HollyFrontier 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

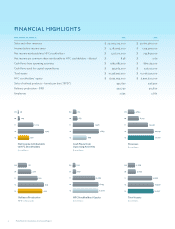

Years Ended December 31,

2013 2012 2011 (10)

Consolidated

Average per produced barrel (6)

Net sales $ 115.60 $ 119.48 $ 118.82

Cost of products (7) 99.61 94.59 98.18

Refinery gross margin 15.99 24.89 20.64

Refinery operating expenses (8) 6.15 5.49 5.36

Net operating margin $ 9.84 $ 19.40 $ 15.28

Refinery operating expenses per throughput barrel (9) $ 5.95 $ 5.22 $ 5.24

Feedstocks:

Sweet crude oil 52% 51% 56%

Sour crude oil 21% 22% 23%

Heavy sour crude oil 17% 17% 12%

Black wax crude oil 2% 2% 2%

Other feedstocks and blends 8% 8% 7%

Total 100% 100% 100%

(1) Crude charge represents the barrels per day of crude oil processed at our refineries.

(2) Refinery throughput represents the barrels per day of crude and other refinery feedstocks input to the crude units and other conversion

units at our refineries.

(3) Refinery production represents the barrels per day of refined products yielded from processing crude and other refinery feedstocks

through the crude units and other conversion units at our refineries.

(4) Includes refined products purchased for resale.

(5) Represents crude charge divided by total crude capacity (BPSD). Effective July 1, 2011, our consolidated crude capacity increased

from 256,000 BPSD to 443,000 BPSD as a result of our merger with Frontier.

(6) Represents average per barrel amount for produced refined products sold, which is a non-GAAP measure. Reconciliations to amounts

reported under GAAP are provided under “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles”

following Item 7A of Part II of this Form 10-K.

(7) Transportation, terminal and refinery storage costs billed from HEP are included in cost of products.

(8) Represents operating expenses of our refineries, exclusive of depreciation and amortization and pension settlement costs.

(9) Represents refinery operating expenses, exclusive of depreciation and amortization and pension settlement costs, divided by refinery

throughput.

(10) Refining operating data for the year ended December 31, 2011 include crude oil processed and products yielded from the El Dorado

and Cheyenne Refineries for the period from July 1, 2011 through December 31, 2011 only, and averaged over the 365 days in the

year ended December 31, 2011.

Principal Products and Customers

Set forth below is information regarding our principal products.

Years Ended December 31,

2013 2012 2011

Consolidated

Sales of produced refined products:

Gasolines 50% 50% 48%

Diesel fuels 33% 31% 32%

Jet fuels 5% 6% 5%

Fuel oil 2% 2% 2%

Asphalt 3% 3% 4%

Lubricants 2% 3% 3%

Gas oil / intermediates —% —% 2%

LPG and other 5% 5% 4%

Total 100% 100% 100%

Light products are shipped to customers via product pipelines or are available for loading at our refinery truck facilities and

terminals. Light products are also made available to customers at various other locations via exchange with other parties.

Table of Content