ING Direct 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Good housekeeping

Capital management is to a large

extent good housekeeping, with

the establishment of proper policies,

procedures and routines. At the beginning

of each year plans are prepared describing

all funding transactions. Procedures were

written for capital contributions into the

business and also for pension funds.

The target maturity profi le and interest

rate profi le of the core debt are also being

written into policy. The policy for hedging

employee options was also renewed to

take into account the changing regulatory

and tax landscape.

We are also continuously streamlining the

organisation and tidying up the corporate

structure. 2006 was again a very active

year with many divestments (some of

which will be formally fi nalised in 2007):

Piraeus, Williams de Broë, Deutsche

Hypothekenbank, Nationale Borg,

Degussa Bank and ING Trust. ING bought

a mutual fund manager in Taiwan and

the pension administrator AZL in the

Netherlands.

Capital management

ING strengthened efforts to monitor and

manage capital adequacy and execute capital

markets transactions. To this end a centralised

capital management function was created with

the benefi t that capital adequacy requirements

are balanced with fi nancial fl exibility. This helps

meet strategic objectives and contributes to an

effi cient allocation of capital.

Stronger capital position

The capital position of ING was further

enhanced during 2006, thanks to

continued strong profi tability of the

business. Financings in the market

throughout the year raised further hybrid

Tier-1 and core debt for ING Group, lower

Tier-2 for ING Bank and core debt for

ING Insurance. Hybrid Tier-1 debt raised

for ING Group is on-lent to either ING

Bank or ING Insurance under the same

conditions as the original instruments.

Core debt is debt that is on-lent as equity

to subsidiaries.

ING stayed well within its key target

capital ratios: a maximum of 10% core

debt for ING Group, a maximum of 15%

core debt for ING Insurance and at least

a 7.2% Tier-1 ratio for ING Bank. ING’s

objective is to have AA ratings for ING

Group, ING Bank and ING Insurance.

Risk-weighted assets grew moderately

on the banking side by 5.7% to EUR 338

billion. This modest growth was made

possible through the execution of an

ambitious securitisation plan that released

a further EUR 8.1 billion of risk-weighted

assets from the balance sheet during the

year. The underlying growth of assets

produced by the business was therefore

much higher.

Implementation of Basel II

Much attention was paid during 2006

to the implementation of Basel II and

its three-pillar framework. Pillar 1 calculates

the minimum capital requirement. Pillar 2

is an overall review by the regulator of

capital adequacy, while Pillar 3 concerns

the external reporting.

We constantly examine our capitalisation

from multiple viewpoints and analyse

whether solvency targets need to be

adjusted.

Managing ING Insurance’s free surplus

In 2006, the management of the free

surplus of ING Insurance was enhanced,

which is the part of fi nancial resources

available above the amount of economic

capital employed. This surplus may have

to be held by the businesses due to

regulatory and rating agency constraints.

To the extent the free surplus is not

constrained, ING is free to employ it

elsewhere to increase organic growth.

02 03 04 05 06

4

0

8

12

16

20

19.9 14.4 10.2 9.4 9.0

Debt/equity ratio ING Group

in percentages

Target 10%

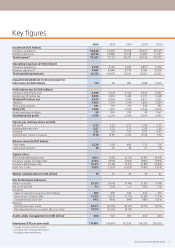

Capital base ING Groep N.V.

31 December 31 December

In EUR million 2006 2005

Shareholders’ equity (in parent) 38,266 36,736

+ Group hybrid capital 7,606 7,883

+ Group leverage (core debt) 4,210 3,969

Total capitalisation (Bank + Insurance) 50,082 48,588

–/– Revaluation reserves fi xed income and other 3,352 6,477

–/– Group leverage (core debt) (d) 4,210 3,969

Adjusted equity (e) 42,520 38,142

Debt/equity ratio (d/(d+e)) 9.01% 9.43%

ING Group Annual Review 2006 11