HollyFrontier 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

As of December 31, 2013, we:

• owned and operated a petroleum refinery in El Dorado, Kansas (the “El Dorado Refinery”), two refinery facilities located

in Tulsa, Oklahoma, a refinery in Artesia, New Mexico that is operated in conjunction with crude oil distillation and

vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the “Navajo

Refinery”), a refinery located in Cheyenne, Wyoming (the “Cheyenne Refinery”) and a refinery in Woods Cross, Utah

(the “Woods Cross Refinery”);

• owned and operated NK Asphalt Partners (“NK Asphalt”) which operates various asphalt terminals in Arizona and New

Mexico;

• owned a 50% interest in Sabine Biofuels II, LLC (“Sabine Biofuels”), a biodiesel production facility located in Port

Arthur, Texas; and

• owned a 39% interest in HEP, a consolidated VIE, which includes our 2% general partner interest. HEP owns and operates

logistic assets consisting of petroleum product and crude oil pipelines and terminal, tankage and loading rack facilities

that principally support our refining and marketing operations in the Mid-Continent, Southwest and Rocky Mountain

regions of the United States and Alon USA, Inc.'s (“Alon”) refinery in Big Spring, Texas. Additionally, HEP owns a 75%

interest in UNEV Pipeline, LLC (“UNEV”), which owns a 12-inch refined products pipeline from Salt Lake City, Utah

to Las Vegas, Nevada, together with terminal facilities in the Cedar City, Utah and North Las Vegas areas (the “UNEV

Pipeline”), and a 25% interest in SLC Pipeline LLC (the “SLC Pipeline”), which owns a 95-mile intrastate pipeline system

that serves refineries in the Salt Lake City area.

Our operations are currently organized into two reportable segments, Refining and HEP. The Refining segment includes the

operations of our El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries and NK Asphalt. The HEP segment involves

all of the operations of HEP. The financial information about our segments is discussed in Note 20 “Segment Information” in the

Notes to Consolidated Financial Statements.

REFINERY OPERATIONS

Our refinery operations serve the Mid-Continent, Southwest and Rocky Mountain regions of the United States. We own and operate

five complex refineries having a combined crude oil processing capacity of 443,000 barrels per stream day. Each of our refineries

has the complexity to convert discounted, heavy and sour crude oils into a high percentage of gasoline, diesel and other high-value

refined products. For 2013, gasoline, diesel fuel, jet fuel and specialty lubricants (excluding volumes purchased for resale)

represented 50%, 33%, 5% and 2%, respectively, of our total refinery sales volumes.

The tables presented below and elsewhere in this discussion of our refinery operations set forth information, including non-GAAP

performance measures, about our refinery operations. The cost of products and refinery gross and net operating margins do not

include the effect of depreciation and amortization. Reconciliations to amounts reported under GAAP are provided under

“Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” following Item 7A of Part II of this

Form 10-K.

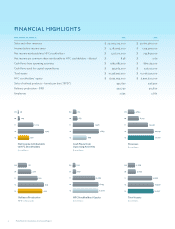

Years Ended December 31,

2013 2012 2011 (10)

Consolidated

Crude charge (BPD) (1) 387,520 415,210 315,000

Refinery throughput (BPD) (2) 424,780 453,740 340,200

Refinery production (BPD) (3) 413,820 442,730 331,890

Sales of produced refined products (BPD) 410,730 431,060 332,720

Sales of refined products (BPD) (4) 446,390 443,620 340,630

Refinery utilization (5) 87.5% 93.7% 89.9%

Table of Content