HollyFrontier 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

Table of contents

-

Page 1

A NNUAL REP ORT -

Page 2

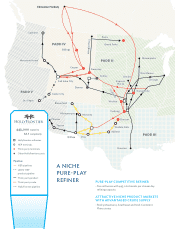

... Salt Lake City Denver Minneapolis Des Moines Omaha Express Platte yh Ja Chicago PADD V Las Vegas Kansas City Cedar City Bloomï¬eld Wichita Albuquerque Phoenix Tucson Cushing Moriarty Duncan Wichita Falls Abilene aw k 443,000 capacity 12.1 complexity El Paso HollyFrontier refineries... -

Page 3

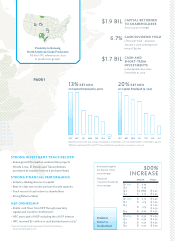

...RECORD • Future growth focused on underwritten projects • Woods Cross, El Dorado and Tulsa refineries purchased at industry lows on a per barrel basis Increased regular dividend 5 times since merger. Declared 11 special dividends since merger. STRONG FINANCIAL PERFORMANCE • Industry-leading... -

Page 4

...WOODS CROSS REFINERY • Located in Woods Cross, Utah (near Salt Lake City) • 31,000 BPSD capacity and Nelson Complexity rating of 12.5 • Processes regional sweet and advantaged waxy crude as well as Canadian sour crude oils • Distributes to high-margin markets in Utah, Idaho, Nevada, Wyoming... -

Page 5

... Region comprises our Cheyenne and Woods Cross refineries and has a combined crude oil processing capacity of 83,000 BPSD. Holly Energy Partners owns and operates substantially all of the refined product pipeline and terminalling assets that support our refining and marketing operations in the Mid... -

Page 6

... Woods Cross Refinery Expansion Our multi-year expansion program at our facility near Salt Lake City, Utah will increase our capacity to serve the important Las Vegas market through the UNEV Pipeline, as well as Salt Lake City and other markets across 2 HollyFrontier Corporation 2013 Annual Report -

Page 7

...This growth project is underway and we expect it to be completed in the spring of 2015. • Holly Energy Partners' Crude Gathering System Expansion We are expanding our New Mexico gathering capacity from 30,000 barrels per day to 100,000 barrels per day by building 40 miles of new pipeline, bringing... -

Page 8

... 332 443 414 09 10 11 12 13 619 697 5,204 6,053 6,000 09 10 11 12 13 2,766 3,050 9,576 10,329 10,057 Refinery Production BPD in thousands HFC Stockholders' Equity $ in millions Total Assets $ in millions 4 HollyFrontier Corporation 2013 Annual Report -

Page 9

... _____ HOLLYFRONTIER CORPORATION (Exact name of registrant as specified in its charter) _____ Delaware (State or other jurisdiction of incorporation or organization) 75-1056913 (I.R.S. Employer Identification No.) 2828 N. Harwood, Suite 1300 Dallas, Texas (Address of principal executive offices... -

Page 10

... and financial disclosure Controls and procedures Other information PART III 10. 11. 12. 13. 14. Directors, executive officers and corporate governance Executive compensation Security ownership of certain beneficial owners and management and related stockholder matters Certain relationships... -

Page 11

... crude oil and refined products; the spread between market prices for refined products and market prices for crude oil; the possibility of constraints on the transportation of refined products; the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines; effects... -

Page 12

... biological resources. "Black wax crude oil" is a low sulfur, low gravity crude oil produced in the Uintah Basin in Eastern Utah that has certain characteristics that require specific facilities to transport, store and refine into transportation fuels. "Catalytic reforming" means a refinery process... -

Page 13

... of converting gasoline type molecules into aromatic, higher octane gasoline blend stocks while producing hydrogen in the process. "Roofing flux" is produced from the bottom cut of crude oil and is the base oil used to make roofing shingles for the housing industry. "ROSE," or "Solvent deasphalter... -

Page 14

... as the surviving corporation. This merger combined the legacy Frontier refinery operations consisting of refineries in El Dorado, Kansas (the "El Dorado Refinery") and Cheyenne, Wyoming (the "Cheyenne Refinery") with Holly's legacy refinery operations to form HollyFrontier. The aggregate equity... -

Page 15

... intrastate pipeline system that serves refineries in the Salt Lake City area. Our operations are currently organized into two reportable segments, Refining and HEP. The Refining segment includes the operations of our El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries and NK Asphalt. The... -

Page 16

... depreciation and amortization and pension settlement costs, divided by refinery throughput. (10) Refining operating data for the year ended December 31, 2011 include crude oil processed and products yielded from the El Dorado and Cheyenne Refineries for the period from July 1, 2011 through December... -

Page 17

... and sour crudes. The Tulsa West and East refinery facilities are both located in Tulsa, Oklahoma. In 2011, we integrated certain refining processes of the Tulsa Refineries which effectively provides us with a highly complex refining operation having a combined crude processing rate of approximately... -

Page 18

... primary markets for the El Dorado Refinery's refined products are Colorado and the Plains States, which include the Kansas City metropolitan area. The gasoline, diesel and jet fuel produced by the El Dorado Refinery are primarily shipped via pipeline to terminals for distribution by truck or rail... -

Page 19

...the principal products produced at our El Dorado and Tulsa Refineries: Years Ended December 31, 2012 2011 2013 Mid-Continent Region (El Dorado and Tulsa Refineries) Sales of produced refined products: Gasolines Diesel fuels Jet fuels Fuel oil Asphalt Lubricants Gas oil / intermediates LPG and other... -

Page 20

... terminals agreement with HEP at terminals in El Paso, Texas; Tucson, Arizona; and Artesia and Moriarty, New Mexico. El Paso Market The El Paso market for refined products is currently supplied by a number of area and Gulf Coast refiners and pipelines. Area refiners include Navajo, WRB Refining, LLC... -

Page 21

... intermediate pipelines running from Lovington to Artesia. From time to time, we purchase gas oil, naphtha and light cycle oil from other refiners for use as feedstock. Rocky Mountain Region (Cheyenne and Woods Cross Refineries) Facilities The Cheyenne Refinery has a crude oil processing capacity of... -

Page 22

...the property of Chevron's Salt Lake City Refinery. Additionally, HEP owns and operates 12 miles of crude oil and refined products pipelines that allows us to connect our Woods Cross Refinery to common carrier pipeline systems. We are expanding the Woods Cross refinery to a planned capacity of 45,000... -

Page 23

... branded and unbranded customers in these markets. In 2012, we began shipping refined products to Cedar City, Utah and Las Vegas, Nevada via the UNEV Pipeline. The majority of the Las Vegas, Nevada market for refined products is supplied by various West Coast refiners and suppliers via Kinder Morgan... -

Page 24

...NK Asphalt Partners We manufacture and market commodity and modified asphalt products in Arizona, New Mexico, Oklahoma, Kansas, Missouri, Texas and northern Mexico. We have three manufacturing facilities located in Glendale, Arizona; Albuquerque, New Mexico; and Artesia, New Mexico. Our Albuquerque... -

Page 25

... located in west Texas, New Mexico and Oklahoma that deliver crude oil to our Navajo Refinery; • approximately 10 miles of refined product pipelines that support our Woods Cross Refinery located near Salt Lake City, Utah; • gasoline and diesel connecting pipelines that support our Tulsa East... -

Page 26

... terminal facilities in the Cedar City, Utah and North Las Vegas areas, and a 25% interest in SLC Pipeline LLC, which owns a 95-mile intrastate pipeline system that serves refineries in the Salt Lake City area. ADDITIONAL OPERATIONS AND OTHER INFORMATION Corporate Offices We lease approximately 60... -

Page 27

..., handled, used, released or disposed of. We currently have environmental remediation projects that relate to recovery, treatment and monitoring activities resulting from past releases of refined product and crude oil into the environment. As of December 31, 2013, we had an accrual of $87.8 million... -

Page 28

.... Insurance Our operations are subject to hazards of operations, including fire, explosion and weather-related perils. We maintain...premium costs, in our judgment, do not justify such expenditures. We have a risk management oversight committee that is made up of members from our senior management... -

Page 29

... refinery) and the expansion of existing ones. Projects are generally initiated to increase the yields of higher-value products, increase the amount of lower cost crude oils that can be processed, increase refinery production capacity, meet new governmental requirements, or maintain the operations... -

Page 30

... as equipment malfunctions, explosions, fires, spills) affecting our facilities, or those of vendors and suppliers; shortages of sufficiently skilled labor, or labor disagreements resulting in unplanned work stoppages; market-related increases in a project's debt or equity financing costs; and/or... -

Page 31

Table of Content We may incur significant costs to comply with new or changing environmental, energy, health and safety laws and regulations, and face potential exposure for environmental matters. Refinery and pipeline operations are subject to federal, state and local laws regulating, among other ... -

Page 32

... has also adopted rules requiring the reporting of GHG emissions from specified large GHG emission sources in the United States, including petroleum refineries, on an annual basis. The EPA has also announced its intention to issue a New Source Performance Standard directly regulating GHG emissions... -

Page 33

... with refineries, terminals, pipelines and related facilities. We are dependent on the production and sale of quantities of refined products at refined product margins sufficient to cover operating costs, including any increases in costs resulting from future inflationary pressures or market... -

Page 34

... We utilize various common carrier or other third party pipeline systems to deliver our products to market. The key systems utilized by the Cheyenne, El Dorado, Navajo, Woods Cross, and Tulsa Refineries are Rocky Mountain, NuStar Energy, SFPP and Plains, Chevron, and Magellan, respectively. All five... -

Page 35

...the 2% general partner interest. HEP operates a system of crude oil and petroleum product pipelines, distribution terminals and refinery tankage in Arizona, Idaho, Kansas, New Mexico, Oklahoma, Texas, Utah, Washington and Wyoming. HEP generates revenues by charging tariffs for transporting petroleum... -

Page 36

...unable to pay future regular and/or special dividends. We will only be able to pay dividends from our available cash on hand, cash from operations or borrowings under our credit agreement. The declaration of future regular and/or special dividends on our common stock will be at the discretion of our... -

Page 37

... or retain new customers. Our hedging transactions may limit our gains and expose us to other risks. We periodically enter into derivative transactions as it relates to inventory levels and/or future production to manage the risks from changes in the prices of crude oil, refined products and... -

Page 38

... loss or unavailability to us of any member of our senior management team or a key technical employee could significantly harm us. We face competition for these professionals from our competitors, our customers and other companies operating in our industry. To the extent that the services of members... -

Page 39

... Refinery are scheduled for 2014. Between November 2010 and February 2012, certain of our subsidiaries submitted multiple reports to the EPA to voluntarily disclose non-compliance with fuels regulations at the Cheyenne, El Dorado, Navajo, Tulsa and Woods Cross refineries and at the Cedar City, Utah... -

Page 40

...there is no assurance as to future dividends since they are dependent upon future earnings, capital requirements, our financial condition and other factors. Our credit agreement and senior notes limit the payment of dividends. See Note 12 "Debt" in the Notes to Consolidated Financial Statements. 32 -

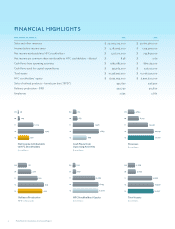

Page 41

... the dates or for the periods indicated. This table should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form... -

Page 42

..., the Tulsa West and East facilities, a petroleum refinery in Artesia, New Mexico, which operates in conjunction with crude, vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (the Navajo Refinery), Cheyenne, Wyoming (the Cheyenne Refinery) and Woods Cross, Utah... -

Page 43

... to use various approaches to mitigate our exposure to the increasing cost of RINs, which include additional renewable fuel blending, shifts in our refined product slate and changes in the way we conduct marketing operations. We cannot predict with certainty whether and to what extent we will be... -

Page 44

...34 157,948 158,756 Sales and other revenues Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization) Operating expenses (exclusive of depreciation and amortization) General and administrative expenses (exclusive of depreciation and amortization) Depreciation... -

Page 45

... Information" in the Notes to Consolidated Financial Statements for additional information on our reportable segments. Refining Operating Data Our refinery operations include the El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries. The following tables set forth information, including... -

Page 46

... products caused in part, by planned turnaround projects and unplanned refinery outages during the year ended December 31, 2013. The average price we paid per barrel for crude oil and feedstocks and the transportation costs of moving the finished products to the market place increased 5% from $94.59... -

Page 47

... year ended December 31, 2012, due principally to the inclusion of sales volumes and related revenues attributable to the El Dorado and Cheyenne Refineries for a full year period and higher sales volumes of refined products produced from the legacy Holly refineries. Additionally, the average sales... -

Page 48

... to higher employee benefit and equity-based compensation costs and increased corporate staffing levels as a result of our July 1, 2011 merger, net of the effects of merger related severance and integration costs incurred during 2011. For the years ended December 31, 2012 and 2011, general and... -

Page 49

... of the 8.25% senior notes is scheduled to occur on March 15, 2014. HEP plans to fund the redemption with borrowings under the HEP Credit Agreement. Indebtedness under the HEP Senior Notes involves recourse to HEP Logistics Holdings, L.P., its general partner, and is guaranteed by HEP's wholly... -

Page 50

... available under our credit facilities will provide sufficient resources to fund currently planned capital projects and our liquidity needs for the foreseeable future. In addition, components of our growth strategy include construction of new refinery processing units and the expansion of existing... -

Page 51

... on refinery turnarounds. Refinery turnaround spending is amortized over the useful life of the turnaround. Our new capital appropriation for 2014 and expected cash spending is as follows: Expected Cash Spending Range New Appropriation Location: El Dorado Tulsa Navajo Cheyenne Woods Cross Corporate... -

Page 52

... selenium concentration in waste water. Woods Cross Refinery Engineering continues on our previously announced expansion project to increase planned processing capacity to 45,000 BPSD, which is expected to cost $300.0 million. On November 18, 2013, the Utah Division of Air Quality issued a revised... -

Page 53

...expansion should provide shippers with additional pipeline takeaway capacity to either common carrier pipeline stations for transportation to major crude oil markets or to our New Mexico refining facilities. To complete the project, HEP plans to convert an existing refined products pipeline to crude... -

Page 54

... at December 31, 2013. Interest payments consist of interest on our 6.875% senior notes and on our long-term financing obligation. We have long-term supply agreements to secure certain quantities of crude oil, feedstock and other resources used in the production process at market prices. We have... -

Page 55

... in years when price levels were generally lower; therefore, our results of operation are less sensitive to current market price reductions. As of December 31, 2013, the excess of current cost over the LIFO inventory value of our crude oil and refined product inventories was $273.0 million. An... -

Page 56

... financial position, capital resources or liquidity or that the cost of eliminating the exposure would outweigh the benefit. Commodity Price Risk Management Our primary market risk is commodity price risk. We are exposed to market risks related to the volatility in crude oil and refined products, as... -

Page 57

...300,000 300,000 2014 19,200,000 9,...market...2013 is presented below: Outstanding Principal HollyFrontier Senior Notes HEP Senior Notes $ $ 150,000 450,000 $ $ Estimated Fair Value (In thousands) Estimated Change in Fair Value $ $ 3,443 12,884 161,250 471,750 For the variable rate HEP Credit Agreement... -

Page 58

... affected by the effect of a sudden change in market interest rates on our investment portfolio. Our operations are subject to hazards of petroleum processing operations, including fire, explosion and weather-related perils. We maintain various insurance coverages, including business interruption... -

Page 59

...in financial statements. Refinery gross margin and net operating margin are non-GAAP performance measures that are used by our management and others to compare our refining performance to that of other companies in our industry. We believe these margin measures are helpful to investors in evaluating... -

Page 60

... produced products sold Total refinery operating expenses for produced products sold Add refining segment pension settlement costs Add other refining segment operating expenses and rounding (5) Total refining segment operating expenses Add HEP segment operating expenses Add corporate and other costs... -

Page 61

...sell exchanges of crude oil with certain parties to facilitate the delivery of quantities to certain locations that are netted at carryover cost. (3) Other refining segment revenue includes the incremental revenues associated with NK Asphalt and miscellaneous revenue. (4) Other refining segment cost... -

Page 62

... Item 8. Financial Statements and Supplementary Data MANAGEMENT'S REPORT ON ITS ASSESSMENT OF THE COMPANY'S INTERNAL CONTROL OVER FINANCIAL REPORTING Management of HollyFrontier Corporation (the "Company") is responsible for establishing and maintaining adequate internal control over financial... -

Page 63

... 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, cash flows and equity for each of the three years in the period ended December 31, 2013 and our report dated February 25, 2014 expressed an unqualified opinion thereon. /s/ ERNST & YOUNG LLP Dallas, Texas... -

Page 64

...to Consolidated Financial Statements Page Reference Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets at December 31, 2013 and 2012 Consolidated Statements of Income for the years ended December 31, 2013, 2012 and 2011 Consolidated Statements of Comprehensive Income... -

Page 65

... 31, 2013, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (1992 framework), and our report dated February 25, 2014 expressed an unqualified opinion thereon. /s/ ERNST & YOUNG LLP Dallas, Texas... -

Page 66

...marketable securities Accounts receivable: Product and transportation (HEP: $34,736 and $38,097, respectively) Crude oil resales Inventories: Crude oil and refined...liability balances attributable to Holly Energy Partners, L.P. ("HEP") as of December 31, 2013 and December 31, 2012. HEP is a ... -

Page 67

... HOLLYFRONTIER CORPORATION CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share data) 2013 Sales and other revenues Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization) Operating expenses (exclusive of depreciation and amortization) General... -

Page 68

Table of Content HOLLYFRONTIER CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) Years Ended December 31, 2013 Net income Other comprehensive income (loss): Securities available-for-sale: Unrealized gain (loss) on marketable securities Reclassification adjustments to net ... -

Page 69

... - HEP Purchase of treasury stock Structured stock repurchase arrangement Contribution from joint venture partner Dividends Distributions to noncontrolling interest Excess tax benefit from equity-based compensation Purchase of units for incentive grants - HEP Deferred financing costs and other Net... -

Page 70

... of common stock upon merger with Frontier Oil Corporation Allocated equity on HEP common unit issuances, net of tax Contribution from joint venture partner Issuance of common stock under incentive compensation plans, net of forfeitures Equity-based compensation, net of tax benefit Purchase of... -

Page 71

... away in Lovington, New Mexico (collectively, the "Navajo Refinery"), a refinery located in Cheyenne, Wyoming (the "Cheyenne Refinery") and a refinery in Woods Cross, Utah (the "Woods Cross Refinery"); owned and operated NK Asphalt Partners ("NK Asphalt") which operates various asphalt terminals in... -

Page 72

... quantities to certain locations. In many cases, we enter into net settlement agreements relating to the buy/sell arrangements, which may mitigate credit risk. Inventories: Inventories are stated at the lower of cost, using the last-in, first-out ("LIFO") method for crude oil unfinished and finished... -

Page 73

...of earnings. Revenue Recognition: Refined product sales and related cost of sales are recognized when products are shipped and title has passed to customers. HEP recognizes pipeline transportation revenues as products are shipped through its pipelines. All revenues are reported inclusive of shipping... -

Page 74

...that relates to pre-merger services. Our consolidated financial and operating results reflect the operations of the merged Frontier businesses beginning July 1, 2011, which consists of crude oil refining and the wholesale marketing of refined petroleum products produced at the El Dorado and Cheyenne... -

Page 75

... Entities Holly Energy Partners HEP, a consolidated VIE, is a publicly held master limited partnership that was formed to acquire, own and operate the petroleum product and crude oil pipeline and terminal, tankage and loading rack facilities that support our refining and marketing operations in... -

Page 76

...eliminated in our consolidated financial statements. In November 2011, HEP issued 3.8 million of its common units to us as partial consideration for its purchase from us of certain tankage, loading rack and crude receiving assets located at our El Dorado and Cheyenne Refineries. As a result of these... -

Page 77

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued The carrying amounts and estimated fair values of our investments in marketable securities, derivative instruments and senior notes at December 31, 2013 and December 31, 2012 were as follows: Fair Value... -

Page 78

... of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Level 3 Financial Instruments We have commodity price swap contracts that relate to forecasted sales of diesel and unleaded gasoline and forecasted purchases of WCS for which quoted forward market prices are... -

Page 79

... a share-based compensation plan for Holly Logistic Services, L.L.C.'s non-employee directors and certain executives and employees. Compensation cost attributable to HEP's share-based compensation plan was $3.6 million, $2.7 million and $2.1 million for the years ended December 31, 2013, 2012 and... -

Page 80

... of $6.0 million and $2.6 million, respectively. As of December 31, 2013, based on the weighted-average grant date fair value of $38.75 per share, there was $28.0 million of total unrecognized compensation cost related to non-vested performance share units. That cost is expected to be recognized... -

Page 81

..., respectively. NOTE 8: Inventories Inventory consists of the following components: December 31, 2013 2012 (In thousands) Crude oil Other raw materials and unfinished products Finished products(2) Process chemicals(3) Repairs and maintenance supplies and other Total inventory (1) $ $ 567,281... -

Page 82

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued NOTE 9: Properties, Plants and Equipment December 31, 2013 2012 (In thousands) Land, buildings and improvements Refining facilities Pipelines and terminals Transportation vehicles Other fixed assets ... -

Page 83

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued NOTE 12: Debt HollyFrontier Credit Agreement We have a $1 billion senior secured credit agreement that matures in July 2016 (the "HollyFrontier Credit Agreement") and may be used to fund working capital... -

Page 84

... of the 8.25% senior notes is scheduled to occur on March 15, 2014. HEP plans to fund the redemption with borrowings under the HEP Credit Agreement. Indebtedness under the HEP Senior Notes involves recourse to HEP Logistics Holdings, L.P., its general partner, and is guaranteed by HEP's wholly... -

Page 85

... Activities Commodity Price Risk Management Our primary market risk is commodity price risk. We are exposed to market risks related to the volatility in crude oil and refined products, as well as volatility in the price of natural gas used in our refining operations. We periodically enter into... -

Page 86

... 446 446 $ As of December 31, 2013, we have the following notional contract volumes related to outstanding derivative instruments serving as cash flow hedges against price risk on forecasted purchases of natural gas and crude oil and sales of refined products: Notional Contract Volumes by Year of... -

Page 87

... LIBOR changes on $305.0 million in credit agreement advances. The first interest rate swap effectively converts $155.0 million of LIBOR based debt to fixed rate debt having an interest rate of 0.99% plus an applicable margin of 2.00% as of December 31, 2013, which equaled an effective interest rate... -

Page 88

...HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS...earnings Total Year Ended December 31, 2012 Interest rate swaps Change in fair ...518) The following table presents the fair value and balance sheet locations of our outstanding derivative instruments. These amounts are presented on a... -

Page 89

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Derivatives in Net Asset Position ...At December 31, 2013, we had a pre-tax net unrealized loss of $44.3 million classified in accumulated other comprehensive income that relates to all accounting hedges... -

Page 90

... (due primarily to tax in excess of book depreciation) Accrued employee benefits Accrued post-retirement benefits Accrued environmental costs Hedging instruments Deferred turnaround costs Net operating loss and tax credit carryforwards Investment in HEP Other Total noncurrent Total Total $ 3,138... -

Page 91

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued December 31, 2012 Liabilities (In thousands) Assets Deferred income taxes Accrued employee benefits Accrued post-retirement benefits Accrued environmental costs Hedging instruments Inventory ... -

Page 92

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued We are subject to U.S. federal income tax, Oklahoma, New Mexico, Kansas, Utah, Arizona, Colorado and Iowa income tax and to income tax of multiple other state jurisdictions. We have substantially ... -

Page 93

... Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued NOTE 16: Other Comprehensive Income (Loss) The components and allocated tax effects of other comprehensive income (loss) are as follows: Before-Tax Year Ended December 31, 2013 Net unrealized gain on marketable... -

Page 94

... sold Operating expenses General and administrative expenses Income tax benefit Net of tax Cost of products sold Operating expenses General and administrative expenses Income tax expense (benefit) Net of tax Post-retirement healthcare obligation Retirement restoration plan (99) General and... -

Page 95

... FINANCIAL STATEMENTS Continued NOTE 17: Retirement Plan In 2012, our Compensation Committee, pursuant to authority delegated to it by the Board of Directors, approved the termination of the HollyFrontier Corporation Pension Plan (the "Plan"), a non-contributory defined benefit retirement plan that... -

Page 96

... years ended December 31, 2013 and 2012, respectively. Post-retirement Healthcare Plans We provide post-retirement medical benefits to certain eligible employees. These plans are unfunded and provide differing levels of healthcare benefits dependent upon hire date and work location. Not all of our... -

Page 97

...Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued The following table sets forth the changes in the benefit obligation and plan assets of our post-retirement healthcare plans for the years ended December 31, 2013 and 2012: Years Ended December 31, 2013 2012 (In... -

Page 98

... HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Net periodic post-retirement expense consisted of the following components: Years Ended December 31, 2013 2012 2011 (In thousands) Service cost - benefit earned during the year Interest cost on projected benefit... -

Page 99

...purchase crude oil, natural gas, feedstocks and other resources to ensure we have adequate supplies to operate our refineries. The substantial majority of our purchase obligations are based on market prices or rates. These contracts expire in 2014 through 2020. We also have long-term agreements with... -

Page 100

.... The Refining segment represents the operations of the El Dorado, Tulsa, Navajo, Cheyenne and Woods Cross Refineries and NK Asphalt (aggregated as a reportable segment). Refining activities involve the purchase and refining of crude oil and wholesale and branded marketing of refined products... -

Page 101

...Subsidiaries NonGuarantor Restricted Subsidiaries HollyFrontier Corp. Before Consolidation of HEP Non-Guarantor Non-Restricted Subsidiaries (HEP Segment) Consolidations and Eliminations December 31, 2013 ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net... -

Page 102

Table of Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued Condensed Consolidating Balance Sheet Guarantor Restricted Subsidiaries NonGuarantor Restricted Subsidiaries HollyFrontier Corp. Before Consolidation of HEP Non-Guarantor Non-Restricted Subsidiaries (... -

Page 103

... Eliminations $ Year Ended December 31, 2012 Sales and other revenues Operating costs and expenses: Cost of products sold Operating expenses General and administrative Depreciation and amortization Total operating costs and expenses Income (loss) from operations Other income (expense): Earnings of... -

Page 104

... revenues Operating costs and expenses: Cost of products sold Operating expenses General and administrative Depreciation and amortization Total operating costs and expenses Income (loss) from operations Other income (expense): Earnings of equity method investments Interest income (expense) Merger... -

Page 105

... from financing activities Net repayments under credit agreement - HEP Redemption of senior notes Proceeds from common unit offerings - HEP Purchase of treasury stock Contribution from general partner Dividends Distributions to noncontrolling interest Excess tax benefit from equitybased compensation... -

Page 106

...arrangement Contribution from general partner Contribution from joint venture partner Distribution from HEP upon UNEV transfer Dividends Distributions to noncontrolling interest Excess tax benefit from equitybased compensation Purchase of units for incentive grants - HEP Deferred financing costs and... -

Page 107

... of treasury stock Redemptions of senior notes Contribution from general partner Contribution from joint venture partner Dividends Distributions to noncontrolling interest Excess tax benefit from equitybased compensation Purchase of units for restricted grants - HEP Deferred financing costs and... -

Page 108

... Contents HOLLYFRONTIER CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued NOTE 22: Significant Customers All revenues are domestic revenues, except for refining segment sales of gasoline and diesel fuel for export into Mexico. We have two significant customers (Sinclair and Shell Oil... -

Page 109

... in our definitive proxy statement for the annual meeting of stockholders to be held on May 14, 2014 and is incorporated herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters The equity compensation plan information required by... -

Page 110

... proxy statement for the annual meeting of stockholders to be held on May 14, 2014 and is incorporated herein by reference. PART IV Item 15. Exhibits, Financial Statement Schedules (a) (1) Documents filed as part of this report Index to Consolidated Financial Statements Page in Form 10-K Report... -

Page 111

... Officer) Vice President, Controller and Chief Accounting Officer (Principal Accounting Officer) Senior Vice President, General Counsel and Secretary Director Date February 25, 2014 February 25, 2014 /s/ J.W. Gann, Jr. J.W. Gann, Jr. February 25, 2014 /s/ Denise C. McWatters Denise C. McWatters... -

Page 112

Table of Content Signature /s/ Franklin Myers Franklin Myers /s/ Michael E. Rose Michael E. Rose /s/ Tommy A. Valenta Tommy A. Valenta Director Capacity Date February 25, 2014 Director February 25, 2014 Director February 25, 2014 104 -

Page 113

... December 29, 2011, among Cheyenne Logistics LLC, El Dorado Logistics LLC, Holly Energy Partners, L.P., Holly Energy Finance Corp., the other Guarantors and U.S. Bank National Association (incorporated by reference to Exhibit 4.16 of Holly Energy Partners, L.P.'s Annual Report on Form 10-K for its... -

Page 114

..., 2012, File No. 1-03876). Amended and Restated Intermediate Pipelines Agreement, dated June 1, 2009, among Holly Corporation, Navajo Refining Company, L.L.C, Holly Energy Partners, L.P., Holly Energy Partners - Operating, L.P., HEP Pipeline, L.L.C., Lovington-Artesia, L.L.C., HEP Logistics Holdings... -

Page 115

...Restated Crude Pipelines and Tankage Agreement, dated July 16, 2013, among Navajo Refining Company, L.L.C., Holly Refining & Marketing Company - Woods Cross LLC, HollyFrontier Refining & Marketing LLC, Holly Energy Partners-Operating, L.P., HEP Pipeline, LLC and HEP Woods Cross, L.L.C. (incorporated... -

Page 116

...Dorado Refining LLC and El Dorado Logistics LLC (incorporated by reference to Exhibit 10.1 to Registrant's Current Report on Form 8-K filed January 13, 2014, File No. 1-03876). Seventh Amended and Restated Omnibus Agreement, dated July 12, 2012, among HollyFrontier Corporation, Holly Energy Partners... -

Page 117

..., File No. 1-07627). Seventeenth Amendment, dated August 27, 2013, to the Frontier Products Offtake Agreement El Dorado Refinery, dated October 19, 1999, between Frontier Oil and Refining Company (now HollyFrontier Refining & Marketing LLC, as successor-by-merger to Frontier Oil and Refining Company... -

Page 118

... 10.49 Transportation Services Agreement, dated July 16, 2013, between HollyFrontier Refining & Marketing LLC and Holly Energy Partners-Operating, L.P. (incorporated by reference to Exhibit 10.1 of Registrant's Current Report on Form 8K filed July 22, 2013, File No. 1-03876). Refined Products... -

Page 119

... in Control Agreement (for HollyFrontier Corporation new hires and promotes) (incorporated by reference to Exhibit 10.2 of Registrant's Current Report on Form 8-K filed March 30, 2012, File No. 1-03876). HollyFrontier Corporation Form of Amendment to Change in Control Agreement for David L. Lamp and... -

Page 120

... by reference to Exhibit 10.41 to Frontier Oil Corporation's Annual Report on Form 10-K for its fiscal year ended December 31, 2006, File No. 1-07627). Form of Indemnification Agreement between HollyFrontier Corporation and each of its officers and directors (incorporated by reference to Exhibit 10... -

Page 121

... information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting b. Date: February 25, 2014 /s/ Michael C. Jennings Michael C. Jennings Chief Executive Officer and President -

Page 122

...; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b. Date: February 25, 2014 /s/ Douglas S. Aron Douglas S. Aron Executive Vice President and Chief Financial Officer -

Page 123

... on Form 10-K for the period ending December 31, 2013 and filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Michael C. Jennings, Chief Executive Officer of HollyFrontier Corporation (the "Company") hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted... -

Page 124

... Form 10-K for the period ending December 31, 2013 and filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Douglas S. Aron, Chief Financial Officer of HollyFrontier Corporation (the "Company") hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant... -

Page 125

... 14, 2014, at Hotel Artesia, 203 North 2nd Street, Artesia, New Mexico. S E C FI L I N G S A direct link to the filings of HollyFrontier Corporation at the U.S. Securities and Exchange Commission website is available on the HollyFrontier Corporation website at www.hollyfrontier.com on the Investor... -

Page 126

2828 North Harwood Suite 1300 Dallas, Texas 75201-1507