ING Direct 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

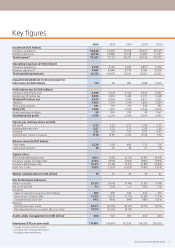

Cees Maas vice-chairman and CFOFinancial highlights

ING again posted strong results in 2006, driven

by solid top-line growth, improved returns,

sustained business momentum at our growth

engines and good performance in the mature

markets in which we operate. Costs remained

under control while we invested in new growth

opportunities. ING proposes to increase total

dividend by 12% to EUR 1.32 per share, to be

paid fully in cash.

In 2006, ING again posted a solid

increase in profi t. Total net profi t

rose by 6.7% to EUR 7,692 million.

Underlying net profi t, which is defi ned

as total net profi t excluding the impact

of divestments and special items, rose

by 24.3% to EUR 7,750 million. This

is the third consecutive year with a

growth in underlying net profi t of

more than 20%. Earnings per share

rose to EUR 3.57 from EUR 3.32.

Growth

ING’s three key growth engines continued

to show strong business momentum,

supported by profi table growth segments in

mature markets. The life insurance business

in developing markets showed strong sales,

refl ected in a rise of 14.4% in the value of

new business and of 31.5% in underlying

pre-tax profi t, compared with 2005. Sales of

US retirement services accumulation products

rose 35.2% and variable annuities were up

9.8% as the US business continues to focus

on meeting the needs of baby boomers as

they reach retirement. ING Direct increased

its underlying profi t before tax by 16.2%

to EUR 717 million and showed a good

operational performance in 2006. It attracted

almost three million new customers and

total own originated mortgages and funds

entrusted rose with EUR 20 billion and EUR

14 billion, respectively. Both fi gures exclude

currency effects and the divestment of

Degussa Bank. Growth in mature markets

is shown in our retail banking businesses,

where underlying profi t before tax rose by

6.4%, especially in the Netherlands and

Belgium, as well as at ING Real Estate, where

profi t before tax rose by 81%.

Our performance

Returns

Margins remained strong as ING focuses on

balancing growth and returns to maximise

value creation. Continued attention for

capital allocation and pricing discipline

led to a further increase in returns at

the banking operations. The underlying

after-tax Risk-Adjusted Return On Capital

improved to 20.4% from 19.1%, driven

by a strong improvement at Wholesale

Banking. Underlying economic capital

increased by EUR 1.0 billion to EUR 15.9

billion due to model refi nements as well as

continued growth at ING Direct and Retail

Banking. The internal rate of return on

new life insurance sales improved slightly

to 13.3%.

Execution

Improving the execution of the business

fundamentals is a priority for ING.

Operating expenses remained under

control, despite continued investments in

new growth initiatives. Recurring expenses

for the Group were up 2.4% in 2006,

excluding one-off items, currency effects

and expenses at the growth businesses of

ING Direct, ING Real Estate and Insurance

Asia/Pacifi c. The underlying cost/income

ratio within the bank improved to 63.6%

from 65.1% in 2005, showing the strong

cost containment. On the insurance side,

expenses to life premiums improved slightly

to 13.26% from 13.28% in 2005, while

expenses to assets under management

improved to 0.75% from 0.82%.

Dividend

At the Annual General Meeting of

Shareholders on 24 April 2007, ING will

propose a total dividend for 2006 of

EUR 1.32 per (depositary receipt for an)

ordinary share, up 12% from EUR 1.18

per (depositary receipt for an) ordinary

share in 2005. Taking into account the

interim dividend of EUR 0.59 made payable

in August 2006, the fi nal dividend will

amount to EUR 0.73 per (depositary receipt

for an) ordinary share to be paid fully in

cash. ING’s shares on Euronext will be

quoted ex-dividend as of 26 April 2007

and the dividend will be made payable

on 3 May 2007 (on the NYSE these dates

are 23 April 2007 and 10 May 2007,

respectively).

Taxes and net profi t

The effective tax rate increased to 19.2%

from 15.5% in 2005, when total profi t

included large tax-exempt gains on

divestments of Group companies. The

effective tax rate on underlying profi t

decreased to 18.8% from 23.4%.

Capital ratios

The debt/equity ratio of ING Group

improved to 9.0% compared with 9.4% at

1 January 2006, supported by growth in

capital and reserves. The capital-coverage

ratio for ING Verzekeringen N.V. increased

to 274% of EU regulatory requirements

at the end of December, compared with

255% at 1 January 2006. The Tier-1 ratio

of ING Bank N.V. stood at 7.63% at the

end of 2006, up from 7.32% at 1 January

2006, as growth in capital was only

partially offset by growth in risk-weighted

ING Group Annual Review 2006

8