Freeport-McMoRan 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 FREEPORT-McMoRan COPPER & GOLD INC. 2008 Annual Report

To Our Shareholders

The theme of this year’s annual report, “Core Assets,”

reflects the strength of our company and our optimism for

the future at a time when our industry and the world’s

economies face significant challenges. With the sharp

and sudden downturn in copper and molybdenum prices

and the weak, uncertain economic outlook, we quickly

changed our business to adapt so that our shareholders

can prosper when business conditions improve.

We entered 2008 in a strong position, having repaid $10

billion in debt associated with our March 2007 acquisition

of Phelps Dodge. Our balance sheet remains strong

with no significant debt maturities for the next several

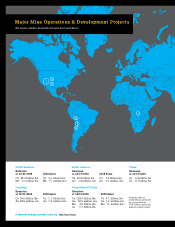

years. We made important progress during the year in

defining the potential of our significant resources on four

continents, which enabled us to add to our reserves and

establish a roadmap for future reserve additions and

growth opportunities. Our 2008 copper sales of 4.1 billion

pounds established a new record for the company.

As the world’s largest publicly traded producer of copper

and the global leader in molybdenum production, our

revenues and cash flows are being significantly affected

by the sharp decline in prices that occurred in late 2008.

Copper prices averaged $3.61 per pound in the first nine

months of 2008 and declined to a low of $1.26 per pound in

Focused Strategy

Our near-term business strategy is focused on protecting

our liquidity position and preserving our large mineral

resources and growth opportunities for anticipated

improved market conditions in the longer term. We

benefit from having as one of our “Core Assets” the

world’s largest gold mine at our Grasberg minerals

district in Indonesia (pictured), where we are mining in

a high-grade section of the mine at a time of high gold

prices. Grasberg is also the world’s largest copper mine

in terms of recoverable reserves.