Freeport-McMoRan 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 FREEPORT-McMoRan COPPER & GOLD INC. 2008 Annual Report

Operational Overview

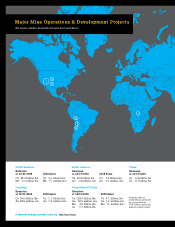

North America

Freeport-McMoRan Copper & Gold Inc. (FCX), the leader in

North America copper production, currently operates five

open-pit copper mines in the southwestern United States

(U.S.), including Morenci, Sierrita, Bagdad and Safford

in Arizona and Tyrone in New Mexico. FCX conducts

molybdenum mining operations at the Henderson underground

mine in Colorado, in addition to sales of by-product

molybdenum from Sierrita and Bagdad. Consolidated copper

sales in North America totaled 1.4 billion pounds in 2008

compared to approximately 1.3 billion pounds in 2007. The

average realized price for copper sold in 2008 was $3.07 per

pound, compared to $3.10 in 2007. Consolidated molybdenum

sales, including production from FCX’s Henderson primary

molybdenum mine and by-product molybdenum from North

and South America copper mines, totaled approximately

71 million pounds in 2008, compared to 69 million pounds

in 2007. The average realized price for molybdenum in

2008 was $30.55 per pound, compared to $25.87 in 2007.

In response to weak market conditions, during the

fourth quarter of 2008 and January 2009 FCX revised its

operating plans at its North America copper mines to

achieve a 50 percent reduction in the mining and crushed-

leach rates at the Morenci mine, a 50 percent reduction

in the mining and stacking rates at the Safford mine, a 50

percent reduction in the mining rate at the Tyrone mine

and a suspension of mining and milling activities at the

Chino mine in New Mexico. The revised plans also include

capital cost reductions, including deferrals of incremental

expansion projects at the Sierrita and Bagdad mines and

the planned restart of the Miami mine in Arizona.

FCX also revised operating plans at its Henderson

primary molybdenum mine to operate at a curtailed rate,

initially to achieve an approximate 25 percent reduction

in Henderson’s annual production.

For the year 2009, FCX expects sales from North America

copper mines to approximate 1.1 billion pounds of copper

and molybdenum sales to approximate 60 million pounds.

FCX suspended construction activities associated with the

restart of the Climax molybdenum mine near Leadville,