HollyFrontier 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Content

6

Items 1 and 2. Business and Properties

COMPANY OVERVIEW

References herein to HollyFrontier Corporation (“HollyFrontier”) include HollyFrontier and its consolidated subsidiaries. In

accordance with the Securities and Exchange Commission's (“SEC”) “Plain English” guidelines, this Annual Report on Form 10-

K has been written in the first person. In this document, the words “we,” “our,” “ours” and “us” refer only to HollyFrontier and

its consolidated subsidiaries or to HollyFrontier or an individual subsidiary and not to any other person, with certain exceptions.

Generally, the words “we,” “our,” “ours” and “us” include Holly Energy Partners, L.P. (“HEP”) and its subsidiaries as consolidated

subsidiaries of HollyFrontier, unless when used in disclosures of transactions or obligations between HEP and HollyFrontier or

its other subsidiaries. This document contains certain disclosures of agreements that are specific to HEP and its consolidated

subsidiaries and do not necessarily represent obligations of HollyFrontier. When used in descriptions of agreements and

transactions, “HEP” refers to HEP and its consolidated subsidiaries.

We merged with Frontier Oil Corporation (“Frontier”) on July 1, 2011. Concurrent with the merger, we changed our name from

Holly Corporation (“Holly”) to HollyFrontier and changed the ticker symbol for our common stock traded on the New York Stock

Exchange to “HFC.” Accordingly, this document includes Frontier, its consolidated subsidiaries and the operations of the merged

Frontier businesses effective July 1, 2011, but not prior to this date.

We are principally an independent petroleum refiner that produces high-value refined products such as gasoline, diesel fuel, jet

fuel, specialty lubricant products, and specialty and modified asphalt. We were incorporated in Delaware in 1947 and maintain

our principal corporate offices at 2828 N. Harwood, Suite 1300, Dallas, Texas 75201-1507. Our telephone number is 214-871-3555

and our internet website address is www.hollyfrontier.com. The information contained on our website does not constitute part of

this Annual Report on Form 10-K. A print copy of this Annual Report on Form 10-K will be provided without charge upon written

request to the Vice President, Investor Relations at the above address. A direct link to our SEC filings is available on our website

under the Investor Relations tab. Also available on our website are copies of our Corporate Governance Guidelines, Audit Committee

Charter, Compensation Committee Charter, Nominating / Corporate Governance Committee Charter, Environmental, Health,

Safety, and Public Policy Committee Charter and Code of Business Conduct and Ethics, all of which will be provided without

charge upon written request to the Vice President, Investor Relations at the above address. Our Code of Business Conduct and

Ethics applies to all of our officers, employees and directors, including our principal executive officer, principal financial officer

and principal accounting officer. Our common stock is traded on the New York Stock Exchange under the trading symbol “HFC.”

On February 21, 2011, we entered into a merger agreement providing for a “merger of equals” business combination between us

and Frontier. On July 1, 2011, North Acquisition, Inc., a direct wholly-owned subsidiary of Holly, merged with and into Frontier,

with Frontier surviving as a wholly-owned subsidiary of Holly. Subsequent to the merger and following approval by HollyFrontier's

post-closing board of directors, Frontier merged with and into HollyFrontier, and HollyFrontier continued as the surviving

corporation. This merger combined the legacy Frontier refinery operations consisting of refineries in El Dorado, Kansas (the “El

Dorado Refinery”) and Cheyenne, Wyoming (the “Cheyenne Refinery”) with Holly’s legacy refinery operations to form

HollyFrontier. The aggregate equity consideration paid in connection with the merger was $3.7 billion.

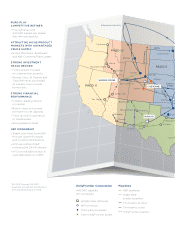

As of December 31, 2015, we:

• owned and operated the El Dorado Refinery, two refinery facilities located in Tulsa, Oklahoma (collectively, the "Tulsa

Refineries"), a refinery in Artesia, New Mexico that is operated in conjunction with crude oil distillation and vacuum

distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the “Navajo Refinery”),

the Cheyenne Refinery and a refinery in Woods Cross, Utah (the “Woods Cross Refinery”);

• owned and operated HollyFrontier Asphalt Company (“HFC Asphalt”), formerly known as NK Asphalt Partners, which

operates various asphalt terminals in Arizona, New Mexico and Oklahoma;

• owned a 39% interest in HEP, which includes our 2% general partner interest.

HEP is a consolidated variable interest entity (“VIE”) as defined under U.S. generally accepted accounting principles (“GAAP”).

Information on HEP's assets and acquisitions completed between 2011 and 2016 can be found under the “Holly Energy Partners,

L.P.” section provided later in this discussion of Items 1 and 2, “Business and Properties.”

Our operations are currently organized into two reportable segments, Refining and HEP. The Refining segment includes the

operations of our El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries and HFC Asphalt. The HEP segment involves

all of the operations of HEP. See Note 19 “Segment Information” in the Notes to Consolidated Financial Statements for additional

information on our reportable segments.