HR Block 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

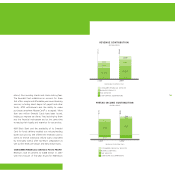

retention rates for tax clients who fund investment

accounts.One of every five current clients of

H&RBlock Financial Advisors has a relationship with

an H&RBlock tax professional.Our PreferredPartner

Program, linking tax professionals to financial advisors,

drives this client acquisition model.

BUSINESS SERVICES FOCUSES ON CORE OFFERINGS

Revenue growth continued to be strong in 2007 in the

RSM McGladrey core service offerings –accounting,

tax, business consulting and wealth management.

This lifted total revenues from continuing operations

by 13 percent to a record $932 million.The increase

includes a full year of operation of American Express

Tax and Business Services (Amex TBS), acquired in

October 2005.We completed a plan during the year

to sell or wind down three small businesses in this

segment to sharpen our focus on core operations.

Pretax income from continuing operations declined

to $58 million from $71 million, reflecting 2007 off-

season expenses for Amex TBS not incurred during the

prior year, losses in a portion of the capital markets

business now being scaled back, and costs associated

with branding initiatives and acquisition efforts.

We progressed significantly on our branding strategy

for RSM McGladrey, including development of a new

brand mark and advertising.To stimulate revenue

growth through brand awareness, we are sponsoring

The focus and market leadership we have in our core tax and

accounting businesses position us well for creating long-term

value. H&R Block has the right businesses and strategies in place

for the future, along with competitive advantages that enable us

to extend our lead.”

“

Bank.Pretax income from continuing operations was

nearly $20 million compared with a $33 million loss a

year earlier.H&RBlock Bank and H&RBlock Financial

Advisors each contributed about equally to the year’s

profit improvement.

H&RBlock Financial Advisors turned profitable

during the year’s second half and exceeded its annual

goals by focusing on advisor productivity, annuitized

products and programs to control costs and improve

efficiencies.Advisor productivity was up 11 percent,

reflecting in part the recruitment in recent years

of high-productivity advisors, and we exceeded our

targets in retaining these new associates.

H&RBlock Bank successfully launched not only the

Emerald Card, but also two new savings products

–the H&RBlock Easy IRASM and H&RBlock Easy

SavingsSM account –that have helped many of our

tax clients save for the first time for a better financial

future.The bank had $1.5 billion in assets at fiscal

year-end, including tax-client Emerald Card and

savings account balances and funds held for clients

of H&RBlock Financial Advisors.

Both businesses differentiate H&RBlock from the tax

services competition by providing our clients with

integrated financial services.Asecond connection

with clients can strengthen our relationship as their

financial partner, and we have significantly higher

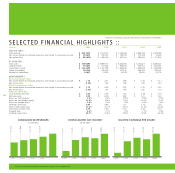

SHARE REPURCHASES

DIVIDENDS PAID

2007

VALUE RETURNED TO SHAREHOLDERS

IN I I NS

72

9