HollyFrontier 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT

Table of contents

-

Page 1

2015 ANNUAL REPORT -

Page 2

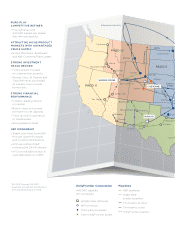

... crude as well as Canadian sour crude oils • Distributes to high-margin markets in Utah, Idaho, Nevada, Wyoming and eastern Washington HOLLY ENERGY PARTNERS • 75% joint-venture interest in the UNEV Pipeline - a 427-mile refined product pipeline running from Salt Lake City, Utah, to Las Vegas... -

Page 3

... Pipeline - a 95-mile crude oil pipeline system that serves refineries in the Salt Lake City area • 3,400 miles of crude oil and petroleum product pipelines • 14 million barrels of refined product and crude oil storage • 9 terminals and 7 rack facilities Holly Energy Partners owns and operates... -

Page 4

... Grand Forks PADD II WOODS CROSS Sidney Salt Lake City CHEYENNE Denver Ja yh Om Express Platte PADD V Cedar City Las Vegas Bloomfield Wichita Cushing Albuquerque Phoenix NAVAJO Tucson Moriarty Abilene El Paso Orla aw k Dunc Wichita F Housto *Q4 2014 through Q3 2015 quarterly LP and GP... -

Page 5

Minneapolis Des Moines Chicago maha PADD I Kansas City EL DORADO TULSA can Falls PADD III on A NICHE PURE-PLAY REFINER Proximity to Growing North American Crude Production All five HFC refineries sit close to production growth. -

Page 6

...bottlenecks at our El Dorado Refinery which we expect will increase crude capacity by 6,000 barrel per day at minimal cost. Together we expect the opportunity capital investments identified to generate $200 million in annual EBITDA by the end of 2018. 2 HollyFrontier Corporation 2015 Annual Report -

Page 7

... that George Damiris would be taking the reins as the Company's Chief Executive Officer. George has been a key member of our leadership team since joining the company in 2007 and has 35 years of industry experience. George and the entire management team are committed to executing our strategic plan... -

Page 8

... 443 6,000 447 6,053 5,204 5,253 9,230 14 5,524 414 425 332 11 12 13 14 15 11 12 13 14 15 11 12 13 Refinery Production BPD in thousands HFC Stockholders' Equity $ in millions Total Assets $ in millions 4 HollyFrontier Corporation 2015 Annual Report 8,388 15 13,238 15 -

Page 9

... _____ HOLLYFRONTIER CORPORATION (Exact name of registrant as specified in its charter) _____ Delaware (State or other jurisdiction of incorporation or organization) 75-1056913 (I.R.S. Employer Identification No.) 2828 N. Harwood, Suite 1300 Dallas, Texas (Address of principal executive offices... -

Page 10

...14. Directors, executive officers and corporate governance Executive compensation Security ownership of certain beneficial owners and management and related stockholder matters Certain relationships and related transactions, and director independence Principal accounting fees and services PART IV 15... -

Page 11

... crude oil and refined products; the spread between market prices for refined products and market prices for crude oil; the possibility of constraints on the transportation of refined products; the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines; effects... -

Page 12

... biological resources. "Black wax crude oil" is a low sulfur, low gravity crude oil produced in the Uintah Basin in Eastern Utah that has certain characteristics that require specific facilities to transport, store and refine into transportation fuels. "Catalytic reforming" means a refinery process... -

Page 13

...diesel in the FCC process. The remaining asphaltenes are either sold, blended to fuel oil or blended with other asphalt as a hardener. "Scanfiner" is a refinery unit that removes sulfur from gasoline to produce low sulfur gasoline blendstock. "Sour crude oil" means crude oil containing quantities of... -

Page 14

... Lovington, New Mexico (collectively, the "Navajo Refinery"), the Cheyenne Refinery and a refinery in Woods Cross, Utah (the "Woods Cross Refinery"); • owned and operated HollyFrontier Asphalt Company ("HFC Asphalt"), formerly known as NK Asphalt Partners, which operates various asphalt terminals... -

Page 15

... expenses (9) Net operating margin (8) Refinery operating expenses per throughput barrel (10) Feedstocks: Sweet crude oil Sour crude oil Heavy sour crude oil Black wax crude oil Other feedstocks and blends Total Years Ended December 31, 2014 406,180 436,400 425,010 420,990 461,640 91.7% 2013 387,520... -

Page 16

...Dorado and Tulsa Refineries) Facilities The El Dorado Refinery is a high-complexity coking refinery with a 135,000 barrels per stream day processing capacity and the ability to process significant volumes of heavy and sour crudes. The integrated refining processes at the Tulsa West and East refinery... -

Page 17

... crude oil Heavy sour crude oil Other feedstocks and blends Total Years Ended December 31, 2014 2013 59% 21% 15% 5% 100% 71% 11% 14% 4% 100% 69% 6% 16% 9% 100% Footnote references are provided under our Consolidated Refinery Operating Data table on page 7. The El Dorado Refinery is located... -

Page 18

... 31, 2014 2015 Mid-Continent Region (El Dorado and Tulsa Refineries) Sales of produced refined products: Gasolines Diesel fuels Jet fuels Fuel oil Asphalt Lubricants LPG and other Total 2013 50% 33% 7% 1% 2% 4% 3% 100% 47% 33% 7% 1% 3% 4% 5% 100% 47% 31% 8% 1% 3% 4% 6% 100% Crude Oil and... -

Page 19

... Navajo Refinery primarily serves the southwestern United States market, including the metropolitan areas of El Paso, Texas; Albuquerque, Moriarty and Bloomfield, New Mexico; Phoenix and Tucson, Arizona; and portions of northern Mexico. Our products are shipped through HEP's pipelines from Artesia... -

Page 20

...NuStar Energy L.P. and HEP. Refined products from the Gulf Coast are transported via Magellan pipelines. Arizona Market The Arizona market for refined products is currently supplied by a number of refiners via pipelines and trucks. Refiners include companies located in west Texas, eastern New Mexico... -

Page 21

...'s Salt Lake City Refinery. Additionally, HEP owns and operates 12 miles of crude oil and refined products pipelines that allows us to connect our Woods Cross Refinery to common carrier pipeline systems. Construction continues on our existing expansion project to increase planned processing capacity... -

Page 22

... by Tesoro Logistics. We sell to branded and unbranded customers in these markets. In 2012, we began shipping refined products to Cedar City, Utah and Las Vegas, Nevada via the UNEV Pipeline. The majority of the Las Vegas, Nevada market for refined products is supplied by various West Coast refiners... -

Page 23

... in Artesia, New Mexico that require terminalling in or through El Paso, Texas. Osage is the owner of the Osage pipeline, a 135-mile pipeline that transports crude oil from Cushing, Oklahoma to our El Dorado Refinery in Kansas and also has a connection to the Jayhawk pipeline that services the... -

Page 24

... in west Texas, New Mexico and Oklahoma that primarily deliver crude oil to our Navajo Refinery; • approximately 8 miles of refined product pipelines that support our Woods Cross Refinery located near Salt Lake City, Utah; • gasoline and diesel connecting pipelines that support our Tulsa East... -

Page 25

... Tulsa West facility and crude oil Leased Automatic Custody Transfer units located at our Cheyenne Refinery; • on-site crude oil tankage at our Tulsa, El Dorado, Navajo, Cheyenne and Woods Cross Refineries having an aggregate storage capacity of approximately 1,350,000 barrels; • on-site refined... -

Page 26

... to extreme volatility over the years and costs to purchase RINs can be significant. On November 30, 2015, the EPA issued final multi-year volume mandates under the RFS2 for 2014 to 2016. While these volume mandates are generally lower than the statutory mandates, they represent a slight increase... -

Page 27

... there is no firm proposal or date for such regulation and the EPA has said that such a performance standard is not imminent. EPA rules require us to report GHG emissions from our refinery operations and consumer use of fuel products produced at our refineries on an annual basis. While the cost of... -

Page 28

..., handled, used, released or disposed of. We currently have environmental remediation projects that relate to recovery, treatment and monitoring activities resulting from past releases of refined product and crude oil into the environment. As of December 31, 2015, we had an accrual of $98.1 million... -

Page 29

...of Content Insurance Our operations are subject to hazards of operations, including fire, explosion and weather-related perils. We maintain...premium costs, in our judgment, do not justify such expenditures. We have a risk management oversight committee consisting of members from our senior management... -

Page 30

... accidents or interruptions in transportation, competition in the particular geographic areas that we serve, and factors that are specific to us, such as the success of particular marketing programs and the efficiency of our refinery operations. The demand for crude oil and refined products can also... -

Page 31

... operation of a new, converted or expanded crude oil pipeline that transports crude oil to other markets could result in a decline in the volume of crude oil available to our refineries. Such an event could result in an overall decline in volumes of refined products processed at our refineries... -

Page 32

... refinery) and the expansion of existing ones. Projects are generally initiated to increase the yields of higher-value products, increase the amount of lower cost crude oils that can be processed, increase refinery production capacity, meet new governmental requirements, or maintain the operations... -

Page 33

Table of Content We may incur significant costs to comply with new or changing environmental, energy, health and safety laws and regulations, and face potential exposure for environmental matters. Refinery and pipeline operations are subject to federal, state and local laws regulating, among other ... -

Page 34

...increased operating costs and reduced demand for the refined products we produce. In December 2009, the EPA ...generally work by requiring major sources of emissions, such as electric power plants, or major producers of fuels, such as refineries and gas processing plants, to acquire and on an annual... -

Page 35

...refining and marketing companies, including certain multinational oil companies. Because of their geographic diversity, larger and more complex refineries, integrated operations and greater resources, some of our competitors may be better able to withstand volatile market conditions, to obtain crude... -

Page 36

... and crude oil through its pipelines, leasing certain pipeline capacity to Alon, charging fees for terminalling refined products and other hydrocarbons and storing and providing other services at its terminals. HEP serves the Cheyenne, El Dorado, Navajo, Woods Cross and Tulsa Refineries under... -

Page 37

..., see "Holly Energy Partners, L.P." under Items 1 and 2, "Business and Properties." For risks related to HEP's business, see Item 1A of HEP's Annual Report on Form 10-K for the fiscal year ended December 31, 2015. We are exposed to the credit risks, and certain other risks, of our key customers and... -

Page 38

... with refineries, terminals, pipelines and related facilities. We are dependent on the production and sale of quantities of refined products at refined product margins sufficient to cover operating costs, including any increases in costs resulting from future inflationary pressures or market... -

Page 39

... agreements. Changes in our credit profile, or a significant increase in the price of crude oil, may affect our relationship with our suppliers, which could have a material adverse effect on our liquidity and limit our ability to purchase sufficient quantities of crude oil to operate our refineries... -

Page 40

... of operations or cash flows. Cheyenne HollyFrontier Cheyenne Refining LLC ("HFCR"), our wholly-owned subsidiary, completed certain environmental audits at the Cheyenne Refinery regarding compliance with federal and state environmental requirements. By letters dated October 5, 2012, November 7, 2012... -

Page 41

... Between November 2010 and February 2012, certain of our subsidiaries submitted multiple reports to the EPA to voluntarily disclose non-compliance with fuels regulations at the Cheyenne, El Dorado, Navajo, Tulsa and Woods Cross Refineries and at the Cedar City, Utah and Henderson, Colorado terminals... -

Page 42

...Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Our common stock is traded on the New York Stock...Yet Be Purchased under the Plans or Programs October 2015 November 2015 December 2015 Total for October to December 2015 2,200,000 1,700,... -

Page 43

... of Operations" and our consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K. Years Ended December 31, 2014 2013 2012 (In thousands, except per share data) 2015 FINANCIAL DATA (1) For the period 2011 Sales and other revenues Income... -

Page 44

... the Tulsa West and East facilities, Artesia, New Mexico, which operates in conjunction with crude, vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the Navajo Refinery), Cheyenne, Wyoming (the Cheyenne Refinery) and Woods Cross, Utah (the Woods... -

Page 45

... 31, 2015 2014 2013 (In thousands, except per share data) 13,237,920 $ 19,764,327 $ 20,160,560 Sales and other revenues Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization): Cost of products sold (exclusive of lower of cost or market inventory valuation... -

Page 46

... Information" in the Notes to Consolidated Financial Statements for additional information on our reportable segments. Refining Operating Data Our refinery operations include the El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries. The following tables set forth information, including... -

Page 47

... per barrel for crude oil and feedstocks and the transportation costs of moving the finished products to the market place decreased 43% from $96.21 for the year ended December 31, 2014 to $55.25 for the year ended December 31, 2015. Gross Refinery Margins Gross refinery margin per produced barrel... -

Page 48

... million non-cash charge against income from operations to adjust the value of our inventory to the lower of cost or market at December 31, 2014. This is attributable to a significant decrease in market prices for crude oil and refined products at December 31, 2014. There was no comparable inventory... -

Page 49

... the year ended December 31, 2013 to $13.98 for the year ended December 31, 2014. This was due to a decrease in average per barrel sales prices for refined products sold, partially offset by decreased crude oil and feedstock prices for the current year. Gross refinery margin per produced barrel does... -

Page 50

... of new refinery processing units and the expansion of existing units at our facilities and selective acquisition of complementary assets for our refining operations intended to increase earnings and cash flow. As of December 31, 2015, our cash, cash equivalents and investments in marketable... -

Page 51

... of marketable securities. Planned Capital Expenditures HollyFrontier Corporation Each year our Board of Directors approves our annual capital budget which includes specific projects that management is authorized to undertake. Additionally, when conditions warrant or as new opportunities arise... -

Page 52

.... Additionally, when faced with new emissions or fuels standards, we seek to execute projects that facilitate compliance and also improve the operating costs and / or yields of associated refining processes. El Dorado Refinery Capital projects at the El Dorado Refinery include the completion of an... -

Page 53

... of Content Woods Cross Refinery Construction continues on our existing expansion project to increase planned processing capacity to 45,000 BPSD and includes new refining facilities and a new rail loading rack for intermediates and finished products associated with refining waxy crude oil. This... -

Page 54

... HollyFrontier Corporation Long-term debt - principal (1) Long-term debt - interest (2) Supply agreements (3) Transportation and storage agreements (4) Other long-term obligations Operating leases Holly Energy Partners Long-term debt - principal (5) Long-term debt - interest (6) Pipeline operating... -

Page 55

... forecasted production levels, operating costs and capital expenditures. Our goodwill is allocated by reporting unit as follows: El Dorado, $1.7 billion; Cheyenne, $0.3 billion; and HEP, $0.3 billion. Based on our testing as of July 1, 2015, the fair value of our Cheyenne reporting unit exceeded its... -

Page 56

Table of Content • • • costs of crude oil and related grade differentials; prices of refined products; and our refining margins. As of December 31, 2015, we have the following notional contract volumes related to all outstanding derivative contracts used to mitigate commodity price risk: ... -

Page 57

... rates applicable to the HEP Credit Agreement would not materially affect cash flows. At December 31, 2015, our marketable securities included investments in investment grade, highly-liquid investments with maturities generally not greater than one year from the date of purchase and hence the... -

Page 58

... the years ended December 31, 2015, 2014 and 2013, respectively. Reconciliations of refinery operating information (non-GAAP performance measures) to amounts reported under generally accepted accounting principles in financial statements. Refinery gross margin and net operating margin are non-GAAP... -

Page 59

... Years Ended December 31, 2014 2015 Consolidated Average refinery operating expenses per produced barrel sold Times sales of produced refined products (BPD) Times number of days in period Refinery operating expenses for produced products sold Total refinery operating expenses for produced products... -

Page 60

... exchanges of crude oil with certain parties to facilitate the delivery of quantities to certain locations that are netted at cost. (3) Other refining segment revenue includes the incremental revenues associated with HFC Asphalt, product purchased and sold forward for profit as market conditions and... -

Page 61

Table of Content Item 8. Financial Statements and Supplementary Data MANAGEMENT'S REPORT ON ITS ASSESSMENT OF THE COMPANY'S INTERNAL CONTROL OVER FINANCIAL REPORTING Management of HollyFrontier Corporation (the "Company") is responsible for establishing and maintaining adequate internal control ... -

Page 62

...balance sheets of HollyFrontier Corporation as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, cash flows and equity for each of the three years in the period ended December 31, 2015 of HollyFrontier Corporation and our report dated February 24... -

Page 63

... for the years ended December 31, 2015, 2014 and 2013 Consolidated Statements of Comprehensive Income for the years ended December 31, 2015, 2014 and 2013 Consolidated Statements of Cash Flows for the years ended December 31, 2015, 2014 and 2013 Consolidated Statements of Equity for the years ended... -

Page 64

...31, 2015, in conformity with U.S. generally accepted accounting principles. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), HollyFrontier Corporation's internal control over financial reporting as of December 31, 2015, based on... -

Page 65

... 27,894 (1,289,075) 5,523,584 577,135 6,100,719 9,230,047 $ $ Parenthetical amounts represent asset and liability balances attributable to Holly Energy Partners, L.P. ("HEP") as of December 31, 2015 and December 31, 2014. HEP is a consolidated variable interest entity. See accompanying notes. 57 -

Page 66

... HOLLYFRONTIER CORPORATION CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share data) 2015 Sales and other revenues Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization): Cost of products sold (exclusive of lower of cost or market inventory... -

Page 67

Table of Content HOLLYFRONTIER CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) Years Ended December 31, 2015 Net income Other comprehensive income: Securities available-for-sale: Unrealized gain (loss) on marketable securities Reclassification adjustments to net income ... -

Page 68

... under credit agreement - HEP Redemption of senior notes Redemption of senior notes - HEP Proceeds from sale of HEP common units Proceeds from common unit offerings - HEP Purchase of treasury stock Dividends Distributions to noncontrolling interest Excess tax benefit from equity-based compensation... -

Page 69

... issuances, net of tax Issuance of common stock under incentive compensation plans, net of forfeitures Equity-based compensation, inclusive of tax benefit Purchase of treasury stock Purchase of HEP units for restricted grants Other Balance at December 31, 2013 $ Net income Dividends Distributions to... -

Page 70

... in Lovington, New Mexico (collectively, the "Navajo Refinery"), a refinery located in Cheyenne, Wyoming (the "Cheyenne Refinery") and a refinery in Woods Cross, Utah (the "Woods Cross Refinery"); owned and operated HollyFrontier Asphalt Company ("HFC Asphalt"), formerly known as NK Asphalt Partners... -

Page 71

... locations. In many cases, we enter into net settlement agreements relating to the buy / sell arrangements, which may mitigate credit risk. Inventories: Inventories are stated at the lower of cost, using the last-in, first-out ("LIFO") method for crude oil, unfinished and finished refined products... -

Page 72

... interest in Frontier Pipeline Company, the owner of a pipeline running from Wyoming to Frontier Station, Utah (the "Frontier Pipeline"), and a 25% joint venture interest in SLC Pipeline, LLC, the owner of a pipeline (the "SLC Pipeline") that serves refineries in the Salt Lake City, Utah area, that... -

Page 73

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Deferred Maintenance Costs: Our refinery units require regular major maintenance and repairs which are commonly referred to as "turnarounds." Catalysts used in certain refinery processes also require ... -

Page 74

... in Artesia, New Mexico that require terminalling in or through El Paso, Texas. Osage is the owner of the Osage pipeline, a 135-mile pipeline that transports crude oil from Cushing, Oklahoma to our El Dorado Refinery in Kansas and also has a connection to the Jayhawk pipeline that services the... -

Page 75

... agreements, we pay HEP fees to transport, store and process throughput volumes of refined products, crude oil and feedstocks on HEP's pipelines, terminals, tankage, loading rack facilities and refinery processing units that result in minimum annual payments to HEP, including UNEV (a consolidated... -

Page 76

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued The carrying amounts and estimated fair values of investments in marketable securities, derivative instruments and senior notes at December 31, 2015 and December 31, 2014 were as follows: Fair Value by ... -

Page 77

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Level 3 Financial Instruments We at times have forward commodity sales and purchase contracts for which quoted forward market prices are not readily available. The forward rate used to value these ... -

Page 78

... share-based compensation plan for Holly Logistic Services, L.L.C.'s non-employee directors and certain executives and employees. Compensation cost attributable to HEP's share-based compensation plan was $3.5 million, $3.5 million and $3.6 million for the years ended December 31, 2015, 2014 and 2013... -

Page 79

... ended December 31, 2014 and 2013, we issued common stock upon the vesting of the performance share units having a grant date fair value of $14.3 million and $11.6 million, respectively. As of December 31, 2015, there was $16.4 million of total unrecognized compensation cost related to nonvested... -

Page 80

... HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued NOTE 7: Inventories Inventory consists of the following components: December 31, 2015 2014 (In thousands) Crude oil Other raw materials and unfinished products Finished products(2) Lower of cost or market reserve... -

Page 81

..., forecasted production levels, operating costs and capital expenditures. Based on our testing as of July 1, 2015, the fair value of our Cheyenne reporting unit exceeded its carrying cost by approximately 8%. The fair value of our El Dorado and HEP reporting units substantially exceeded their... -

Page 82

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued in the HEP Credit Agreement). The weighted average interest rates in effect on HEP's Credit Agreement borrowings were 2.572% and 2.152% at December 31, 2015 and 2014, respectively. HEP's obligations ... -

Page 83

... Activities Commodity Price Risk Management Our primary market risk is commodity price risk. We are exposed to market risks related to the volatility in crude oil and refined products, as well as volatility in the price of natural gas used in our refining operations. We periodically enter into... -

Page 84

... HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Accounting Hedges We have swap contracts serving as cash flow hedges against price risk on forecasted purchases of natural gas. We also have forward sales contracts that lock in the prices of future sales of refined... -

Page 85

...December 31, Location of Gain (Loss) Recognized in Income Cost of products sold Operating expenses Total $ $ 2015 48,082 (12,003) 36,079 $ 2014 (In thousands) $ 68,509 (185) 68,324 $ 2013 $ 20,751 (5,250) 15,501 As of December 31, 2015, we have the following notional contract volumes related to our... -

Page 86

...HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS...2014 Interest rate swaps Change in fair value Loss reclassified to earnings due to settlements Total Year Ended December 31, 2013...fair value and balance sheet locations of our outstanding derivative instruments...31, 2015 Derivatives ... -

Page 87

...loss into the statement of income as the hedging instruments contractually mature over the next twelve-month period. NOTE 13: Income Taxes The provision for income taxes is comprised of the following: 2015 Current Federal State Deferred Federal State Years Ended December 31, 2014 2013 (In thousands... -

Page 88

... of book depreciation) Accrued employee benefits Accrued post-retirement benefits Accrued environmental costs Hedging instruments Inventory differences Deferred turnaround costs Net operating loss and tax credit carryforwards Investment in HEP Other Total December 31, 2014 Liabilities (In thousands... -

Page 89

... had no unrecognized tax benefits at December 31, 2015 and 2014. We recognize interest and penalties relating to liabilities for unrecognized tax benefits as an element of tax expense. We are subject to U.S. federal income tax, Oklahoma, Kansas, New Mexico, Iowa, Arizona, Utah, Colorado and Nebraska... -

Page 90

... interest Other comprehensive loss attributable to HollyFrontier stockholders Year Ended December 31, 2014 Net unrealized loss on marketable securities Net unrealized gain on hedging instruments Net change in pension and other post-retirement benefit obligations Other comprehensive income Less other... -

Page 91

... of tax Cost of products sold Operating expenses General and administrative expenses Income tax expense Net of tax Post-retirement healthcare obligation Retirement restoration plan (111) General and administrative expenses (43) Income tax benefit (68) Net of tax (11,811) Total reclassifications... -

Page 92

...date and work location. Not all of our employees are covered by these plans at December 31, 2015. The following table sets forth the changes in the benefit obligation and plan assets of our post-retirement healthcare plans for the years ended December 31, 2015 and 2014: Years Ended December 31, 2015... -

Page 93

... Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Net periodic post-retirement credit consisted of the following components: 2015 Service cost - benefit earned during the year Interest cost on projected benefit obligations Amortization of prior service credit... -

Page 94

... various long-term agreements (entered in the normal course of business) to purchase crude oil, natural gas, feedstocks and other resources to ensure we have adequate supplies to operate our refineries. The substantial majority of our purchase obligations are based on market prices or rates. These... -

Page 95

.... The Refining segment represents the operations of the El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries and HFC Asphalt (aggregated as a reportable segment). Refining activities involve the purchase and refining of crude oil and wholesale and branded marketing of refined products... -

Page 96

... under the Refining segment. HEP segment revenues from external customers were $66.7 million, $57.3 million and $53.4 million for the years ended December 31, 2015, 2014 and 2013, respectively. NOTE 20: Supplemental Financial Information Borrowings pursuant to the HollyFrontier Credit Agreement are... -

Page 97

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Condensed Consolidating Balance Sheet HollyFrontier Corp. Before Consolidation of HEP December 31, 2015 ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net ... -

Page 98

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Condensed Consolidating Balance Sheet HollyFrontier Corp. Before Consolidation of HEP December 31, 2014 ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net ... -

Page 99

... Income HollyFrontier Corp. Before Consolidation of HEP $ 13,171,846 10,525,610 226,979 960,352 108,290 299,233 12,120,464 1,051,382 78,969 6,098 (1,370) 8,916 92,613 1,143,995 405,832 738,163 (30) 738,193 $ 706,144 $ $ Year Ended December 31, 2015 Sales and other revenues Operating costs... -

Page 100

... Comprehensive Income HollyFrontier Corp. Before Consolidation of HEP $ 19,708,328 17,500,601 397,478 1,041,571 103,785 317,149 19,360,584 347,744 65,375 6,221 - 866 72,462 420,206 140,937 279,269 (25) 279,294 $ 306,366 $ $ Year Ended December 31, 2014 Sales and other revenues Operating costs... -

Page 101

... and Comprehensive Income HollyFrontier Corp. Before Consolidation of HEP $ 20,106,757 17,641,119 995,194 116,214 253,062 19,005,589 1,101,168 52,288 (6,338) (22,109) 23,841 1,125,009 391,243 733,766 - 733,766 $ 743,013 $ $ Year Ended December 31, 2013 Sales and other revenues Operating costs and... -

Page 102

... and maturities of marketable securities Cash flows from financing activities Net borrowings under credit agreement - HEP Redemption of senior notes - HFC Purchase of treasury stock Dividends Distributions to noncontrolling interest Distribution from HEP Contribution from general partner Other, net... -

Page 103

...net Cash flows from financing activities: Net borrowings under credit agreement - HEP Redemption of senior notes - HEP Purchase of treasury stock Dividends Distributions to noncontrolling interest Contribution from general partner Excess tax benefit from equity-based compensation Other, net Cash and... -

Page 104

... under credit agreement - HEP Redemptions of senior notes Proceeds from sale of HEP common units Proceeds from common unit offerings - HEP Purchase of treasury stock Contribution from general partner Dividends Distributions to noncontrolling interest Excess tax benefit from equity-based compensation... -

Page 105

... Mexico. We have two significant customers (Shell Oil and Sinclair), each of which has historically accounted for 10% or more of our annual revenues. Shell Oil accounted for $1,252.6 million (9%), $2,097.4 million (11%) and $1,830.5 million (9%) for the years ended December 31, 2015, 2014 and 2013... -

Page 106

... in our definitive proxy statement for the annual meeting of stockholders to be held on May 11, 2016 and is incorporated herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters The equity compensation plan information required by... -

Page 107

... proxy statement for the annual meeting of stockholders to be held on May 11, 2016 and is incorporated herein by reference. PART IV Item 15. Exhibits, Financial Statement Schedules (a) (1) Documents filed as part of this report Index to Consolidated Financial Statements Page in Form 10-K Report... -

Page 108

...of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. HOLLYFRONTIER CORPORATION (Registrant) Date: February 24, 2016 /s/ George J. Damiris George J. Damiris Chief Executive Officer Pursuant to the requirements of the Securities... -

Page 109

... Holly Refining & Marketing-Midcon, L.L.C. and Sunoco, Inc. (incorporated by reference to Exhibit 2.1 of Registrant's Current Report on Form 8-K filed April 16, 2009, File No. 1-03876). Agreement and Plan of Merger among Holly Corporation, North Acquisition, Inc. and Frontier Oil Corporation, dated... -

Page 110

..., File No. 1-32225). Second Amended and Restated Crude Pipelines and Tankage Agreement, dated July 16, 2013, among Navajo Refining Company, L.L.C., Holly Refining & Marketing Company - Woods Cross LLC, HollyFrontier Refining & Marketing LLC, Holly Energy Partners-Operating, L.P., HEP Pipeline, LLC... -

Page 111

... Report on Form 8-K filed December 7, 2009, File No. 1-03876). Pipeline Systems Operating Agreement, dated February 8, 2010, among Navajo Refining Company, L.L.C., Lea Refining Company, Woods Cross Refining Company, L.L.C., Holly Refining & Marketing - Tulsa LLC and Holly Energy Partners - Operating... -

Page 112

... Refining LLC and El Dorado Logistics LLC. (incorporated by reference to Exhibit 10.36 of Registrant's Annual Report on Form 10-K for its fiscal year ended December 31, 2013, File No. 1-03876). Senior Unsecured 5-Year Revolving Credit Agreement, dated July 1, 2014, among HollyFrontier Corporation... -

Page 113

..., File No. 1-07627). Seventeenth Amendment, dated August 27, 2013, to the Frontier Products Offtake Agreement El Dorado Refinery, dated October 19, 1999, between Frontier Oil and Refining Company (now HollyFrontier Refining & Marketing LLC, as successor-by-merger to Frontier Oil and Refining Company... -

Page 114

... LLC, Holly Refining & Marketing Company - Woods Cross LLC, Navajo Refining Company, L.L.C., El Dorado Logistics LLC, Cheyenne Logistics LLC, HEP Tulsa LLC, HEP Woods Cross, L.L.C. and HEP Pipeline, L.L.C. (incorporated by reference to Exhibit 10.6 of Registrant's Current Report on Form 8-K filed... -

Page 115

...HollyFrontier Refining & Marketing LLC, HollyFrontier Corporation, Holly Energy Partners - Operating, L.P. and Holly Energy Partners, L.P. Refined Products Terminal Transfer Agreement, dated February 22, 2016, by and among HEP Refining Assets, L.P., Holly Energy Partners, L.P., El Paso Logistics LLC... -

Page 116

... Restricted Stock Units (for non-employee directors) (incorporated by reference to Exhibit 10.64 of Registrant's Annual Report on Form 10-K for its fiscal year ended December 31, 2012, File No. 1-03876). Form of Indemnification Agreement entered into with directors and officers of Holly Corporation... -

Page 117

...CERTIFICATION I, George J. Damiris, certify that: 1. 2. I have reviewed this annual report on Form 10-K of HollyFrontier Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in... -

Page 118

Exhibit 31.2 CERTIFICATION I, Douglas S. Aron, certify that: 1. 2. I have reviewed this annual report on Form 10-K of HollyFrontier Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the ... -

Page 119

... on Form 10-K for the period ending December 31, 2015 and filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, George J. Damaris, Chief Executive Officer of HollyFrontier Corporation (the "Company") hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted... -

Page 120

... Form 10-K for the period ending December 31, 2015 and filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Douglas S. Aron, Chief Financial Officer of HollyFrontier Corporation (the "Company") hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant... -

Page 121

..., at 2950 North Harwood, Suite 2100, Dallas, Texas 75201. SEC FILINGS A direct link to the filings of HollyFrontier Corporation at the U.S. Securities and Exchange Commission website is available on the HollyFrontier Corporation website at www.hollyfrontier.com on the Investor Relations page. STOCK... -

Page 122

2828 North Harwood Suite 1300 Dallas, Texas 75201-1507