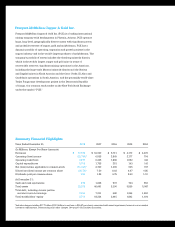

Freeport-McMoRan 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

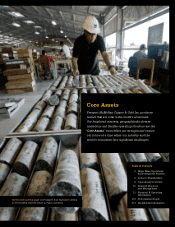

The mill/concentrating complex

at our Grasberg minerals district

in Indonesia is processing high-

grade ore from the world’s largest

single recoverable copper reserve

and the largest single gold reserve.

PT Freeport Indonesia’s unit net

cash costs are expected to be

significantly lower in 2009 because

of higher gold volumes.

10 FREEPORT-McMoRan COPPER & GOLD INC. 2008 Annual Report

(gold and molybdenum), averaged $1.14 per pound in

2008, and $1.03 per pound in 2007. South America unit

net cash costs were higher in 2008 primarily because of

higher mining costs and milling rates and higher energy,

acid and other commodity-based input costs. These

increases were partly offset by higher production, higher

by-product credits and lower treatment charges.

Assuming achievement of current 2009 sales estimates

and estimates for commodity-based input costs, FCX

expects that average unit net cash costs, including gold

and molybdenum credits, for its South America mines

would approximate $1.00 per pound of copper in 2009.

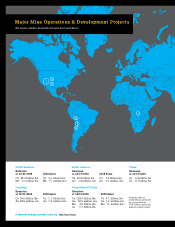

Indonesia

Through its 90.64 percent owned subsidiary, PT Freeport

Indonesia, FCX operates the world’s largest single

recoverable copper reserve and largest single gold reserve

at its Grasberg minerals district in Papua, Indonesia. Sales

from the Grasberg minerals district totaled 1.1 billion pounds

of copper and 1.2 million ounces of gold in 2008 at an

average realized price of $2.36 per pound for copper and

$861 per ounce of gold. Copper sales for the year were

approximately the same as 2007. Gold sales in 2008 were

significantly lower than the 2.2 million ounces in 2007 because

of a required sequencing of production to mine areas with

lower ore grades. FCX is currently mining in a high-grade

section of the Grasberg mine which is expected to continue

throughout 2009. FCX expects Indonesia sales of 1.3 billion

pounds of copper and 2.1 million ounces of gold for 2009.

PT Freeport Indonesia’s unit net cash costs, including gold

and silver credits, averaged $0.96 per pound in 2008, and

$0.29 per pound in 2007. Unit net cash costs were higher

in 2008, primarily because of lower gold and silver credits

associated with lower gold volumes in 2008 and higher input

costs, including higher mining rates and energy costs. FCX

expects PT Freeport Indonesia’s 2009 unit net cash costs

to be significantly lower than 2008 levels because of higher

gold volumes and reduced commodity-based input costs.

Assuming average gold prices of $800 per ounce for 2009,

achievement of current 2009 sales estimates and revised

estimates for energy, currency exchange rates and other cost

factors, FCX expects PT Freeport Indonesia’s average unit

net cash costs per pound to approximate zero for 2009.

PT Freeport Indonesia has several capital projects in

progress throughout the Grasberg minerals district, including

developing its large-scale underground ore bodies located

beneath and adjacent to the Grasberg open pit. Current

projects include the development of the Grasberg block cave

reserves through the Common Infrastructure adit system;

further expansion of the capacity of the Deep Ore Zone (DOZ)

underground operation to allow a sustained rate of 80,000

metric tons of ore per day with completion targeted by 2010;

and the development of the high-grade Big Gossan mine,

designed to ramp up to full production of 7,000 metric tons

per day by late 2012. FCX is deferring capital spending in the

Grasberg minerals district where practicable.