ING Direct 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assets. The solvency ratio (BIS ratio) for the

bank improved to 11.02% at the end of

December 2006 from 10.86% at 1 January

2006. Total risk-weighted assets of the

banking operations increased by EUR 18.3

billion, or 5.7%, to EUR 337.9 billion at

the end of December 2006. See for more

detailed information the chapter on Capital

management.

Divestments and special items

Divestments resulted in a loss after tax of

EUR 85 million in 2006 compared with a gain

of EUR 414 million in 2005. Divested units

contributed EUR 27 million to profi t after tax

in 2006, up from a loss of EUR 21 million a

year earlier. Special items 2005 of EUR 583

million consisted of tax provision releases

and the establishment of deferred tax assets.

Excluding the impact of divestments and

special items, underlying net profi t increased

24.3% to EUR 7,750 million.

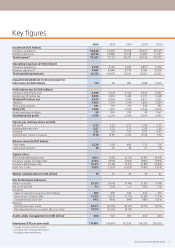

Profi t and loss account

in EUR million 2006 2005 change

Total income 73,621 71,120 3.5%

Total expenditures 63,681 62,226 2.3%

Profi t before tax 9,940 8,894 11.8%

Taxation 1,907 1,379 38.3%

Third-party interests 341 305 11.8%

Net profi t 7,692 7,210 6.7%

Divestments/special items -58 976

Underlying net profi t 7,750 6,234 24.3%

Profi t before tax 9,940 8,894 11.8%

Gains/losses from divestments 63 -366

Profi t from divested units -45 1

Underlying profi t before tax 9,958 8,529 16.8%

Insurance operations

ING’s insurance operations continued to

benefi t from strong growth in retirement

services and life insurance in developing

markets, higher investment results and a

favourable claims environment for the non-

life insurance businesses. Underlying profi t

before tax from insurance rose 22.9% to

EUR 4,886 million.

Underlying profi t before tax from life

insurance increased by 23.0%. The life

insurance activities in the Netherlands,

Latin America and Asia showed strong

profi t growth, supported by increased

sales, growth in assets under management

and investment gains. The underlying

profi t before tax from non-life insurance

went up 22.7%, driven by higher results

in the Netherlands and benefi ting from

a favourable underwriting cycle. Canada

showed lower but still good results, due to

less favourable developments in prior-year

reserves and lower investment related gains.

Underlying premium income increased

2.5% to EUR 46,834 million. Life premiums

of total insurance increased 2.3%, or 3.3%

excluding currency effects, mainly driven

by strong growth of life premiums in

Central and Rest of Europe, the US, Latin

America and Australia. In the Netherlands

and Belgium life premiums declined, while

in Asia, growth in life premiums in all

countries, especially Korea and Taiwan,

was more than offset by Japan, which

showed a signifi cant drop in premiums.

Non-life premiums increased 3.8%, or

1.1% excluding currency effects, as lower

premiums in the Netherlands were more

than offset by higher premiums in all

other regions, especially in Canada and

Latin America.

Operating expenses from the insurance

operations increased 2.0% to EUR 5,275

million. Recurring expenses increased with

6.1% to EUR 5,252 million, as the non-

recurring part of the expenses was much

higher in 2005 (IT expenses, reorganisation

costs, SOX implementation and other

projects). The recurring expense growth

was mainly caused by costs to support

the ongoing growth of the business,

particularly in Asia.

0

2

4

6

8

Underlying net profit*

in EUR million

4,053 4,959 6,234 7,750

* Underlying net profit is defined as net profit

excluding divestments and special items.

** Dutch GAAP.

03**

04 05 06

ING Group Annual Review 2006 9