HR Block 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

H&RBlock had an excellent tax season operationally

in 2007.Our solid performance against strategic

growth plans to better position the business for the

long term was especially evident in our retail offices

during the early season.We had been losing ground

over the past few years to competitors selling high-

cost pre-season and early season loans to clients

focused on getting cash fast.For tax season 2007,

we combined the new Instant Money Advance Loan,

or IMAL (originated by a third-party bank), with our

own bank’s H&RBlock Emerald Prepaid MasterCard®

to develop a low-cost offering that was right for

clients and our company.Our long-term strategy for

integrating H&RBlock Bank with Tax Services took an

important initial step, and, as a result, we have begun

to win back and grow our base of early season clients.

Strategic initiatives are under way to further assert

H&RBlock’s industry leadership and more aggressively

compete in each of the four segments of the U.S.tax

market (see pages 8 to 19).These initiatives build

on our brand and traditional strengths and should

help us to return value to shareholders by serving tax

clients in new and more tailored ways.

With the introduction of the H&RBlock Emerald

CardSM, we have a powerful differentiator in serving

early season tax clients.It’s a product that clients –

many of whom have limited banking relationships

–typically use at first to receive either a loan or IRS tax

4

SOLIDPERFORMANCE IN TAXSERVICES

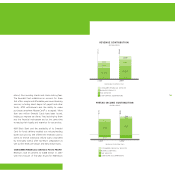

Iam pleased to report that 2007 was one of our best

tax seasons ever.Tax Services’revenues increased

10 percent to $2.7 billion, and pretax income from

continuing operations advanced by 20 percent to

$705 million.Prior year results include a $70 million

pretax charge for litigation settlements and legal

costs.Among the year’s highlights:

.We opened approximately 4,500 U.S.retail offices

in November to better appeal to our “early season”

filers;

.We launched a new YouGot People advertising and

marketing campaign featuring our tax professionals

and their expertise;

.We achieved higher client satisfaction scores and

demonstrated once again that clients judge our

services to be valuable and fairly priced;

.Our Digital Tax Group posted a second straight year

of strong client growth, up more than 19 percent due

to aggressive marketing, a simplified product lineup

and smart pricing;and

.Our international tax operations delivered a

14 percent gain in pretax earnings from continuing

operations in Canada and Australia.(The small U.K.

operation is being discontinued.)

achieved record revenues and strengthened its

market leadership in meeting the accounting, tax

and business consulting needs of middle-market

companies.

As one of the steps in further focusing H&RBlock

on our core tax, accounting and related financial

services, in April 2007 we announced a transaction

to sell Option One Mortgage Corp., marking our exit

from the non-prime mortgage industry.We also have

exited several smaller businesses that did not offer

competitive advantage in our core operations.

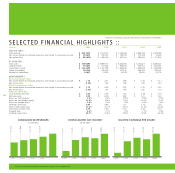

Revenues from our continuing operations rose to

$4.0 billion in fiscal 2007 from $3.6 billion a year

earlier.Net income from continuing operations was

up to $374 million from $298 million, and earnings

per diluted share increased to $1.15 from 89 cents.

(The 2006 results include an after tax charge of

$42.5 million, or 13 cents per share, for litigation and

associated legal costs.)

We are working to complete the sale of Option One

to an affiliate of Cerberus Capital Management, LP

and to close H&RBlock Mortgage Corp.These two

businesses represented most of an $808 million net

loss from discontinued operations in fiscal 2007, or

$2.48 per diluted share, which led to a consolidated

net loss for the year of $434 million, or $1.33 per

diluted share.