HollyFrontier 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SOLID FINANCIAL RESULTS DRIVEN BY UNDERLYING STRENGTHS

The geographic proximity of our refining assets to lower cost feedstocks, and our ability

to process both light and heavy crudes continue to be key dierentiators for HollyFrontier.

While the narrowing of the WTI / Brent crude dierential and the market impact of the

government’s Renewable Fuel Standard aected our results in 2013, our margins remained

strong and we are optimistic about our forward outlook.

In 2013 we achieved:

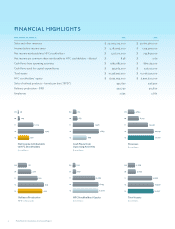

• Net Income attributable to HFC stockholders of $735.8 million

• Gross refining margins of $15.99 per produced barrel

• Operating cash flow of $869 million

• As of December 31, 2013, we had $1.7 billion in cash and short-term investments

and approximately $190 million in long-term debt (excluding HEP debt of $808 million)

These 2013 financial results demonstrate HollyFrontier’s ability to successfully execute,

deliver solid financial performance, and create value for stockholders. We expect contin-

uedgrowth in North American crude oil production, consistent customer demand for our

products and we believe that our Company’s fundamental strengths will continue to create

attractive opportunities.

STRONG TRACK RECORD OF RETURNING CAPITAL TO STOCKHOLDERS

In 2013, HollyFrontier returned over $825 million to stockholders through regular quarterly

dividends, special dividends and share repurchases. During the year, the Board of Directors

increased the Company’s regular quarterly dividend by 50% and approved four special divi-

dends. On an annualized basis, the Company’s cash dividend yield is now approximately 7%.

Inaddition, we completed the repurchase of more than $180 million worth of shares under our

$700 million share repurchase plan previously approved by the Board. Since completing the

HollyFrontier merger in July 2011, the Board has increased the regular dividend by 300% and

the Company has returned nearly $2.0 billion in capital to stockholders.

Over the last two and half years, we believe we have proven our commitment to returning a

significant portion of cash we generate to shareholders. Looking forward, our structural advan-

tages should continue to drive strong free cash flow, allowing us to continue with significant

dividend and share repurchase distributions driving superior total shareholder returns.

INVESTING IN OUR OPERATIONS

This was a year of investment and transition for HollyFrontier, as we completed planned

turnaround projects at four of our five refineries. While these projects were planned prior to

our merger in 2011, moving forward we anticipate staggering these types of projects to better

balance production downtime and project management needs across our system.

We invested more than $370 million in our facilities in 2013, with the goal of expanding our

refining capabilities, improving eciency of our operations and minimizing environmental

impacts by reducing waste, emissions and other releases. We are confident that the invest-

ments we are making in our facilities will enable us to achieve stronger margins and drive

sustainable long-term value creation. Our 2013 capital investment projects included:

• Woods Cross Refinery Expansion Our multi-year expansion program at our facility

near Salt Lake City, Utah will increase our capacity to serve the important Las Vegas

market through the UNEV Pipeline, as well as Salt Lake City and other markets across

2 HollyFrontier Corporation 2013 Annual Report

TO OUR SHAREHOLDERS

I am pleased to report that 2013

wasanother strong year for

HollyFrontier, a year that included

significant financial and operational

accomplishments as we delivered

healthy earnings results, continued

to return capital to stockholders,

and successfully completed

major turnaround projects at our

refineries. We are proud of what

weaccomplished in a volatile

market and are confident that we

are well positioned to continue

building on HollyFrontier’s success.