Freddie Mac 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2Freddie Mac

Our financial results are subject to significant earnings and net worth variability from period to period. This variability

can be driven by changes in interest rates, the yield curve, implied volatility, home prices, and mortgage spreads, as well as

other factors. For example, while derivatives are an important aspect of our strategy to manage interest-rate risk, they increase

the volatility of reported comprehensive income because fair value changes on derivatives are included in comprehensive

income, while fair value changes associated with several of the types of assets and liabilities being economically hedged are

not. As a result, there can be timing mismatches affecting current period earnings, which may not be reflective of the

underlying economics of our business.

Our Primary Business Objectives

Our primary business objectives are:

• to support U.S. homeowners and renters by maintaining mortgage availability even when other sources of financing

are scarce and by providing struggling homeowners with alternatives that allow them to stay in their homes or avoid

foreclosure;

• to reduce taxpayer exposure to losses by increasing the role of private capital in the mortgage market and reducing our

overall risk profile;

• to build a commercially strong and efficient business enterprise to succeed in a to-be-determined “future state;” and

• to support and improve the secondary mortgage market.

Our business objectives reflect direction that we have received from the Conservator, including the 2014 and 2015

Conservatorship Scorecards. For information on the Scorecards and the related 2014 Strategic Plan, see “Regulation and

Supervision — Legislative and Regulatory Developments — FHFA’s Strategic Plan for Freddie Mac and Fannie Mae

Conservatorships.”

Supporting U.S. Homeowners and Renters

Maintaining Mortgage Availability

We maintain a consistent presence in the secondary mortgage market, and we are available to purchase mortgages even

when other sources of financing are scarce. By providing this consistent source of liquidity for mortgages, we help provide our

customers with confidence to continue lending even in difficult environments. In 2014, we purchased, or issued other guarantee

commitments for, $255.3 billion in UPB of single-family conforming mortgage loans (representing approximately 1.2 million

homes), compared to $422.7 billion in 2013 (representing approximately 2.1 million homes). Origination volumes in the U.S.

residential mortgage market declined significantly during 2014, as compared to 2013, driven by a significant decline in the

volume of refinance mortgages. We estimate that we, Fannie Mae, and Ginnie Mae collectively guaranteed more than 90% of

the single-family conforming mortgages originated in 2014.

During 2014, our total multifamily new business activity was $28.3 billion in UPB, which provided financing for nearly

1,800 multifamily properties (representing approximately 413,000 apartment units). Approximately 90% of the units were

affordable to families earning at or below the median income in their area. In 2013, our total multifamily new business activity

was $25.9 billion in UPB, which provided financing for nearly 1,600 multifamily properties (representing approximately

388,000 apartment units).

Providing Struggling Homeowners with Alternatives that Allow Them to Stay in Their Homes or Avoid Foreclosure

We use a variety of borrower-assistance programs (such as HARP and HAMP) designed to provide struggling borrowers

with alternatives to help them stay in their homes. We establish guidelines for our servicers to follow and provide them with

default management programs to use in determining which type of borrower-assistance program (i.e., one of our loan workout

activities or our relief refinance initiative) would be expected to enable us to manage our exposure to credit losses.

Our relief refinance initiative is a key program used to keep families in their homes. Our relief refinance initiative

includes HARP, which is the portion of the initiative for loans with LTV ratios above 80%. In 2014, we purchased or

guaranteed $27.3 billion in UPB of relief refinance loans, including $14.1 billion of HARP loans. In 2013, we purchased or

guaranteed $99.2 billion in UPB of relief refinance loans, including $62.5 billion of HARP loans. We have purchased HARP

loans provided to more than 1.3 million borrowers since the initiative began in 2009, including approximately 82,000

borrowers during 2014. See “Table 49 — Single-Family Relief Refinance Loans” for more information about the volume of

relief refinance loans we have purchased.

When a refinancing of a loan is not practicable, we require our servicer first to evaluate the loan for a repayment plan,

forbearance agreement, or loan modification, because the level of recovery on a loan that reperforms is often much higher than

for a loan that proceeds to a foreclosure or foreclosure alternative. Our servicers contact borrowers experiencing hardship with

a goal of helping them to stay in their homes or otherwise to avoid foreclosure. Across all of our modification programs, we

modified $12.8 billion in UPB of loans during 2014, compared to $17.4 billion in 2013. Since 2009, we have helped

approximately 1,073,000 borrowers experiencing hardship to complete a loan workout under these programs. When a home

retention solution is not practicable, we require our servicers to pursue foreclosure alternatives, such as short sales, before

initiating foreclosure.

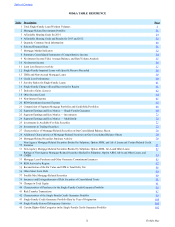

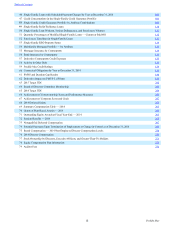

Table of Contents