ING Direct 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Building on the momentum

of profi table growth

www.ing.com

2006

ING Group

Annual Review

Table of contents

-

Page 1

www.ing.com 2006 ING Group Annual Review Building on the momentum of proï¬table growth -

Page 2

... Europe Insurance Americas Insurance Asia/Paciï¬c Banking Banking overview Wholesale Banking Retail Banking ING Direct Asset management Our people Our brand Corporate responsibility 8 11 12 14 14 15 16 17 18 18 19 20 21 22 24 25 26 10 8 6 4 2 0 Operating/underlying net proï¬t in EUR billion... -

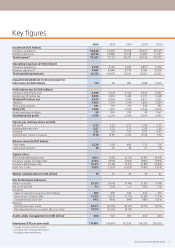

Page 3

... Return on equity Net proï¬t growth Insurance Value of new life business (in EUR million) Internal rate of return (life) Combined ratio (non-life) Banking Cost/income ratio (total) Risk-adjusted return on capital after tax (total) Assets under management (in EUR billion) Employees (FTEs at year-end... -

Page 4

.... We are well-established in Australia, Hong Kong, Japan, Malaysia, New Zealand, South Korea and Taiwan. Our activities in China, India and Thailand are key future growth engines. Underlying proï¬t before tax Insurance Asia/Paciï¬c 2006 2005 621 447 in EUR million 2 ING Group Annual Review 2006 -

Page 5

... service to our customers and on ï¬rmly managing costs, risks and reputation. We invest in growth, and to this end ensure we are in businesses and markets with good long-term growth potential. Retirement services, ING Direct and our life insurance activities in developing markets are all good... -

Page 6

... rates and a substantial ï¬,attening of yield curves. At the same time, our businesses have also beneï¬ted in the current market environment, for instance from rallying equity and real estate markets. ING continues to offer a solid increase in shareholder return. Amongst our peer group of 20 global... -

Page 7

... Euronext Amsterdam Stock Exchange in EUR 2006 2005 2004 â,¬1 .32 Proposed dividend per share up 12% 109% Total Shareholder Return 2004 - 2006 AAS&P rating of ING Group 24 April 2007 Annual General Meeting of Shareholders Price - high Price - low Price - year-end Price/earnings ratio* share for... -

Page 8

... retirement services business in the US had a successful year, ING Direct was able to increase proï¬ts in a challenging interest rate environment, and our life insurance business in Asia/Paciï¬c posted a strong rise in the value of new business. We are also investing in future growth opportunities... -

Page 9

... satisfaction. In 2006, increasing brand awareness was a key priority. After thorough research we decided to sign a three-year sponsorship agreement with Renault Formula One. We chose Renault for its track record as a top, high-performing team. Coupled with our ï¬rst-ever global marketing campaign... -

Page 10

... increased by EUR 1.0 billion to EUR 15.9 billion due to model reï¬nements as well as continued growth at ING Direct and Retail Banking. The internal rate of return on new life insurance sales improved slightly to 13.3%. Execution Improving the execution of the business fundamentals is a priority... -

Page 11

... Asia showed strong proï¬t growth, supported by increased sales, growth in assets under management and investment gains. The underlying proï¬t before tax from non-life insurance went up 22.7%, driven by higher results in the Netherlands and beneï¬ting from a favourable underwriting cycle. Canada... -

Page 12

... business lines to 2006 underlying proï¬t before tax* in percentages Insurance Europe Insurance Americas Insurance Asia/Paciï¬c Wholesale Banking Retail Banking ING Direct Total 23 20 6 25 19 7 100 * Excludes component 'Other' in Banking and Insurance. Embedded value and value of new business... -

Page 13

... being written into policy. The policy for hedging employee options was also renewed to take into account the changing regulatory and tax landscape. We are also continuously streamlining the organisation and tidying up the corporate structure. 2006 was again a very active year with many divestments... -

Page 14

...performance continued Risk management ING strives every day to ï¬nd the optimal balance between risk, return and capital. In 2006, we strengthened the Group Risk function emphasising our commitment to a sound risk management organisation. Faster approvals Risk management works with ING businesses... -

Page 15

... in ING's insurance portfolios is managed by setting insurance risk tolerance levels. ING Insurance is exposed to market risks: the risk that changes in interest rates, equity prices, foreign exchange rates and real estate prices affect its present and future earnings as well as shareholders' equity... -

Page 16

...Central Europe, where the reform of pension systems in many countries has opened up opportunities for diversiï¬ed ï¬nancial services companies such as ING, will be a key focus in the years ahead. â,¬ 12 billion ING is a leader in the Japanese variable annuity market, with assets under management... -

Page 17

... in the value of new business and in the internal rate of return. Postbank Insurance had a solid ï¬nancial performance. In 2006, proï¬ts, premiums and value creation at ING Insurance Belgium decreased, mainly due to one-off factors. Ongoing growth initiatives in Central Europe In the rapidly... -

Page 18

... to ING winning the bid. San Jose added USD 300 million new assets to the USD 200 million we already manage for the City. Annuities were brought together in a new Wealth Management division. United States Individual Life, Group Life and Group Reinsurance businesses were combined in the US Insurance... -

Page 19

...and special items. Insurance Asia/Paciï¬c continued to deliver strong results in 2006, largely assisted by strong proï¬t growth in South Korea and Japan. The Asia/Paciï¬c region accounts for almost half of the Group's total value of new business. Underlying proï¬t before tax from Insurance Asia... -

Page 20

... of Europe North America Latin America Asia Australia Total 54% 10% 19% 9% 1% 3% 4% 100% 258.0 47.7 91.2 43.6 3.0 12.6 18.3 474.4 2006 was another good year for our banking activities. Underlying proï¬t before tax rose 11.4% to EUR 5,072 million. Demand for mortgages, savings and real estate bene... -

Page 21

... reports to Wholesale Banking. ING Real Estate is also discussed in the chapter on Asset management. ** Total proï¬t before tax is deï¬ned as proï¬t before tax including divestments and special items. In 2006, Wholesale Banking did well in a challenging business climate by focusing on clients... -

Page 22

... good year, despite ï¬,attening yield curves and lower interest rates, thanks to growth in core products, such as savings and mortgages, direct distribution, cost control and process improvement. ING has a leading position in its retail home markets and is well positioned in Central Europe and Asia... -

Page 23

... our customers who again reported high levels of satisfaction and gave us more of their business. Brand awareness, a key competitive strength, increased further." Dick Harryvan, Executive Board member responsible for ING Direct Proï¬t and loss account* (underlying) in EUR million 2006 2005 change... -

Page 24

... focus on a global offering of products and services that meet the needs of our clients. Assets under management, by business line in EUR billion Insurance Europe 26% Insurance Americas 34% Insurance Asia/Paciï¬c 14% Wholesale Banking 10% Retail Banking 15% ING Direct 1% Total 100% 157.9 202... -

Page 25

...business in Taiwan added EUR 2.4 billion to assets under management. â,¬ 2.3 billion In October 2006, ING Real Estate successfully bid for Summit REIT, the largest owner of industrial real estate in Canada with a EUR 2.3 billion portfolio. This public-to-private transaction provided ING Real Estate... -

Page 26

... corporate performance. Number of employees by business line Year-end FTEs 2006 Insurance Europe Insurance Americas Insurance Asia/Paciï¬c Wholesale Banking Retail Banking ING Direct Other Total 15,126 28,778 10,487 20,605 37,113 7,638 54 119,801 13% 24% 9% 17% 31% 6% 100% Since launching a new... -

Page 27

... in Amsterdam. ING announced, in October 2006, it had secured a three-year title sponsorship agreement with the highly successful Renault F1 Team, beginning in the 2007 race season. The sponsorship will give ING year-long global exposure. Brand awareness and the understanding of ING's brand values... -

Page 28

... ING IM's proprietary portfolio. Community development ING Chances for Children is a companywide programme aimed at giving children in Brazil, Ethiopia and India access to primary education. In 2006, we raised enough funds for the education of some 52,000 children for one year. Our target for 2007... -

Page 29

... Shareholders' Meeting. The site gives extensive information about ING's corporate governance. For users of PDAs and smartphones with internet access ING developed www.ing.mobi Recent developments During 2006, ING worked on new provisions arising from legislative changes, which will give investors... -

Page 30

... Corporation, Communications Systems Inc. and Hector Communications Corporation (USA). 5. Claus Dieter Hoffmann* Born 1942, appointed in 2003, German nationality. Former Chief Financial Ofï¬cer Robert Bosch GmbH. Managing partner of H+H Senior Advisors, Stuttgart. Chairman of the Supervisory Board... -

Page 31

... Global Management Team of ING Direct. Dick Harryvan is responsible for ING Direct. 6. Tom J. McInerney Born 1956, American nationality. Tom McInerney was appointed a member of the Executive Board in April 2006. He started his career in 1978 with Aetna Financial Services, which was acquired by ING... -

Page 32

..., which compensates for past performance measured over one year; - long-term incentive (LTI), in stock options and/or performance shares, compensates for performance measured over multiple years and is forward-looking. Base salary 2006 The base salary of the Executive Board members has been frozen... -

Page 33

...long-term incentive awards. The conditional shares will be 100% vested four years after the grant date and the condition being an active employment contract. The conditional shares are provided to align Tom McInerney's total remuneration with the US market practice. ING Group Annual Review 2006 31 -

Page 34

.... ING's website (www.ing.com) gives detailed information about the performance of the ING share, also related to several stock market indices, up to a ï¬ve-year period and as of 1997. Geographical distribution of ING shares* in percentages United Kingdom Netherlands Belgium United States & Canada... -

Page 35

...on ING's corporate website www.ing.com: - Annual Review, in Dutch and English; - Corporate Responsibility Report, in Dutch and English; - Annual Report, in Dutch and English; - Annual Report on Form 20-F, in English (in accordance with SEC guidelines). The publications can be ordered on the internet... -

Page 36

222267 W W W. IN G.COM