HollyFrontier 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Content

13

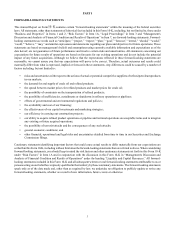

The following table sets forth information about our Rocky Mountain region operations, including non-GAAP performance

measures.

Years Ended December 31,

2015 2014 2013

Rocky Mountain Region (Cheyenne and Woods Cross Refineries)

Crude charge (BPD) (1) 68,770 64,820 64,680

Refinery throughput (BPD) (2) 74,480 71,130 70,440

Refinery production (BPD) (3) 70,180 68,140 67,860

Sales of produced refined products (BPD) 68,000 68,520 68,870

Sales of refined products (BPD) (4) 73,320 72,390 72,280

Refinery utilization (5) 82.9% 78.1% 77.9%

Average per produced barrel (6)

Net sales $ 70.05 $ 107.51 $ 112.49

Cost of products (7) 51.80 90.95 94.63

Refinery gross margin (8) 18.25 16.56 17.86

Refinery operating expenses (9) 9.89 10.20 8.65

Net operating margin (8) $ 8.36 $ 6.36 $ 9.21

Refinery operating expenses per throughput barrel (10) $ 9.03 $ 9.83 $ 8.46

Feedstocks:

Sweet crude oil 42% 44% 43%

Sour crude oil —% 2% 1%

Heavy sour crude oil 37% 30% 34%

Black wax crude oil 13% 15% 14%

Other feedstocks and blends 8% 9% 8%

Total 100% 100% 100%

Footnote references are provided under our Consolidated Refinery Operating Data table on page 7.

The Cheyenne Refinery facility is located on a 255-acre site and is a fully integrated refinery with crude distillation, vacuum

distillation, coking, FCC, HF alkylation, catalytic reforming, hydrodesulfurization of naphtha and distillates, butane isomerization,

hydrogen production, sulfur recovery and product blending units. The operating units at the Cheyenne Refinery include both newly

constructed units and older units that have been upgraded over the years.

The Woods Cross Refinery facility is located on a 200-acre site and is a fully integrated refinery with crude distillation, solvent

deasphalter, FCC, HF alkylation, catalytic reforming, hydrodesulfurization, isomerization, sulfur recovery and product blending

units. The operating units at the Woods Cross Refinery include newly constructed units, older units that have been relocated from

other facilities, upgraded and re-erected in Woods Cross, and units that have been operating as part of the Woods Cross facility

(with periodic major maintenance) for many years, in some very limited cases since before 1950. The facility typically processes

or blends an additional 2,000 BPSD of natural gasoline, butane and gas oil over its 31,000 BPSD capacity.

We own and operate 4 miles of hydrogen pipeline that connects the Woods Cross Refinery to a hydrogen plant located on the

property of Chevron's Salt Lake City Refinery. Additionally, HEP owns and operates 12 miles of crude oil and refined products

pipelines that allows us to connect our Woods Cross Refinery to common carrier pipeline systems.

Construction continues on our existing expansion project to increase planned processing capacity to 45,000 BPSD and includes

new refining facilities and a new rail loading rack for intermediates and finished products associated with refining waxy crude

oil. This initial phase of the project is expected to cost $420.0 million and is planned to be put into operation during the first quarter

of 2016. An additional investment of $20.0 million is being made to allow for greater crude slate flexibility, which we believe will

increase capacity utilization and improve overall economic returns during periods when wax crudes are in short supply. Further

discussion of this project can be found in “Management's Discussion and Analysis of Financial Condition and Results of Operations”

under Liquidity and Capital Resources.