ING Direct 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The only way to achieve growth in a

market is to put our customers fi rst, to

know what their preferences are and

how we can best serve them. A satisfi ed

customer provides a good opportunity to

expand our product range and to attract

new customers. We have launched a

number of initiatives, especially in mature

markets, to improve customer centricity.

To check our progress, we continually

monitor customer satisfaction.

In 2006, increasing brand awareness was

a key priority. After thorough research we

decided to sign a three-year sponsorship

agreement with Renault Formula One. We

chose Renault for its track record as a top,

high-performing team. Coupled with our

fi rst-ever global marketing campaign we

aim to increase ING’s visibility and raise our

brand awareness.

We want to position ourselves as a

company that sets the standard in helping

our customers manage their fi nancial

future. When customers consider doing

business with ING, they should know

exactly what they will get. They should

know that ING is easy to deal with, that

we treat our customers fairly and that we

deliver on our promises.

Exemplary customer service Managing costs, risk and reputation

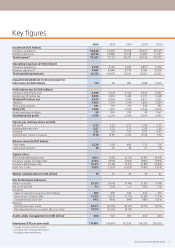

Higher returns and profi table growth

require sound business sense, including the

management of costs, risk and reputation,

and instilling a winning performance

culture among employees.

We have improved the ratio of costs to

income in our banking operations and

maintained solid effi ciency ratios in our

life insurance business. Our effi ciency

programme in the Netherlands and

Belgium is on track. Important progress

has also been made in measuring risk. We

developed methods to capture bank and

insurance risk, improved the quantifi cation

of credit risk, created more accurate pricing

of insurance products and consolidated our

risk management.

Reputation and integrity are also essential

to fi nancial services providers. As

regulation has increased, we have stepped

up our compliance. This is more important

than just adhering to a set of rules. It also

refl ects the way we want to treat our

clients and our shareholders: fairly and

with excellent performance.

However great a strategy may be, it cannot

be implemented without the right attitude

and the right people. ING invests in people

through various global projects to develop a

high performance workforce with a common

vision that inspires operational excellence.

Conclusions

We are satisfi ed with the progress we

made in 2006. By keeping a constant

and persistent course, we have created

value for our shareholders. We were

able to achieve more profi table growth,

to continue to invest in new growth

opportunities and to improve further the

execution of our business fundamentals.

We will continue our strategic course

in 2007 and build on the momentum

of profi table growth. We will continue to

analyse where we are creating value and

where we need to deploy resources for

improved growth and return. On top

of that we will continue to invest in

promising new business opportunities.

Growth can be achieved only for as long

as we properly execute our business

fundamentals. We want to continue

improving customer satisfaction,

tightening up compliance, keeping costs

under control and ensuring risk is

properly managed. By improving in these

areas, we want to drive our performance

to the next level.

As such, ING keeps focusing on creating

value for its shareholders to reward them

with a better total return on investment

than the average of that of our peers in

the fi nancial sector over the longer term.

ING Group Annual Review 2006 7