Freddie Mac 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6Freddie Mac

• Providing market leadership and innovation: We continue to develop innovative programs and services that benefit our

customers and leverage our existing capabilities and product offerings to better meet the needs of an evolving

mortgage market. We are doing this primarily by: (a) expanding access to credit for credit-worthy borrowers, such as

the recently announced initiative for loans with LTV ratios up to 97%; (b) continuing to execute our credit risk transfer

transactions and seeking to expand and refine our offerings of these transactions; and (c) continuing to work with

FHFA and Fannie Mae on enhancing the secondary mortgage market, including the development of a new common

securitization platform and a single (common) security. We completed ten credit risk transfer transactions in 2014 and

three in 2013. Our 2014 transactions consisted of: (a) seven STACR debt note transactions that transferred $4.9 billion

in mezzanine credit risk to third parties associated with $147.5 billion in principal of loans in our New single-family

book; and (b) three ACIS transactions that transferred $0.7 billion in mezzanine credit risk to third parties. The 2015

Conservatorship Scorecard sets a goal for us to complete credit risk transfer transactions for at least $120 billion in

UPB using at least two transaction types.

• Managing the credit risk of the single-family credit guarantee portfolio: We are managing our credit risk by setting our

underwriting standards at a level commensurate with the long-term credit risk appetite of the company. We made

various changes to our credit policies in the last several years, including changes to improve our underwriting

standards, have purchased fewer loans with higher risk characteristics, and have assisted in improving our mortgage

insurers’ and lenders’ underwriting practices. The credit quality of the New single-family book reflects the impact of

these changes, as measured by original LTV ratios, credit scores, delinquency rates, credit losses, and the proportion of

loans underwritten with full documentation. However, in 2014 and 2013, as refinancing volumes have declined, the

composition of our loan purchase activity has been shifting to a higher proportion of home purchase loans, which

generally have higher original LTV ratios than loans sold to us during 2010 through 2012.

• Reducing our credit losses: We continue to develop and implement plans intended to reduce our credit losses and

identify and address emerging mortgage credit risks. As part of our loss mitigation strategy, we sold certain seriously

delinquent loans during 2014. We also facilitated the transfer of servicing for certain groups of loans that were

delinquent or deemed to be at risk of default to servicers that we believe have the capabilities and resources necessary

to improve loss mitigation for those loans. We expect to execute similar loan sales and servicing transfers in 2015. Our

portfolio includes several types of mortgage products that contain terms which may result in scheduled increases in

monthly payments after specified initial periods (e.g., HAMP loans). A significant number of these will experience

payment changes in 2015. To help address this risk, we implemented a new principal reduction incentive for our

HAMP loans in January 2015.

• Optimizing the economics of our single-family business: We seek to achieve strong economic returns on our single-

family credit guarantee portfolio while considering and balancing our: (a) housing mission and goals; (b) seller

diversification; and (c) security price performance (i.e., the trading value of our PCs relative to comparable Fannie

Mae securities in the market). However, economic returns on our guarantee activities are limited by, and subject to,

FHFA's oversight.

We are investing in the company, in particular our infrastructure and operations, by:

• Improving our infrastructure: We continue to make strategic investments to maintain and improve our ability to

operate the company for the foreseeable future in conservatorship, and potentially afterwards. We are improving our

information technology to provide the necessary capabilities to meet our needs, the needs of the Conservator, and the

mortgage industry. We are investing to continuously address risk, especially in the information security area and the

recently deployed out-of-region disaster recovery capability. We are actively striving to operate our information

technology at world class levels by investing in capabilities that will support the future mortgage market while also

acting as good stewards of our technology assets by maintaining, standardizing and simplifying our existing

technology portfolio.

• Strengthening our operations: We continue to strengthen and streamline our operations. We are conducting a multi-

year project focused on eliminating redundant control activities. We are also conducting detailed operational control

design reviews to identify ways to simplify our controls structure. We are improving our risk management capabilities

by further enhancing our three-lines-of-defense risk management framework. As part of this effort, we have moved or

are moving several key functions within the organization to better align business decision-making with the first line of

defense. We believe these enhancements will improve our risk management effectiveness. Our enhanced framework is

designed to balance ownership of the risk by our business units with corporate oversight and independent assessment.

See “MD&A — RISK MANAGEMENT” for more information.

To Support and Improve the Secondary Mortgage Market

Under the direction of FHFA, we continue various efforts to build the infrastructure for a future housing finance system,

including the following:

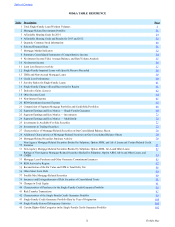

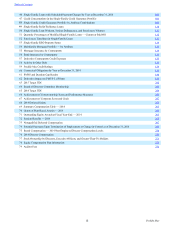

Table of Contents