Freeport-McMoRan 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report FREEPORT-McMoRan COPPER & GOLD INC. 9

Colorado. Approximately $180 million of the $500 million

project was incurred through December 31, 2008. The project

was previously expected to commence production in 2010.

Once a decision is made to resume construction activities, cost

estimates will be updated and the project would be capable

of starting up in approximately an 18-month timeframe.

North America unit net cash costs, including molybdenum

credits, averaged $1.33 per pound in 2008, compared with

$0.87 per pound in 2007. Unit net cash costs at our North

America operations were higher in 2008 than in 2007

primarily because of higher input costs, including higher

mining costs and milling rates, higher energy and acid

costs and higher costs associated with Safford as the mine

ramped up to full production rates. A sharp decline in

molybdenum prices in the fourth quarter of 2008 resulted in

lower by-product credits. Based on current operating plans

and assuming $9.00 per pound of molybdenum for 2009 and

estimates for commodity-based input costs, FCX estimates

that average unit net cash costs, including molybdenum

credits, for its North America copper mines would

approximate $1.17 per pound of copper in 2009.

South America

FCX operates four copper mines in South America — Cerro

Verde in Peru and Candelaria, Ojos del Salado and El Abra in

Chile. FCX owns a 53.56 percent interest in Cerro Verde, an 80

percent interest in both Candelaria and Ojos del Salado, and

a 51 percent interest in El Abra. South America consolidated

copper sales in 2008 totaled 1.5 billion pounds at an average

realized price of $2.57 per pound and approximately 1.4

billion pounds at an average realized price of $3.25 in 2007.

During the fourth quarter of 2008 and in January 2009,

FCX revised its operating plans at its South America mines

to reduce mining rates at the Candelaria and Ojos del

Salado mines; reduce capital spending plans, including a

deferral of the planned incremental expansion project at

Cerro Verde and a delay in the sulfide project at El Abra;

reduce spending on discretionary items and temporarily

curtail the molybdenum circuit at Cerro Verde.

For 2009, FCX expects South America sales of 1.4 billion

pounds of copper and 100 thousand ounces of gold. South

America unit net cash costs, including by-product credits

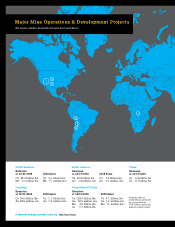

Geographically Diverse Resources

Our “Core Assets” are located in North and South America,

Indonesia and Africa. We are responding to economic conditions

by positioning our company to operate on a lean, efficient and

low-cost basis while preserving our valuable resources and

growth opportunities for the future.

Photo: The Cerro Verde open-pit mine in Peru