JCPenney 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

x

o

xo

ox

xo

xo

o

xooo

ox

Table of contents

-

Page 1

...executive offices) (Zip Code) (972)-431-1000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Tct: Title of each class Common Stock of 50 cents par value Preferred Stock Purchase Rights Name of each exchange on which registered New York... -

Page 2

... 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accounting Fees and Services Part IV Item 15. Exhibits, Financial Statement Schedules Signatures... -

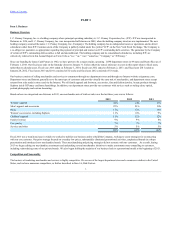

Page 3

... The new holding company assumed the name J. C. Penney Company, Inc. (Company). The holding company has no independent assets or operations, and no direct subsidiaries other than JCP. Common stock of the Company is publicly traded under the symbol "JCP" on the New York Stock Exchange. The Company is... -

Page 4

... and the accompanying name recognition to be valuable to our business. Website Tvailability We maintain an Internet website at www.jcpenney.com and make available free of charge through this website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and... -

Page 5

... Director of Executive Compensation and Retirement Plans. Mr. Laverty has served as Executive Vice President, Chief Information Officer since September 2013 after serving as interim Chief Information Officer since June 2013. He joined the Company as Senior Vice President, Business Solutions in 2012... -

Page 6

... of competitors as well as changes in their pricing and promotional policies, marketing activities, customer loyalty programs, new store openings, store renovations, launches of Internet websites, brand launches and other merchandise and operational strategies could cause us to have lower sales... -

Page 7

...other third parties. As part of our normal operations, we receive and maintain information about our customers (including credit/debit card information), our employees and other third parties. Confidential data must at all times be protected against security breaches or other unauthorized disclosure... -

Page 8

...website, www.jcpenney.com. As a result of a significant decline in sales volume through our website in fiscal 2012, we reorganized our Internet operations in fiscal 2013. Our Internet operations are subject to numerous risks, including rapid technological change and the implementation of new systems... -

Page 9

... become unable to supply us with products. Our arrangements with our suppliers and nendors may be impacted by our financial results or financial position . Substantially all of our merchandise suppliers and vendors sell to us on open account purchase terms. There is a risk that our key suppliers... -

Page 10

... our liquidity are funds generated from operating activities, available cash and cash equivalents, borrowings under our credit facilities, other debt financings, equity financings and sales of non-operating assets. We have sold a substantial amount of nonoperating assets over the past two years. We... -

Page 11

... which merchandise is imported. Political or financial instability, trade restrictions, tariffs, currency exchange rates, labor conditions, transport capacity and costs, systems issues, problems in third party distribution and warehousing and other interruptions of the supply chain, compliance... -

Page 12

...assumptions used to estimate pension income or expense for the year are the expected long-term rate of return on plan assets and the discount rate. In addition, at the measurement date, we must also reflect the funded status of the plan (assets and liabilities) on the balance sheet, which may result... -

Page 13

... to an annual limitation that is cumulative to the extent it is not all utilized in a year. This limitation is derived by multiplying the fair market value of the Company stock as of the ownership change by the applicable federal long-term tax-exempt rate which was 3.5% at February 1, 2014. To the... -

Page 14

... where there is a new cumulative 50 percentage point change under the rolling three year testing periods. The Company plans to continue its analysis of the elections available to it in filing its federal income tax return and the impact of the new regulations. If an ownership change should occur in... -

Page 15

... West Virginia Wisconsin Wyoming Puerto Rico 18 8 26 92 9 6 28 23 8 47 9 22 5 7 In May 2013, we entered into a $2.25 billion five-year senior secured term loan that is secured by mortgages on certain real property of the Company, in addition to liens on substantially all personal property of the... -

Page 16

... Total furniture distribution centers Total supply chain network Owned Owned Owned Owned 357 147 291 583 1,378 14,315 We also own our home office facility in Plano, Texas, and approximately 240 acres of property adjacent to the facility. Subsequent to our fiscal year end, we sold approximately... -

Page 17

... have a material adverse effect on our results of operations, financial position, liquidity or capital resources. Class Action Securities Litigation From October 1, 2013 through October 24, 2013, four purported class action complaints were filed naming the Company, Myron E. Ullman, III and Kenneth... -

Page 18

... from the Securities and Exchange Commission (SEC) requesting information regarding the Company's liquidity, cash position, and debt and equity financing, as well as the Company's underwritten public offering of common stock announced on September 26, 2013. On February 13, 2014, the Company received... -

Page 19

...and low market prices of our common stock on the NYSE for each quarterly period indicated, the quarter-end closing market price of our common stock, as well as the quarterly cash dividends declared per share of common stockO Fiscal Year 2013 Per shareO Dividend First Quarter Second Quarter Third... -

Page 20

...Department Stores over the same period. A list of these companies follows the graph below. The graph assumes $100 invested at the closing price of our common stock on the NYSE and each index as of the last trading day of our fiscal year 2008 and assumes that all dividends were reinvested on the date... -

Page 21

... Item 6. Selected Financial Data Five-Year Financial Summary ($ in millions, except per share data) Results for the year Total net sales Sales percent increase/(decrease)O Total net sales Comparable store sales (2) Operating income/(loss) As a percent of sales 2013 2012 2011 2010 2009... -

Page 22

... the full fiscal year and sales for jcpenney.com. (3) All stores opened during 2011. Gross selling space was 51 thousand square feet as of the end of 2013, 2012 and 2011. Non-GTTP Financial Measures We report our financial information in accordance with generally accepted accounting principles in... -

Page 23

... filing states related to the sale of the non-operating assets. (8) Represents the tax benefit for the last nine months of 2013 related to the Company's income tax benefit from income resulting from actuarial gains included in other comprehensive income. This tax benefit was offset by tax expense... -

Page 24

... the proceeds from the sale of operating assets. Free cash flow is a relevant indicator of our ability to repay maturing debt, revise our dividend policy or fund other uses of capital that we believe will enhance stockholder value. Free cash flow is considered a non-GAAP financial measure under the... -

Page 25

...stabilize our business and to rebuild the Company, working to create strategies for reconnecting with our core customer. Our prior strategy focused on everyday low prices, substantially eliminated promotional activities, emphasized brands in a shops presentation and introduced new merchandise brands... -

Page 26

...(in millions, except per share data) Total net sales Percent increase/(decrease) from prior year Comparable store sales increase/(decrease) (2) Gross margin Operating expenses/(income)O Selling, general and administrative Pension Depreciation and amortization Real estate and other, net Restructuring... -

Page 27

... a result of better in-stock merchandise positions, improvements in site performance and a favorable response to our promotional activity. The decline in total net sales was primarily related to our prior strategy that did not resonate with our customers. The prior strategy focused on everyday low... -

Page 28

... utilities and maintenance information technology administrative costs related to our home office, district and regional operations credit/debit card fees real property, personal property and other taxes (excluding income taxes) ($ in millions) SG&A As a percent of sales 2013 2012 $ 4,114 34... -

Page 29

...assets and benefit obligations, our 2014 Primary Pension Plan expense will change to income of $19 million compared to expense of $100 million in 2013. The flip to income for our Primary Pension Plan is primarily a result of strong asset performance and a 70 basis point increase in our discount rate... -

Page 30

... Other liabilities in the Consolidated Balance Sheets. During the third quarter of 2012, we sold our investments in four joint ventures that own regional mall properties for $90 million , resulting in net gains totaling $151 million . The gain exceeded the cash proceeds as a result of distributions... -

Page 31

... the U.S. and Puerto Rico rights of the monet ® trade name. See restructuring and management transition charges below for additional impairments related to stores scheduled to be closed in 2014. In 2012, store impairments totaled $26 million and related to 13 underperforming department stores that... -

Page 32

... websites CLADâ„¢ and Gifting Graceâ„¢ in the first quarter of 2012, and costs associated with the closing of our Pittsburgh, Pennsylvania customer call center in the second quarter of 2012. Operating Income/(Loss) and Adjusted Operating Income/(Loss) For 2013, we reported an operating loss... -

Page 33

... strategy. We underwent tremendous change as we began shifting our business model from a promotional department store to a specialty department store. 2012 was a difficult year, as our comparable store sales decreased 25.2%. Internet sales, which are included in comparable store sales, decreased... -

Page 34

...of sales sold as "everyday value" (+240 basis points); lower margins achieved on clearance merchandise sales combined with a greater penetration of clearance sales (-460 basis points); lower margins on services and other activities, which included the impact of free haircuts and promotionally priced... -

Page 35

...basis point decrease in our discount rate, an increase in the pension liability resulting from our voluntary early retirement program offered during the third quarter of 2011 and a decrease in the value of plan assets due to unfavorable capital market returns in 2011. In September 2012, as a result... -

Page 36

...-Operating Assets During the third quarter of 2012, we sold a building used in our former drugstore operations with a net book value of zero for $3 million resulting in a net gain of $3 million. Impairments In 2012, store impairments totaled $26 million and related to 13 underperforming department... -

Page 37

...of shortening the useful lives of department store fixtures that were replaced throughout 2013 with the build out of additional shops. Management transition During 2012 and 2011, we implemented several changes within our management leadership team that resulted in management transition costs of $41... -

Page 38

... of our eligible credit card receivables, accounts receivable and inventory. On May 22, 2013, we entered into a $2.25 billion five-year senior secured term loan that is guaranteed by J. C. Penney Company, Inc. and certain subsidiaries of JCP, and is secured by mortgages on certain real estate of JCP... -

Page 39

... this change to improve our cash position and align our vendor payment process to the process expected to be used after implementation of our new accounts payable system effective in the second quarter of 2013. The positive effect of this vendor payment schedule change on 2012 operating cash flow... -

Page 40

... quarter of 2012. During the year, we also opened 78 Sephora inside JCPenney stores and nine new department stores. In 2012, we received net proceeds of $526 million from the sale or redemption of non-operating assets including REIT shares or units, leveraged lease assets, investments in real estate... -

Page 41

... and strengthening our balance sheet. In addition, in accordance with our long-term financing strategy, we may access the capital markets opportunistically. Credit Facility On February 8, 2013, J. C. Penney Company, Inc., JCP and J. C. Penney Purchasing Corporation (Purchasing) entered into an... -

Page 42

...to our long-term credit ratings could result in reduced access to the credit and capital markets and higher interest costs on future financings. Contractual Obligations and Commitments Aggregated information about our obligations and commitments to make future contractual payments, such as debt and... -

Page 43

..." method) or market, determined under the Retail Inventory Method (RIM) for department stores, store distribution centers and regional warehouses and standard cost, representing average vendor cost, for merchandise we sell through the Internet at jcpenney.com. Under RIM, retail values are converted... -

Page 44

... Statement of Operations in the line item Real estate and other, net. Fiscal 2013 was a transitional year in which we worked to stabilize our business and to rebuild the Company, working to create strategies for reconnecting with our core customer. Our former strategy focused on everyday low prices... -

Page 45

... amounts are discounted using a risk-free rate. We do not anticipate any significant change in loss trends, settlements or other costs that would cause a significant fluctuation in net income. However, a 10% variance in the workers' compensation and general liability reserves at year-end 2013 would... -

Page 46

..., to estimate the cost of remediation. Our experience, as well as relevant data, was used to develop a range of potential liabilities, and a reserve was established at the time of the sale of our drugstore business. The reserve is adjusted as payments are made or new information becomes known. In... -

Page 47

...), real estate (private and public) and alternative asset classes. The expected return on plan assets is based on the plan's long-term asset allocation policy, historical returns for plan assets and overall capital market returns, taking into account current and expected market conditions. In 2012... -

Page 48

... fund and conduct its operations, a systems failure and/or security breach that results in the theft, transfer or unauthorized disclosure of customer, employee or Company information, legal and regulatory proceedings, significant changes in discount rates, actual investment return on pension assets... -

Page 49

... management of our Company believes that, as of February 1, 2014 , our Company's internal control over financial reporting is effective based on those criteria. The Company's independent registered public accounting firm, KPMG LLP, has audited the financial statements included in this Annual Report... -

Page 50

...J. C. Penney Company, Inc. and subsidiaries as of February 1, 2014 and February 2, 2013, and the related consolidated statements of operations, comprehensive income/(loss), stockholders' equity and cash flows for each of the years in the three-year period ended February 1, 2014, and our report dated... -

Page 51

... The Statement of Business Ethics and Corporate Governance Guidelines are available on our website at www.jcpenney.com. Additionally, we will provide copies of these documents without charge upon request made toO J. C. Penney Company, Inc. Office of Investor Relations 6501 Legacy Drive Plano, Texas... -

Page 52

..., and Director Independence The information required by Item 13 is included under the captions "Policies and Procedures with Respect to Related Person Transactions " and "Board Independence " in our Company's definitive proxy statement for 2014, which will be filed with the Securities and Exchange... -

Page 53

... has been submitted in the Consolidated Financial Statements and related financial information contained otherwise in this Annual Report on Form 10-K. 3. ExhibitsO See separate Exhibit Index beginning on page 102. Each management contract or compensatory plan or arrangement required to be filed... -

Page 54

.... J. C. PENNEY COMPANY, INC. (Registrant) By /s/ Kenneth H. Hannah Kenneth H. Hannah Executive Vice President and Chief Financial Officer DateO March 21, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 55

... officer); Director Executive Vice President and Chief Financial Officer (principal financial officer) Date March 21, 2014 Kenneth H. Hannah* Kenneth H. Hannah /s/ Dennis P. Miller Dennis P. Miller March 21, 2014 Senior Vice President and Controller (principal accounting officer) March 21, 2014... -

Page 56

... Other Assets 7. Other Accounts Payable and Accrued Expenses 8. Other Liabilities 9. Fair Value Disclosures 10. Credit Facility 11. Long-Term Debt 12. Stockholders' Equity 13. Stock-Based Compensation 14. Leases 15. Retirement Benefit Plans 16. Restructuring and Management Transition 17. Real Estate... -

Page 57

... financial statements referred to above present fairly, in all material respects, the financial position of J. C. Penney Company, Inc. and subsidiaries as of February 1, 2014 and February 2, 2013 , and the results of their operations and their cash flows for each of the years in the threeyear period... -

Page 58

...share data) Total net sales Cost of goods sold $ Gross margin Operating expenses/(income)O Selling, general and administrative (SG&A) Pension Depreciation and amortization Real estate and other, net Restructuring and management transition 2013 11,859 8,367 3,492 $ 2012... Financial Statements. 58 -

Page 59

...) $ 2012 2011 (985) $ (152) Other comprehensive income/(loss), net of taxO Real estate investment trusts (REITs) Unrealized gain/(loss) Reclassification adjustment for realized (gain)/loss Retirement benefit plans Net actuarial gain/(loss) arising during the period Prior service credit/(cost... -

Page 60

... Contents CONSOLIDTTED BTLTNCE SHEETS (In millions, except per share data) Tssets Current assetsO Cash in banks and in transit Cash short-term investments Cash and cash equivalents Merchandise inventory Income tax receivable Deferred taxes Prepaid expenses and other 2013 2012 $ 113 1,402 1,515... -

Page 61

...EQUITY Number of Common Shares 236.7 - - - - (24.4) (in millions) January 29, 2011 Net income/(loss) Other comprehensive income/(loss) Dividends declared, common Common Stock Tdditional Paid-in $ Stock warrant issued Common stock repurchased and retired Stock-based compensation January 28, 2012... -

Page 62

... Benefit plans Stock-based compensation Excess tax benefits from stock-based compensation Other comprehensive income tax benefits Deferred taxes Change in cash fromO Inventory Prepaid expenses and other assets Merchandise accounts payable Current income taxes Accrued expenses and other 2013 2012... -

Page 63

... increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period 3,188 585 930 (274) (577) 1,507 Cash and cash equivalents at end of period $ 1,515 $ 930 $ (1,065) (1,115) 2,622 1,507 See the accompanying notes to the Consolidated Financial Statements. 63 -

Page 64

... national retailer, operating 1,094 department stores in 49 states and Puerto Rico, as well as through our Internet website at jcpenney.com. We sell family apparel and footwear, accessories, fine and fashion jewelry, beauty products through Sephora inside JCPenney, and home furnishings. In addition... -

Page 65

... to information technology, administrative costs related to our home office and district and regional operations, real and personal property and other taxes (excluding income taxes) and credit card fees. Adnertising Advertising costs, which include newspaper, television, Internet search marketing... -

Page 66

...short-term maturity. Cash in banks and in transit also include credit card sales transactions that are settled early in the following period. Merchandise Innentory Inventories are valued at the lower of cost (using the first-in, first-out or "FIFO" method) or market. For department stores, regional... -

Page 67

... asset over its fair value and is included in Real estate and other, net on the Consolidated Statements of Operations. We estimate fair value based on either a projected discounted cash flow method using a discount rate that is considered commensurate with the risk inherent in our current business... -

Page 68

...at the reporting date. Retrospective application is also permitted. This update is effective for annual periods, and interim periods within those years, beginning after December 15, 2013. We do not anticipate the adoption will have a material impact on our consolidated results operations, cash flows... -

Page 69

... assets consist of our trade name Liz Claiborne and our ownership of the U.S. and Puerto Rico rights of the monet trade name. During the fourth quarter of 2013, as a result of sales performance below our expectations, we decided to reduce our future product offerings under the monet trade name... -

Page 70

... 2013 and 2012, we sold all of our investments in public REIT assets (see Note 17). The market values of our investment in public REIT assets were accounted for as available-for-sale securities and were carried at fair value on an ongoing basis in Other assets in the Consolidated Balance Sheets... -

Page 71

... savings from ownership of the intangible asset. Key assumptions in determining relief from royalty include, among other things, discount rates, royalty rates, growth rates, sales projections and terminal value rates. In 2013, our ownership of the U.S. and Puerto Rico rights of the monet trade name... -

Page 72

..., accounts receivable and inventory. The 2013 Credit Facility is available for general corporate purposes, including the issuance of letters of credit. Pricing under the 2013 Credit Facility is tiered based on JCP's senior unsecured long-term credit ratings issued by Moody's Investors Service... -

Page 73

... Due 2037 7.625% Notes Due 2097 7.65% Debentures Due 2016 7.95% Debentures Due 2017 Term Loan Total notes and debentures LessO current maturities Total long-term debt Weighted-average interest rate at year end Weighted-average maturity 2013 2012 400 300 400 $ $ 400 300 400 200 200 2 10... -

Page 74

... and is secured by mortgages on certain real estate of JCP and the guarantors, in addition to substantially all other assets of JCP and the guarantors. Proceeds of the 2013 Term Loan Facility were used to fund the Amended Tender Offer and will be used to fund ongoing working capital requirements and... -

Page 75

...other comprehensive income/(loss)which is offset by a tax benefit on the loss for the year. See Note 18. (2) During the second quarter of 2012, the reclassification adjustment for the Simon Property Group, L.P. (SPG) units of $270 million was calculated by using the closing fair market value per SPG... -

Page 76

.../(Loss) 2013 2012 2011 Line Item in the Consolidated Statements of Operations $ (24) $ (270) $ Total, net of tax - 8 (16) 176 7 (1) (8) (15) 101 (184) 243 - - - - 155 1 (1) (25) Real estate and other, net Real estate and other, net Income tax expense/(benefit) Retirement benefit plans... -

Page 77

... shares were retired on the date of purchase, and the excess of the purchase price over par value was allocated between reinvested earnings and additional paid-in capital. Stockholders' Rights Agreement As authorized by our Company's Board of Directors (the Board), on January 27, 2014, the Company... -

Page 78

...to purchase a number of shares of Common Stock from the Company having an aggregate market value (as defined in the Amended Rights Agreement) equal to twice the then-current exercise price for an amount in cash equal to the then-current exercise price. The Rights will not prevent an ownership change... -

Page 79

...February 1, 2014, all outstanding stock options had an exercise price above the closing price of JCPenney common stock of $5.92. If all outstanding options were exercised, common stock outstanding would increase by 4.6%. Cash proceeds, tax benefits and intrinsic value related to total stock options... -

Page 80

... of February 1, 2014 , we had $18 million of unrecognized compensation expense related to unearned employee stock awards, which will be recognized over the remaining weighted-average vesting period of approximately two years. The aggregate market value of shares vested during 2013, 2012 and 2011 was... -

Page 81

... well as 401(k) savings, profit-sharing and stock ownership plan benefits to various segments of our workforce. Retirement benefits are an important part of our total compensation and benefits program designed to retain and attract qualified, talented employees. Pension benefits are provided through... -

Page 82

... Operations (see Note 16). As a result of these curtailments, the liabilities for our Supplemental Retirement Program and Benefit Restoration Plan were remeasured as of October 15, 2011. The discount rate used for the October 15 remeasurements was 5.06% as compared to the year-end 2010 discount rate... -

Page 83

... are as followsO ($ in millions) Primary Pension Plan Service cost Interest cost Expected return on plan assets Amortization of actuarial loss/(gain) Amortization of prior service cost/(credit) Settlement expense Net periodic benefit expense/(income) 2013 2012 2011 $ 78 204 (340) $ 87 242... -

Page 84

... for 2013 and 2014 was further reduced from 7.5% to 7.0% given our new asset allocation targets and updated expected capital markets return assumptions. The discount rate used to measure pension expense each year is the rate as of the beginning of the year (i.e., the prior measurement date). In... -

Page 85

... debt securities) and other asset classes to maintain an efficient risk/return diversification profile. In 2011 and 2012, we shifted 15% and 5%, respectively, of the plan's target allocation from equities into fixed income. In 2013, we added an allocation to low volatility hedge fund strategies... -

Page 86

... updated market and liability information. Actual asset allocations are monitored monthly and rebalancing actions are executed at least quarterly, if needed. To manage the risk associated with an actively managed portfolio, the plan's management team reviews each manager's portfolio on a quarterly... -

Page 87

... securities Corporate loans Municipal bonds Mortgage backed securities Other fixed income Fixed income total Public REITs Private real estate Real estate total Hedge funds Other investments total Total investment assets at fair value Liabilities Swaps Other fixed income Fixed income total... -

Page 88

... backed securities Corporate loans Government securities Other fixed income Fixed income total - 1,535 3 3 - 6 - 574 1,171 871 216 49 26 54 8 35 2,430 297 297 - 10 $ 78 161 407 Public REITs Private real estate Real estate total 133 - 133 Total investment assets at fair value $ $ 1,702... -

Page 89

... market transactions for comparable assets, (2) the income approach using the discounted cash flow model, or (3) cost method. Private equity funds also provide audited financial statements. Private equity investments are classified as level 3 of the fair value hierarchy. Corporate Bonds - Corporate... -

Page 90

... rates do not materially affect the accumulated postretirement benefit obligation or our annual expense. Postretirement Plan (Income) ($ in millions) Interest cost Amortization of actuarial loss/(gain) Amortization of prior service cost/(credit) Net periodic benefit expense/(income) 2013 2012... -

Page 91

... - 13 4 $ $ Change in fair value of plan assets Beginning balance Participant contributions Company contributions Benefits (paid) Balance at measurement date - 14 (17) $ $ - (15) (1) $ $ 2 (16) - (18) (1) Funded status of the plan (1) Of the total accrued liability, $2 million for 2013 and... -

Page 92

...our operating cash flow and cash investments. The expense for these plans, which was predominantly included in SG&A expenses on the Consolidated Statements of Operations, was as followsO ($ in millions) Savings Plan - 401(k) Savings Plan - retirement account Mirror Savings Plan Total 2013 2012 38... -

Page 93

... outlet stores In the fourth quarter of 2010, we announced our plan to exit our catalog outlet stores, and, in October 2011, we sold the assets related to this operation. We sold fixed assets and inventory with combined net book values of approximately $31 million , for a total purchase price of... -

Page 94

... call center. Activity for the restructuring and management transition liability for 2013 and 2012 was as followsO ($ in millions) January 28, 2012 Charges Cash payments Non-cash February 2, 2013 Charges Cash payments Non-cash February 1, 2014 Supply Chain $ 3 Home Office 19 (18) (2) and Stores... -

Page 95

...Net gain on sale or redemption of non-operating assets Dividend income from REITs Investment income from joint ventures Net gain from sale of operating assets Store impairments Intangible asset impairment Operating asset impairments Other Real estate and other (income)/expense, net 2013 2012 2011... -

Page 96

... the fourth quarter of 2013, we recorded a $9 million impairment charge for our ownership of the U.S. and Puerto Rico rights of the monet trade name. (See Note 9). In 2012, store impairments totaled $26 million and related to 13 underperforming department stores that continued to operate (See Note... -

Page 97

... vacation pay Gift cards Stock-based compensation State taxes Workers' compensation/general liability Accrued rent 2013 2012 $ 62 28 69 69 36 93 32 $ 42 Mirror savings plan Pension and other retiree obligations Net operating loss and tax credit carryforwards Other Total deferred tax assets... -

Page 98

... year to the aggregate fair market value of the company's common stock immediately prior to the ownership change, multiplied by the long-term tax-exempt interest rate in effect for the month of the ownership change. As discussed in Note 12, on January 27, 2014, the Board adopted the Amended Rights... -

Page 99

... cash flow information Income taxes received/(paid), net Interest received/(paid), net Supplemental non-cash investing and financing activity Increase/(decrease) in other accounts payable related to purchases of property and equipment Financing costs withheld from proceeds of long-term debt Purchase... -

Page 100

... the sale of our Direct Marketing Services business. In connection with the sale of the operations of our outlet stores, we assigned leases on certain outlet store locations to the purchaser. In the event that the purchaser fails to make the required lease payments, we continue for a period of time... -

Page 101

... prior strategy. (7) Restructuring and management transition charges (See Note 16) by quarter for 2012 consisted of the following: ($ in millions) Supply chain Home office and stores First Quarter Second Quarter Third Quarter Fourth Quarter 3 4 $ 6 $ 10 $ $ - 4 Software and systems 45... -

Page 102

..., as Successor Trustee to Bank of America National Trust and Savings Association) to Indenture dated as of October 1, 1982 10-K 001-15274 4(o) 4/25/2002 4.7 Sixth Supplemental Indenture, dated as of May 20, 2013, among J. C. Penney Corporation, Inc., J. C. Penney Company, Inc., as co-obligor... -

Page 103

..., National Association, as LC Agent First Amendment, dated as of May 20, 2013, to the Amended and Restated Credit Agreement, dated as of January 27, 2012, as further amended and restated as of February 8, 2013, among J. C. Penney Company, Inc., J. C. Penney Corporation, Inc., J. C. Penney Purchasing... -

Page 104

...representative with respect to the ABL credit agreement, Goldman Sachs Bank USA, as representative with respect to the term loan agreement, J. C. Penney Company, Inc., J. C. Penney Corporation, Inc. and the subsidiary guarantors party thereto Asset Purchase Agreement dated as of April 4, 2004, among... -

Page 105

... Term Life Insurance Plan for Management Profit-Sharing Associates, as amended and restated effective July 1, 2007 Form of Notice of Restricted Stock Unit Award under the J. C. Penney Company, Inc. 2001 Equity Compensation Plan Form of Notice of Restricted Stock Award under the J. C. Penney Company... -

Page 106

... Election to Defer under the J. C. Penney Company, Inc. Deferred Compensation Plan for Directors Form of Notice of Grant of Stock Options for Executive Officers subject to Executive Termination Pay Agreements under the J. C. Penney Company, Inc. 2005 Equity Compensation Plan Form of Notice of Grant... -

Page 107

... Form of Notice of Non-Associate Director Restricted Stock Unit Award under the J. C. Penney Company, Inc. 2009 Long-Term Incentive Plan Consumer Credit Card Program Agreement by and between JCP and GE Money Bank, as amended and restated as of November 5, 2009 First Amendment, dated as of October 29... -

Page 108

Table of Contents Incorporated by Reference Filed (†) SEC Exhibit No. Filing Herewith (as indicated) Exhibit Description Form File No. Exhibit Date 24 31.1 Power of Attorney ††Certification by CEO pursuant to 15 U.S.C. 78m(a) or 780(d), as adopted pursuant to Section 302 of the ... -

Page 109

... Company, Inc. Computation of Ratios of Earnings to Fixed Charges (Unaudited) 52 Weeks Ended 2/1/2014 $ (1,886) 53 Weeks Ended 2/2/2013 $ (1,536) 52 Weeks Ended 1/28/2012 $ (229) 52 Weeks Ended 1/29/2011 $ 581 231 52 Weeks Ended 1/30/2010 ($ in millions) Income/(loss) from continuing operations... -

Page 110

... OF THE REGISTRANT Set forth below is a direct subsidiary of the Company as of March 21, 2014 . All of the voting securities of this subsidiary are owned by the Company. Subsidiaries J. C. Penney Corporation, Inc. (Delaware) The names of other subsidiaries have been omitted because these... -

Page 111

... our reports dated March 21, 2014, with respect to the consolidated balance sheets of J. C. Penney Company, Inc. and subsidiaries as of February 1, 2014 and February 2, 2013, and the related consolidated statements of operations, comprehensive income/(loss); stockholders' equity, and cash flows for... -

Page 112

... directors and officers of J. C. PENNEY COMPANY, INC., a Delaware corporation, which will file with the Securities and Exchange Commission, Washington, D.C. ("Commission"), under the provisions of the Securities Exchange Act of 1934, as amended, its Annual Report on Form 10-K for the fiscal year... -

Page 113

... financial information; and (h) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 21, 2014 /s/ Myron E. Ullman, III Myron E. Ullman, III Chief Executive Officer -

Page 114

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 21, 2014 /s/ Kenneth Hannah Kenneth Hannah Executive Vice President and Chief Financial Officer -

Page 115

...the Securities Exchange Act of 1934; and (2) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. DATED this 21st day of March 2014 . /s/ Myron E. Ullman, III Myron E. Ullman, III Chief Executive Officer -

Page 116

... the Securities Exchange Act of 1934; and (2) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. DATED this 21st day of March 2014 . /s/ Kenneth Hannah Kenneth Hannah Executive Vice President and Chief... -

Page 117