred and expensed obligations related to workers’ compensation and general liability claims.

(9) Consists primarily of (a) minimum purchase requirements for exclusive merchandise and fixtures; (b) royalty obligations; and (c) minimum obligations

for professional services, energy services, software maintenance and network services.

(10)Amounts committed under open purchase orders for merchandise inventory of which a significant portion are cancelable without penalty prior to a

date that precedes the vendor’s scheduled shipment date.

(11)Relates to third-party guarantees. See Note 20 to the Consolidated Financial Statements.