HollyFrontier 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR STOCKHOLDERS

2015 was a year of transition and continuous improvement

for HollyFrontier. We established and began executing a

strategy to both improve our refining operations through

reliability improvement initiatives, and enhance our gross

margin and free cash generation through commercial

optimization and opportunity capital investments. Our

reported full-year operational results illustrate the initial

benefits and execution of our business improvement plan.

We reported strong earnings driven by record refinery

utilization rates and lower operating costs. We also made

significant progress on key capital investment projects

that are making our refining systems even stronger. We

are confident that the actions we are taking will enable

us to increase our competitive advantages and extend

our lengthy track record of success to create further value

for all HollyFrontier stockholders.

Solid Financial Results in a Volatile Market Environment

HollyFrontier’s financial results in 2015 reflect the inherent

advantages of our refineries, our focus on operational

execution and impact of the investments we are making

to improve our refining capabilities, safety and reliability.

In 2015, we achieved:

• Net income attributable to HFC stockholders

of $879 million (excluding the non-cash lower

of cost or market “LOCM” adjustment);

• Gross refining margins of $16.07 per produced barrel;

• Operating cash flow of $980 million; and

• A sterling balance sheet with $211 million in cash and

short-term investments as of December 31, 2015, and

just $31 million in total debt (exclusive of HEP debt);

• Approximately $990 million in capital returned

to shareholders.

We benefited from the growing demand for gasoline and

strong margins through most of the year. The commodity

price environment remains volatile and we are confident

that our core motor fuels and specialty products will be

highly demanded going forward. In addition, the actions

we are taking to increase our core competitive advantages

will position us to meet our mission of achieving superior

sustainable financial performance and profitable growth.

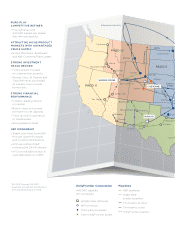

Prudent Investments to Support Continued Growth

In 2015, we invested more than $600 million to enhance

and expand our manufacturing operations, improve safety

and reliability and minimize our environmental impact.

We are nearing completion on several components of

our large capital investment program. Going forward, our

focus is on our opportunity capital program, where we

will deploy small amounts of capital targeted at extract-

ing more out of our existing refinery units. Combined,

we expect these large capital and opportunity capital

investments will help us capture an annual average

EBITDA opportunity of $365 million by 2018. Some of

the highlights of the capital projects from 2015 include:

• El Dorado Naphtha Fractionation: This project to

increase yields by reducing byproducts such as fuel gas,

propane and butane and reduce the benzene content of

our gasoline pool was completed. Through it, we gained

an additional 2,000 barrels per day of gasoline production.

In September 2015, HollyFrontier dropped down the

newly constructed naphtha fractionation and hydrogen

generation units to our MLP affiliate Holly Energy Partners

for consideration of approximately $62 million.

• Cheyenne Hydrogen Upgrade: At the Cheyenne Refinery,

we completed installation of a new hydrogen plant in

the fourth quarter resulting in improved liquid yield and

the ability to process higher volumes of advantaged

heavy crude.

• Woods Cross Refinery Expansion: The initial phase of

the Woods Cross expansion from 31,000 barrels per

day to 45,000 barrels per day is expected to be put into

operation during the first quarter of 2016. Given the

commodity price volatility which persisted through 2015,

we elected to invest an incremental $20 million in this

project to allow for greater crude slate flexibility.

• Opportunity Capital Program: Going forward, our

focus is on our opportunity capital investment program

targeting liquid yield improvement and debottlenecking

opportunities. In 2016, work is scheduled at both our

Tulsa and Cheyenne Refineries, where the catalytic

cracking units will be modernized driving an improve-

ment in liquid yield. Work is also underway to address

bottlenecks at our El Dorado Refinery which we expect

will increase crude capacity by 6,000 barrel per day

at minimal cost. Together we expect the opportunity

capital investments identified to generate $200 million

in annual EBITDA by the end of 2018.

2 HollyFrontier Corporation 2015 Annual Report