Humana 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015

Annual Report

Humana.com

Health through

partnership

Table of contents

-

Page 1

Annual Report 2015 Health through partnership Humana.com -

Page 2

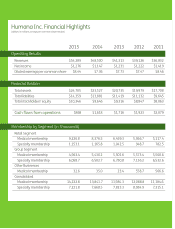

... common share results) 2015 Operating Results Revenues Net income Diluted earnings per common share $54,289 $1,276 $8.44 2014 $48,500 $1,147 $7.36 2013 $41,313 $1,231 $7.73 2012 $39,126 $1,222 $7.47 2011 $36,832 $1,419 $8.46 Financial Position Total assets Total liabilities Total stockholders... -

Page 3

... experience, ultimately increasing our members' engagement in clinical and wellness programs. The other major element of our strategy is to build strong partnerships with providers to assist their transition to value-based payments by providing them with technology, expertise and resources. Bruce... -

Page 4

... Humana At Home care-management services We were rated Highest in Customer Satisfaction with Mail Order Pharmacies in the J.D. Power 2015 U.S. Pharmacy Study 1.1 million engaged in clinical programs identiï¬ed through health risk assessments and predictive modeling capabilities 2 2015 Annual... -

Page 5

... Effectiveness Data and Information Set (HEDIS) scores - versus providers in standard Medicare Advantage settings Although we were pleased with the progress we made last year on the consumer front, at the same time we had to address certain challenges in our Medicare Advantage operations in 2015... -

Page 6

... 1, 2015, $0.14 per share of expense associated with the pending transaction with Aetna Inc., and $0.74 per share of expense related to a premium deï¬ciency reserve (PDR) associated with certain of the company's 2016 individual commercial policies. $2.50 0 2013 4 2015 Annual Report 2014 2015 -

Page 7

...this program. In July 2015, we signed a deï¬nitive merger agreement with Aetna Inc. We believe Aetna is the ideal business partner to accelerate our strategy and to bring the beneï¬ts of integrated care - including clinical capabilities and data analytics - to millions more Americans. Like Humana... -

Page 8

... Operations and Chief Financial Ofï¬cer Pï¬zer, Inc. William E. Mitchell Managing Partner Sequel Venture Capital, LLC Marissa T. Peterson President and Chief Executive Ofï¬cer Mission Peak Executive Coaching W. Roy Dunbar Former Chairman of the Board NetworkSolutions 6 2015 Annual Report -

Page 9

... as specified in its charter) HUMANA INC. Delaware (State of incorporation) 61-0647538 (I.R.S. Employer Identification Number) 500 West Main Street Louisville, Kentucky (Address of principal executive offices) 40202 (Zip Code) Registrant's telephone number, including area code: (502) 580-1000... -

Page 10

... of Operations Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Part III Directors, Executive Officers and Corporate... -

Page 11

... Medicare and Medicaid Services, or CMS, under which we provide health insurance coverage to approximately 587,400 members as of December 31, 2015. Humana Inc. was organized as a Delaware corporation in 1964. Our principal executive offices are located at 500 West Main Street, Louisville, Kentucky... -

Page 12

... of the Health Care Reform Law include, among others, mandated coverage requirements, mandated benefits and guarantee issuance associated with commercial medical insurance, rebates to policyholders based on minimum benefit ratios, adjustments to Medicare Advantage premiums, the establishment... -

Page 13

... time medical services are needed, to seek care from a provider within the plan's network or outside the network. In addition, we offer services to our health plan members as well as to third parties that promote health and wellness, including pharmacy solutions, provider, home based, and clinical... -

Page 14

... identify member needs, complex case management, tools to guide members in their health care decisions, care management programs, wellness and prevention programs and, in some instances, a reduced monthly Part B premium. Most Medicare Advantage plans offer the prescription drug benefit under Part... -

Page 15

... LI-NET prescription drug plan program, and subsequently transitions each member into a Medicare Part D plan that may or may not be a Humana Medicare plan. Group Medicare Advantage and Medicare stand-alone PDP We offer products that enable employers that provide post-retirement health care benefits... -

Page 16

...long-term care. Our American Eldercare Inc., or American Eldercare, acquisition in 2013 expanded our LTSS footprint in Florida. Our contracts are generally for three to five year terms. Medicare beneficiaries who also qualify for Medicaid due to low income or special needs are known as dual eligible... -

Page 17

...loss insurance coverage from us to cover catastrophic claims or to limit aggregate annual costs. As with individual commercial policies, employers can customize their offerings with optional benefits such as dental, vision, life, and a portfolio of voluntary benefit products. Military Services Under... -

Page 18

... 1.3% Humana Pharmacy Solutions®, or HPS, manages traditional prescription drug coverage for both individuals and employer groups in addition to providing a broad array of pharmacy solutions. HPS also operates prescription mail order services for brand, generic, and specialty drugs and diabetic... -

Page 19

..., 2014, reflecting enhanced predictive modeling capabilities and focus on proactive clinical outreach and member engagement, particularly for our Medicare Advantage membership. We believe these initiatives lead to better health outcomes for our members and lower health care costs. Clinical programs... -

Page 20

... to protect the insured from the cost of long-term care services including those provided by nursing homes, assisted living facilities, and adult day care as well as home health care services. No new policies have been written since 2005 under this closed block. Membership The following table... -

Page 21

...our members, product and benefit designs, hospital inpatient management systems, the use of sophisticated analytics, and enrolling members into various care management programs. The focal point for health care services in many of our HMO networks is the primary care provider who, under contract with... -

Page 22

... Advantage members, or 31.3% of our total individual Medicare Advantage membership. Physicians under capitation arrangements typically have stop loss coverage so that a physician's financial risk for any single member is limited to a maximum amount on an annual basis. We typically process all claims... -

Page 23

... payroll deductions for any premiums payable by the employees. We attempt to become an employer's or group's exclusive source of health insurance benefits by offering a variety of HMO, PPO, and specialty products that provide cost-effective quality health care coverage consistent with the needs and... -

Page 24

... These services include management information systems, product development and administration, finance, human resources, accounting, law, public relations, marketing, insurance, purchasing, risk management, internal audit, actuarial, underwriting, claims processing, billing/enrollment, and customer... -

Page 25

... of operations, financial position, cash flows and the price per share for our common stock. The Merger Agreement prohibits us from pursuing alternative transactions to the Merger. Following the receipt of approval by our stockholders and Aetna's shareholders (with respect to the Aetna stock to... -

Page 26

... restrictions that could materially adversely affect our results of operations, financial position and cash flows or result in a loss of employees, customers, members or suppliers. The Merger Agreement includes restrictions on the conduct of our business prior to the completion or termination of the... -

Page 27

...operations, financial position, cash flows and the price per share for our common stock. Risks Relating to Our Business If we do not design and price our products properly and competitively, if the premiums we charge are insufficient to cover the cost of health care services delivered to our members... -

Page 28

... marketing practices create pressure to contain premium price increases, despite being faced with increasing medical costs. The policies and decisions of the federal and state governments regarding the Medicare, military, Medicaid and health insurance exchange programs in which we participate have... -

Page 29

..., financial position, and cash flows may be materially adversely affected. If we fail to effectively implement our operational and strategic initiatives, including our Medicare initiatives, our state-based contracts strategy, and our participation in the new health insurance exchanges, our business... -

Page 30

.... Our business strategy involves providing members and providers with easy to use products that leverage our information to meet their needs. Our ability to adequately price our products and services, provide effective and efficient service to our customers, and to timely and accurately report our... -

Page 31

...results of operations, financial position and cash flows. In addition, if some providers continue to use ICD-9 codes on claims after October 1, 2015, including providers in our network who are employees, we will have to reject such claims, which may lead to claim resubmissions, increased call volume... -

Page 32

... December 31, 2015, under our contracts with CMS we provided health insurance coverage to approximately 587,400 individual Medicare Advantage members in Florida. These contracts accounted for approximately 14% of our total premiums and services revenue for the year ended December 31, 2015. The loss... -

Page 33

... TRICARE South Region contract, should it occur, may have a material adverse effect on our results of operations, financial position, and cash flows. • There is a possibility of temporary or permanent suspension from participating in government health care programs, including Medicare and Medicaid... -

Page 34

...have a material adverse effect on our results of operations, financial position, or cash flows. • Our CMS contracts which cover members' prescription drugs under Medicare Part D contain provisions for risk sharing and certain payments for prescription drug costs for which we are not at risk. These... -

Page 35

... revenue, enrollment and premium growth in certain products and market segments, restricting our ability to expand into new markets, increasing our medical and operating costs by, among other things, requiring a minimum benefit ratio on insured products, lowering our Medicare payment rates... -

Page 36

...health insurance that became effective January 1, 2014, with an annual open enrollment period. Insurers participating on the health insurance exchanges must offer a minimum level of benefits and are subject to guidelines on setting premium rates and coverage limitations. We may be adversely selected... -

Page 37

... all medical decisions, as well as for hiring and managing physicians and other licensed healthcare providers, developing operating policies and procedures, implementing professional standards and controls, and maintaining malpractice insurance. We believe that our health services operations comply... -

Page 38

... service we provide is covered by any of the state or federal health benefit programs described above. Violation of these provisions constitutes a felony criminal offense and applicable sanctions could include exclusion from the Medicare and Medicaid programs. Section 1877 of the Social Security Act... -

Page 39

...care to our members. Our products encourage or require our customers to use these contracted providers. A key component of our integrated care delivery strategy is to increase the number of providers who share medical cost risk with us or have financial incentives to deliver quality medical services... -

Page 40

... the measure for determining payment by Medicare or Medicaid programs for the drugs sold in our mail-order pharmacy business may reduce the revenues and gross margins of this business which may result in a material adverse effect on our results of operations, financial position, and cash flows. 32 -

Page 41

... that provide us with purchase discounts and volume rebates on certain prescription drugs dispensed through our mail-order and specialty pharmacies. These discounts and volume rebates are generally passed on to clients in the form of steeper price discounts. Changes in existing federal or state laws... -

Page 42

... overall market and our industry, our credit ratings and debt capacity, as well as the possibility that customers or lenders could develop a negative perception of our long or short-term financial prospects. Similarly, our access to funds could be limited if regulatory authorities or rating agencies... -

Page 43

... contracted providers to operate. Our principal executive office is located in the Humana Building, 500 West Main Street, Louisville, Kentucky 40202. In addition to the headquarters in Louisville, Kentucky, we maintain other principal operating facilities used for customer service, enrollment, and... -

Page 44

... may include employment matters, claims of medical malpractice, bad faith, nonacceptance or termination of providers, anticompetitive practices, improper rate setting, provider contract rate disputes, failure to disclose network discounts and various other provider arrangements, general contractual... -

Page 45

... holders of our common stock. Dividends The following table provides details of dividend payments, excluding dividend equivalent rights, in 2014 and 2015, under our Board approved quarterly cash dividend policy: Record Date 2014 payments Payment Date Amount per Share Total Amount (in millions) 12... -

Page 46

... as business needs or market conditions change. In addition, under the terms of the Merger Agreement, we have agreed with Aetna to coordinate the declaration and payment of dividends so that our stockholders do not fail to receive a quarterly dividend around the time of the closing of the Merger. On... -

Page 47

... Under the Plans or Programs (1) Period Total Number of Shares Purchased (1) Average Price Paid per Share October 2015 November 2015 December 2015 Total - - - - $ $ - - - - - - - - $ - - - (1) In September 2014, the Board of Directors replaced a previous share repurchase authorization of... -

Page 48

... ($154 million after tax, or $0.99 per diluted common share) for reserve strengthening associated with our non-strategic closed block of long-term care insurance policies. Includes the acquired operations of Arcadian Management Services, Inc. from March 31, 2012, SeniorBridge Family Companies, Inc... -

Page 49

... Aetna common stock and (ii) $125 in cash. The total transaction was estimated at approximately $37 billion including the assumption of Humana debt, based on the closing price of Aetna common shares on July 2, 2015. The Merger Agreement includes customary restrictions on the conduct of our business... -

Page 50

... LI-NET prescription drug plan program and contracts with various states to provide Medicaid, dual eligible, and Long-Term Support Services benefits, collectively our state-based contracts. The Group segment consists of employer group commercial fully-insured medical and specialty health insurance... -

Page 51

...-alone prescription drug plans, or PDPs, under the Medicare Part D program. Our quarterly Retail segment earnings and operating cash flows are impacted by the Medicare Part D benefit design and changes in the composition of our membership. The Medicare Part D benefit design results in coverage that... -

Page 52

...follows. Year-over-year comparisons of the operating cost ratio are impacted by an increase in 2015 of the non-deductible health insurance industry fee mandated by the Health Care Reform Law. Likewise, year-over-year comparisons of the benefit ratio reflect the increase in this fee in the pricing of... -

Page 53

... premium increases for the 2016 coverage year related generally to the first half of 2015 claims experience, the discontinuation of certain products as well as exit of certain markets for 2016, network improvements, enhancements to claims and clinical processes and administrative cost control... -

Page 54

... LI-NET prescription drug plan program) increased approximately 240,000 members, or 5%, from December 31, 2015 reflecting net membership additions, primarily for our HumanaWalmart plan offering, during the recently completed 2016 annual election period for Medicare beneficiaries. For full year 2016... -

Page 55

...health insurance that became effective January 1, 2014, with an annual open enrollment period. Insurers participating on the health insurance exchanges must offer a minimum level of benefits and are subject to guidelines on setting premium rates and coverage limitations. We may be adversely selected... -

Page 56

... acuity, enrollment levels, adverse selection, or other assumptions used in setting premium rates could have a material adverse effect on our results of operations, financial position, and cash flows and could impact our decision to participate or continue in the program in certain states. As... -

Page 57

...47.2% Represents total benefits expense as a percentage of premiums revenue. Represents total operating costs, excluding depreciation and amortization, as a percentage of total revenues less investment income. Summary Net income was $1.3 billion, or $8.44 per diluted common share, in 2015 compared... -

Page 58

... segment and an increase in fully-insured group commercial medical per member premiums in the Group segment. Average membership is calculated by summing the ending membership for each month in a period and dividing the result by the number of months in a period. Premiums revenue reflects changes in... -

Page 59

... the Health Care Reform Law, including the non-deductible health insurance industry fee. The consolidated operating cost ratio for 2015 was 13.6%, decreasing 230 basis points from 2014 primarily due to decreases in the operating cost ratios in the Group and Retail segments reflecting cost management... -

Page 60

...Revenue: Premiums: Individual Medicare Advantage Group Medicare Advantage Medicare stand-alone PDP Total Retail Medicare Individual commercial State-based Medicaid Individual specialty Total premiums Services Total premiums and services revenue Income before income taxes Benefit ratio Operating cost... -

Page 61

...-year comparisons of prior-period medical claims reserve development as discussed below. In addition, the increase reflects higher benefit ratios associated with a greater number of members from state-based contracts and the impact of the change in estimate for the 2014 net 3Rs receivables in 2015... -

Page 62

... non-deductible health insurance industry fee increased the operating cost ratio by approximately 160 basis points in 2015 as compared to 120 basis points in 2014. Group Segment Change 2015 2014 Members Percentage Membership: Medical membership: Fully-insured commercial group ASO Military services... -

Page 63

... commercial medical membership. Benefits expense • The Group segment benefit ratio increased 70 basis points from 79.5% in 2014 to 80.2% in 2015 primarily reflecting the impact of higher specialty drug costs, net of rebates, as well as higher outpatient costs and lower prior-period medical claims... -

Page 64

... Services: Provider services Home based services Pharmacy solutions Total services revenues Intersegment revenues: Pharmacy solutions Provider services Home based services Clinical programs Total intersegment revenues Total services and intersegment revenues Income before income taxes Operating cost... -

Page 65

...our Medicare membership which resulted in higher utilization of our Healthcare Services segment businesses. Operating costs • The Healthcare Services segment operating cost ratio of 95.2% for 2015 decreased 40 basis points from 95.6% for 2014 primarily due to lower operating costs in our pharmacy... -

Page 66

...(a) Represents total benefits expense as a percentage of premiums revenue. (b) Represents total operating costs, excluding depreciation and amortization, as a percentage of total revenues less investment income. Summary Net income was $1.1 billion, or $7.36 per diluted common share, in 2014 compared... -

Page 67

...our closed-block of long-term care insurance policies included with Other Businesses as discussed above, as well as the loss of our Medicaid contracts in Puerto Rico effective September 30, 2013 which more than offset higher ratios year-over-year in the Retail and Group segments. Operating Costs Our... -

Page 68

... fee levied on the insurance industry beginning in 2014 as mandated by the Health Care Reform Law increased our effective tax rate by approximately 9.4 percentage points for 2014. Retail Segment Change 2014 2013 Members Percentage Membership: Medical membership: Individual Medicare Advantage Group... -

Page 69

...Revenue: Premiums: Individual Medicare Advantage Group Medicare Advantage Medicare stand-alone PDP Total Retail Medicare Individual commercial State-based Medicaid Individual specialty Total premiums Services Total premiums and services revenue Income before income taxes Benefit ratio Operating cost... -

Page 70

... health care exchanges and state-based contracts, partially offset by scale efficiencies from Medicare and individual commercial medical membership growth. Group Segment Change 2014 2013 Members Percentage Membership: Medical membership: Fully-insured commercial group ASO Military services Total... -

Page 71

...2013 (in millions) Dollars Percentage Premiums and Services Revenue: Premiums: Fully-insured commercial group Group specialty Military services Total premiums Services Total premiums and services revenue Income before income taxes Benefit ratio Operating cost ratio Pretax Results • $ $ $ 5,339... -

Page 72

... business which carries a higher operating cost ratio than large group business, offset by operating cost efficiencies. Healthcare Services Segment Change 2014 2013 (in millions) Dollars Percentage Revenues: Services: Provider services Home based services Pharmacy solutions Clinical programs Total... -

Page 73

... on borrowings, dividends, and share repurchases. Because premiums generally are collected in advance of claim payments by a period of up to several months, our business normally should produce positive cash flows during periods of increasing premiums and enrollment. Conversely, cash flows would be... -

Page 74

... operating cash flows for 2015 were negatively impacted from the typical pattern of claim payments that lagged premium receipts related to new membership in 2014. Individual commercial medical added 548,000 new members in 2014 compared to a decline of 90,400 members in 2015. Likewise, group Medicare... -

Page 75

... fully-insured individual commercial medical plans compliant with the Health Care Reform Law grew as compared with a decline in membership in these plans in 2015. Similarly, growth in group Medicare Advantage membership in 2014 favorably impacted the 2014 cash flows while a decline in group Medicare... -

Page 76

...-deductible health insurance industry fee. As discussed previously, the timing of payments and receipts associated with these provisions impact our operating cash flows as we build receivables for each coverage year that are expected to be collected in subsequent coverage years. The net receivable... -

Page 77

... information technology initiatives, support of services in our provider services operations including medical and administrative facility improvements necessary for activities such as the provision of care to members, claims processing, billing and collections, wellness solutions, care coordination... -

Page 78

... terms of the Merger Agreement, we have agreed with Aetna that our quarterly dividend will not exceed $0.29 per share prior to the closing of the Merger. Declaration and payment of future quarterly dividends is at the discretion of our Board and may be adjusted as business needs or market conditions... -

Page 79

... relationships, including financial advisory and banking, with some parties to the credit agreement. Commercial Paper In October 2014, we entered into a commercial paper program pursuant to which we may issue short-term, unsecured commercial paper notes privately placed on a discount basis through... -

Page 80

... December 31, 2015. Liquidity Requirements We believe our cash balances, investment securities, operating cash flows, and funds available under our credit agreement and our commercial paper program or from other public or private financing sources, taken together, provide adequate resources to fund... -

Page 81

In 2015, we paid the federal government $867 million for the annual health insurance industry fee and expect to pay a higher amount in 2016 given an increase in market share. The Consolidated Appropriations Act, 2016, enacted on December 18, 2015, included a one-time one year suspension in 2017 of ... -

Page 82

... cost of services which have been incurred but not yet reported, or IBNR. IBNR represents a substantial portion of our benefits payable as follows: December 31, 2015 Percentage of Total December 31, 2014 Percentage of Total (dollars in millions) IBNR Reported claims in process Premium deficiency... -

Page 83

... of recent hospital and drug utilization data, provider contracting changes, changes in benefit levels, changes in member cost sharing, changes in medical management processes, product mix, and weekday seasonality. The completion factor method is used for the months of incurred claims prior to... -

Page 84

... two months. (c) The factor change indicated represents the percentage point change. The following table provides a historical perspective regarding the accrual and payment of our benefits payable, excluding military services. Components of the total incurred claims for each year include amounts... -

Page 85

... claims associated with individual commercial medical products. The higher favorable prior period development during 2014 and 2013 resulted from increased membership, better than originally expected utilization across most of our major business lines and increased financial recoveries. The increase... -

Page 86

... future gross premiums, may not be adequate to provide for future expected policy benefits and maintenance costs. Future policy benefits payable include $1.5 billion at December 31, 2015 and 2014 associated with a non-strategic closed block of long-term care insurance policies acquired in connection... -

Page 87

Long-term care insurance policies provide nursing home and home health coverage for which premiums are collected many years in advance of benefits paid, if any. Therefore, our actual claims experience will emerge many years after assumptions have been established. The risk of a deviation of the ... -

Page 88

... premiums paid to Medicare Advantage plans according to health severity. The risk-adjustment model pays more for enrollees with predictably higher costs. Under the riskadjustment methodology, all Medicare Advantage plans must collect and submit the necessary diagnosis code information from hospital... -

Page 89

...173 million and $484 million at December 31, 2015 and 2014, respectively, of tax-exempt securities guaranteed by monoline insurers. The equivalent weighted average S&P credit rating of these tax-exempt securities without the guarantee from the monoline insurer was AA. Our direct exposure to subprime... -

Page 90

... or one level below the operating segments, referred to as a component, which comprise our reportable segments. A component is considered a reporting unit if the component constitutes a business for which discrete financial information is available that is regularly reviewed by management. We are... -

Page 91

... the long-term inflation rate. Key assumptions in our cash flow projections, including changes in membership, premium yields, medical and operating cost trends, and certain government contract extensions, are consistent with those utilized in our long-range business plan and annual planning process... -

Page 92

... the full 3% point reduction. (b) The interest rate under our senior notes is fixed. There were no borrowings outstanding under the credit agreement at December 31, 2015 or December 31, 2014. There was $299 million outstanding under our commercial paper program at December 31, 2015. As of December... -

Page 93

... Unearned revenues Short-term borrowings Liabilities held-for-sale Total current liabilities Long-term debt Future policy benefits payable Other long-term liabilities Total liabilities Commitments and contingencies (Note 16) Stockholders' equity: Preferred stock, $1 par; 10,000,000 shares authorized... -

Page 94

Humana Inc. CONSOLIDATED STATEMENTS OF INCOME For the year ended December 31, 2015 2014 (in millions, except per share results) 2013 Revenues: Premiums Services Investment income Total revenues Operating expenses: Benefits Operating costs Depreciation and amortization Total operating expenses ... -

Page 95

Humana Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31, 2015 2014 (in millions) 2013 Net income Other comprehensive (loss) income: Change in gross unrealized investment gains/losses Effect of income taxes Total change in unrealized investment gains/losses, net of... -

Page 96

Humana Inc. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock Issued Shares Balances, January 1, 2013 Net income Other comprehensive income Common stock repurchases Dividends and dividend equivalents Stock-based compensation Restricted stock unit vesting Stock option exercises Stock ... -

Page 97

Humana Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS 2015 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Gain on sale of business Depreciation Amortization Stock-based compensation Net realized capital gains (Benefit) ... -

Page 98

... contracts with the Centers for Medicare and Medicaid Services, or CMS, to provide health insurance coverage for individual Medicare Advantage members in Florida. CMS is the federal government's agency responsible for administering the Medicare program. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES... -

Page 99

...-based exchanges coupled with three premium stabilization programs, as described more fully below. The Health Care Reform Law imposes an annual premium-based fee on health insurers for each calendar year beginning on or after January 1, 2014 which is not deductible for tax purposes. We are required... -

Page 100

... data released by the Department of Health and Human Services, or HHS, regarding estimates of state average risk scores. Risk adjustment is subject to audit by HHS beginning with the 2015 coverage year, however, there will be no payments associated with these audits for 2015, the pilot year... -

Page 101

... consolidated statements of cash flows. We do not recognize premiums revenue or benefits expense for these subsidies. Receipt and payment activity is accumulated at the state and legal entity level and recorded in our consolidated balance sheet in other current assets or trade accounts payable and... -

Page 102

... one-year commercial membership contracts with employer groups, subject to cancellation by the employer group on 30-day written notice. Our Medicare contracts with CMS renew annually. Our military services contracts with the federal government and our contracts with various state Medicaid programs... -

Page 103

... drug insurance coverage. We recognize premiums revenue for providing this insurance coverage ratably over the term of our annual contract. Our CMS payment is subject to risk sharing through the Medicare Part D risk corridor provisions. In addition, receipts for reinsurance and low-income cost... -

Page 104

... to our provider networks and clinical programs, claim processing, customer service, enrollment, and other services, while the federal government retains all of the risk of the cost of health benefits. We account for revenues under the current contract net of estimated health care costs similar to... -

Page 105

...payments, capitation payments, pharmacy costs net of rebates, allocations of certain centralized expenses and various other costs incurred to provide health insurance coverage to members, as well as estimates of future payments to hospitals and others for medical care and other supplemental benefits... -

Page 106

... represent monthly contractual fees disbursed to primary care and other providers who are responsible for providing medical care to members. Pharmacy costs represent payments for members' prescription drug benefits, net of rebates from drug manufacturers. Receivables for such pharmacy rebates are... -

Page 107

...of cash flows. The related interest income is included in investment income in our consolidated statement of income. MCCI provides services to Humana Medicare Advantage members under capitation contracts with our health plans. Under these capitation agreements with Humana, MCCI assumes the financial... -

Page 108

... pricing models, discounted cash flow methodologies, or similar techniques reflecting our own assumptions about the assumptions market participants would use as well as those requiring significant management judgment. Fair value of actively traded debt securities are based on quoted market prices... -

Page 109

... interim and annual reporting periods in 2016, with early adoption permitted. All legal entities are subject to reevaluation under the revised consolidation model. We are currently evaluating the impact, if any, on our results of operations, financial position, and cash flows. In May 2014, the FASB... -

Page 110

.... American Eldercare complements our core capabilities and strength in serving seniors and disabled individuals with a unique focus on individualized and integrated care, and has contracts to provide Medicaid long-term support services across the entire state of Florida. The enrollment effective... -

Page 111

... acquisition dates. Acquisition-related costs recognized in each of 2015, 2014, and 2013 were not material to our results of operations. The pro forma financial information assuming the acquisitions had occurred as of the beginning of the calendar year prior to the year of acquisition, as well... -

Page 112

... across the United States with no individual state exceeding 11%. In addition, 6% of our tax-exempt securities were insured by bond insurers and had an equivalent weighted average S&P credit rating of AA exclusive of the bond insurers' guarantee. Our investment policy limits investments in a single... -

Page 113

... tranches having high credit support, with over 99% of the collateral consisting of prime loans. The weighted average credit rating of all commercial mortgage-backed securities was AA+ at December 31, 2015. The percentage of corporate securities associated with the financial services industry was 25... -

Page 114

... 31, 2015 and 2014, respectively, for financial assets measured at fair value on a recurring basis: Fair Value Measurements Using Quoted Prices Other in Active Observable Markets Inputs (Level 1) (Level 2) (in millions) Unobservable Inputs (Level 3) Fair Value December 31, 2015 Cash equivalents... -

Page 115

... fair value of our long-term debt was $3,986 million at December 31, 2015 and $4,102 million at December 31, 2014. The fair value of our long-term debt is determined based on Level 2 inputs, including quoted market prices for the same or similar debt, or if no quoted market prices are available, on... -

Page 116

... premium increases for the 2016 coverage year related generally to the first half of 2015 claims experience, the discontinuation of certain products as well as exit of certain markets for 2016, network improvements, enhancements to claims and clinical processes and administrative cost control... -

Page 117

...term asset Total 2015 coverage year net (liability) asset Total net (liability) asset $ (91) (87) $ $ $ $ $ In 2015, we paid the federal government $867 million for the annual health insurance industry fee attributed to calendar year 2015, in accordance with the Health Care Reform Law. In 2014... -

Page 118

... Changes in the carrying amount of goodwill for our reportable segments for the years ended December 31, 2015 and 2014 were as follows: Retail Group Healthcare Services Total (in millions) Balance at January 1, 2014 Acquisitions Dispositions Subsequent payments/adjustments Balance at December... -

Page 119

...Weighted Average Life 2015 Cost Accumulated Amortization Net Cost 2014 Accumulated Amortization Net (in millions) Other intangible assets: Customer contracts/relationships Trade names and technology Provider contracts Noncompetes and other Total other intangible assets 9.8 years $ 566 8.3 years... -

Page 120

... claims associated with individual commercial medical products. The higher favorable prior period development during 2014 and 2013 resulted from increased membership, better than originally expected utilization across most of our major business lines and increased financial recoveries. The increase... -

Page 121

... as individual commercial medical members transitioned to plans compliant with the Health Care Reform Law. The higher benefits expense associated with future policy benefits payable during 2013 relates to reserve strengthening for our closed block of long-term care insurance policies acquired in... -

Page 122

... the federal statutory rate for the years ended December 31, 2015, 2014 and 2013 due to the following: 2015 2014 (in millions) 2013 Income tax provision at federal statutory rate States, net of federal benefit, and Puerto Rico Tax exempt investment income Health insurer fee Nondeductible executive... -

Page 123

... States and certain foreign jurisdictions. The U.S. Internal Revenue Service, or IRS, has completed its examinations of our consolidated income tax returns for 2013 and prior years. Our 2014 tax return is in the post-filing review period under the Compliance Assurance Process (CAP). Our 2015 tax... -

Page 124

... relationships, including financial advisory and banking, with some parties to the credit agreement. Commercial Paper In October 2014, we entered into a commercial paper program pursuant to which we may issue short-term, unsecured commercial paper notes privately placed on a discount basis through... -

Page 125

... STATEMENTS-(Continued) the year ended December 31, 2015 was $414 million, with $299 million outstanding at December 31, 2015. There were no outstanding borrowings at December 31, 2014. 13. EMPLOYEE BENEFIT PLANS Employee Savings Plan We have defined contribution retirement savings plans covering... -

Page 126

... the deductibility of annual compensation in excess of $500,000 per employee as mandated by the Health Care Reform Law. The actual tax benefit realized for the deductions taken on our tax returns from option exercises and restricted stock vesting totaled $34 million in 2015, $30 million in 2014, and... -

Page 127

..., and a weighted-average remaining contractual term of 3.5 years. The total intrinsic value of stock options exercised during 2015 was $28 million, compared with $32 million during 2014 and $39 million during 2013. Cash received from stock option exercises totaled $23 million in 2015, $52 million in... -

Page 128

... terms of the Merger Agreement, we have agreed with Aetna that our quarterly dividend will not exceed $0.29 per share prior to the closing of the Merger. Declaration and payment of future quarterly dividends is at the discretion of our Board and may be adjusted as business needs or market conditions... -

Page 129

... program authorized in September 2014. Under the ASR Agreement, on November 10, 2014, we made a payment of $500 million to Goldman Sachs from available cash on hand and received an initial delivery of 3.06 million shares of our common stock from Goldman Sachs based on the then current market price... -

Page 130

... December 31, 2015 under all of our noncancelable operating leases with initial terms in excess of one year are as follows: Minimum Lease Payments Sublease Rental Receipts (in millions) Net Lease Commitments For the years ending December 31,: 2016 2017 2018 2019 2020 Thereafter Total $ $ 173 159... -

Page 131

... our total premiums and services revenue for the year ended December 31, 2015, primarily consisted of products covered under the Medicare Advantage and Medicare Part D Prescription Drug Plan contracts with the federal government. These contracts are renewed generally for a calendar year term unless... -

Page 132

... results of operations, financial position, or cash flows. At December 31, 2015, our military services business, which accounted for approximately 1% of our total premiums and services revenue for the year ended December 31, 2015, primarily consisted of the TRICARE South Region contract. The current... -

Page 133

...Our state-based Medicaid business accounted for approximately 4% of our total premiums and services revenue for the year ended December 31, 2015. In addition to our state-based Temporary Assistance for Needy Families, or TANF, Medicaid contracts in Florida and Kentucky, we have contracts in Illinois... -

Page 134

... regulatory authorities. These authorities regularly scrutinize the business practices of health insurance, health care delivery and benefits companies. These reviews focus on numerous facets of our business, including claims payment practices, statutory capital requirements, provider contracting... -

Page 135

... to providers, members, and others, including failure to properly pay claims, improper policy terminations, challenges to our implementation of the Medicare Part D prescription drug program and other litigation. A limited number of the claims asserted against us are subject to insurance coverage... -

Page 136

... LI-NET prescription drug plan program and contracts with various states to provide Medicaid, dual eligible, and Long-Term Support Services benefits, collectively our state-based contracts. The Group segment consists of employer group commercial fully-insured medical and specialty health insurance... -

Page 137

... Services segment, primarily pharmacy, provider, and home based services as well as clinical programs, to our Retail and Group customers. Intersegment sales and expenses are recorded at fair value and eliminated in consolidation. Members served by our segments often use the same provider networks... -

Page 138

... Total Medicare Fully-insured Specialty Medicaid and other Total premiums Services revenue: Provider ASO and other Pharmacy Total services revenue Total revenues-external customers Intersegment revenues Services Products Total intersegment revenues Investment income Total revenues Operating expenses... -

Page 139

... Total Medicare Fully-insured Specialty Medicaid and other Total premiums Services revenue: Provider ASO and other Pharmacy Total services revenue Total revenues-external customers Intersegment revenues Services Products Total intersegment revenues Investment income Total revenues Operating expenses... -

Page 140

... Advantage $ 22,481 Group Medicare Advantage 4,710 Medicare stand-alone PDP 3,033 Total Medicare 30,224 Fully-insured 1,160 Specialty 210 Medicaid and other 328 Total premiums 31,922 Services revenue: Provider - ASO and other 18 Pharmacy - Total services revenue 18 Total revenues-external customers... -

Page 141

... long-duration insurance products accounted for approximately 1% of our consolidated premiums and services revenue for the year ended December 31, 2015. We use long-duration accounting for products such as long-term care, life insurance, annuities, and certain health and other supplemental policies... -

Page 142

Humana Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) Long-term care insurance policies provide nursing home and home health coverage for which premiums are collected many years in advance of benefits paid, if any. Therefore, our actual claims experience will emerge many years after ... -

Page 143

... well-established, as evidenced by the strong financial ratings at December 31, 2015 presented below: Total Recoverable (in millions) A.M. Best Rating at December 31, 2015 Reinsurer Protective Life Insurance Company Munich American Reassurance Company Employers Reassurance Corporation General Re... -

Page 144

..., the financial position of Humana Inc. and its subsidiaries at December 31, 2015 and 2014, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2015 in conformity with accounting principles generally accepted in the United States of... -

Page 145

Humana Inc. QUARTERLY FINANCIAL INFORMATION (Unaudited) A summary of our quarterly unaudited results of operations for the years ended December 31, 2015 and 2014 follows: 2015 First Second Third Fourth (2) Total revenues Income before income taxes Net income Basic earnings per common share Diluted ... -

Page 146

... is supported by formal policies and procedures which are reviewed, modified and improved as changes occur in business conditions and operations. The Audit Committee of the Board of Directors, which is composed solely of independent outside directors, meets periodically with members of management... -

Page 147

... control over financial reporting as of December 31, 2015 has been audited by PricewaterhouseCoopers LLP, our independent registered public accounting firm, who also audited the Company's consolidated financial statements included in our Annual Report on Form 10-K, as stated in their report which... -

Page 148

... President and Chief Operating Officer Senior Vice President and Chief Medical Officer Senior Vice President and Chief Consumer Officer Senior Vice President and Chief Strategy Officer Senior Vice President and Chief Human Resources Officer Senior Vice President and Chief Financial Officer Senior... -

Page 149

...Treasury Services and Technology & Global Operations. (7) Mr. Kane currently serves as Senior Vice President and Chief Financial Officer, having been elected to this position in June 2014. Prior to joining the Company, Mr. Kane spent nearly 17 years at Goldman, Sachs & Co. As a managing director, he... -

Page 150

...New York Stock Exchange Corporate Governance Standard 303A.10. The Humana Inc. Ethics Every Day is available on our web site at www.humana.com. Any waiver of the application of the Humana Inc. Principles of Business Ethics to directors or executive officers must be made by the Board of Directors and... -

Page 151

...awards, see Note 13. (2) The Humana Inc. 2011 Stock Incentive Plan was approved by stockholders at the Annual Meeting held on April 21, 2011. On July 5, 2011, 18.5 million shares were registered with the Securities and Exchange Commission on Form S-8. (3) Of the number listed above, 3,814,148 can be... -

Page 152

... Annual Meeting of Stockholders scheduled to be held on April 21, 2016 appearing under the captions "Certain Transactions with Management and Others" and "Corporate Governance - Independent Directors" of such Proxy Statement. ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES The information required... -

Page 153

...Schedule II Parent Company Financial Information Valuation and Qualifying Accounts All other schedules have been omitted because they are not applicable. (3) 2.1 Exhibits: Agreement and Plan of Merger, dated as of July 2, 2015 among Aetna Inc., Echo Merger Sub, Inc., Echo Merger Sub, LLC and Humana... -

Page 154

... 17, 2011). Letter agreement with Humana Inc. officers concerning health insurance availability (incorporated herein by reference to Exhibit 10(mm) to Humana Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 1994). Executive Long-Term Disability Program (incorporated herein by... -

Page 155

...Medicare Voluntary Prescription Drug Plan (incorporated herein by reference to Exhibit 10.3 to Humana Inc.'s Quarterly Report on Form 10-Q for the quarter ended September 30, 2005). Addendum to Agreement Providing for the Operation of an Employer/Union-only Group Medicare Advantage Prescription Drug... -

Page 156

... 2011 Stock Incentive Plan (Non-Qualified Stock Options with Non-Compete/Non-Solicit). Computation of ratio of earnings to fixed charges. Code of Conduct for Chief Executive Officer & Senior Financial Officers (incorporated herein by reference to Exhibit 14 to Humana Inc.'s Annual Report on Form 10... -

Page 157

Humana Inc. SCHEDULE I-PARENT COMPANY FINANCIAL INFORMATION CONDENSED BALANCE SHEETS December 31, 2015 2014 (in millions, except share amounts) ASSETS Current assets: Cash and cash equivalents Investment securities Receivable from operating subsidiaries Other current assets Total current assets ... -

Page 158

Humana Inc. SCHEDULE I-PARENT COMPANY FINANCIAL INFORMATION CONDENSED STATEMENTS OF INCOME For the year ended December 31, 2015 2014 (in millions) 2013 Revenues: Management fees charged to operating subsidiaries Investment and other income, net Expenses: Operating costs Depreciation Interest $ ... -

Page 159

Humana Inc. SCHEDULE I-PARENT COMPANY FINANCIAL INFORMATION CONDENSED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31, 2015 2014 (in millions) 2013 Net income Other comprehensive (loss) income: Change in gross unrealized investment gains/losses Effect of income taxes Total change ... -

Page 160

Humana Inc. SCHEDULE I-PARENT COMPANY FINANCIAL INFORMATION CONDENSED STATEMENTS OF CASH FLOWS For the year ended December 31, 2015 2014 (in millions) 2013 Net cash provided by operating activities Cash flows from investing activities: Proceeds from sale of business Acquisitions Capital ... -

Page 161

..., by state regulatory authorities, Humana Inc., our parent company, charges a management fee for reimbursement of certain centralized services provided to its subsidiaries including information systems, disbursement, investment and cash administration, marketing, legal, finance, and medical and... -

Page 162

Humana Inc. SCHEDULE I-PARENT COMPANY FINANCIAL INFORMATION NOTES TO CONDENSED FINANCIAL STATEMENTS-(Continued) 3. REGULATORY REQUIREMENTS Certain of our insurance subsidiaries operate in states that regulate the payment of dividends, loans, or other cash transfers to Humana Inc., our parent company... -

Page 163

Humana Inc. SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2015, 2014, and 2013 (in millions) Additions Charged (Credited) to Costs and Expenses Balance at Beginning of Period Acquired/ (Disposed) Balances Charged to Other Accounts (1) Deductions or Write-offs ... -

Page 164

... President and Chief Financial Officer (Principal Financial Officer) Vice President, Chief Accounting Officer and Controller (Principal Accounting Officer) President and Chief Executive Officer, Director (Principal Executive Officer) Chairman of the Board February 18, 2016 /s/ CYNTHIA H. ZIPPERLE... -

Page 165

...'s Internet site at Humana.com or by writing: Regina C. Nethery Enterprise Vice President - Investor Relations Humana Inc. Post Ofï¬ce Box 1438 Louisville, Kentucky 40201-1438 Transfer Agent and Registrar American Stock Transfer & Trust Company, LLC Shareholder Services - ATTN: Operations Center... -

Page 166

GCHJJZ8EN 0216