HollyFrontier 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

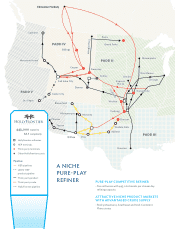

PADD I

PADD I

Proximity to Growing

North American Crude Production

All five HFC refineries sit close

to production growth.

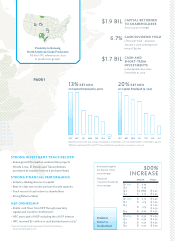

Increased regular

dividend 5 times

since merger.

Declared

11 special dividends

since merger.

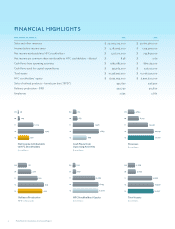

Based on 5-year and 3-year averages calculated as stockholders’ net income/(total debt + stockholders’ equity).

* Reflects combined HOC and FTO financial data for periods prior to merger in July 2011.

STRONG INVESTMENT TRACK RECORD

• Future growth focused on underwritten projects

• Woods Cross, El Dorado and Tulsa refineries

purchased at industry lows on a per barrel basis

STRONG FINANCIAL PERFORMANCE

• Industry-leading returns on capital

• Best-in-class net income per barrel crude capacity

• Track record of cash return to shareholders

• Strong Balance Sheet

HEP OWNERSHIP

• Stable cash flows from HEP through quarterly

regular and incentive distributions

• HFC owns 39% of HEP including the 2% GP interest

• HFC received $71 million in cash distributions in 2013*

*Q4 2012 through Q3 2013 quarterly LP and GP distributions,

announced and paid in 2013

INCREASE

REGULAR SPECIAL

Q 1 2011 $ 0.75 –

Q 2 $ 0.75 –

Q 3 $ 0.0875 $ 0.50

Q 4 $ 0.10 $ 0.50

Q 1 2012 $ 0.10 $ 0.50

Q 2 $ 0.15 $ 0.50

Q 3 $ 0.15 $ 0.50

$ 0.50

Q 4 $ 0.20 $ 0.50

Q 1

2013 $ 0.30 $ 0.50

Q 2 $ 0.30 $ 0.50

Q 3 $ 0.30 $ 0.50

Q 4 $ 0.30 $ 0.50

Dividend

Return to

Stockholders

RETURN

on Capital Employed (5-year)

HFC* MPC DK WNR TSO VLO ALJ

RETURN

on Capital Employed (3-year)

HFC* MPC WNR DK TSO VLO ALJ

CAPITAL RETURNED

TO SHAREHOLDERS

Since July 2011 merger

CASH DIVIDEND YIELD

LTM Cash Yield – based on

January 2, 2013 opening stock

price of $47.69

CASH AND

SHORTTERM

INVESTMENTS

in Marketable Securities

December 31, 2013

. BIL

. BIL

.