Freeport-McMoRan 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

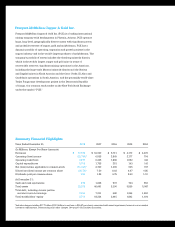

2008 Annual Report FREEPORT-McMoRan COPPER & GOLD INC. 5

December 2008. Molybdenum prices also declined sharply

in the fourth quarter, from a level exceeding $30 per pound

to below $10 per pound. We benefit from having the world’s

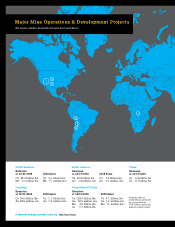

largest gold mine at our Grasberg minerals district in

Indonesia. The rise in gold prices and our current mining

in a high-grade section of the Grasberg mine is partially

offsetting the decline in copper and molybdenum prices.

During the fourth quarter of 2008, we acted quickly and

decisively to adjust our near-term business strategy to

adapt to the changing market conditions. We established

and are executing plans to achieve significant reductions

in all elements of our costs and capital spending programs.

We also changed our financial policy to respond to the

new economic environment. We are pleased with the

results of these efforts, which have resulted in hundreds

of millions of dollars in savings from our previous plans.

We also took steps to enhance our liquidity position

by eliminating the dividend on our common stock in

December 2008 and through a successful $750 million

equity offering in early 2009. These actions place

us in a strong position during a period of economic

weakness and turmoil in the global financial markets.

Our near-term business strategy is focused on protecting

our liquidity position and preserving our large mineral