Freddie Mac 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1Freddie Mac

PART I

This Annual Report on Form 10-K includes forward-looking statements that are based on current expectations and are

subject to significant risks and uncertainties. These forward-looking statements are made as of the date of this Form 10-K. We

undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form

10-K. Actual results might differ significantly from those described in or implied by such statements due to various factors and

uncertainties, including those described in the “BUSINESS — Forward-Looking Statements” and “RISK FACTORS” sections

of this Form 10-K.

Throughout this Form 10-K, we use certain acronyms and terms that are defined in the “GLOSSARY.”

ITEM 1. BUSINESS

Executive Summary

You should read this Executive Summary in conjunction with our MD&A and consolidated financial statements and

related notes for the year ended December 31, 2014.

Overview

Freddie Mac is a GSE chartered by Congress in 1970. Our public mission is to provide liquidity, stability, and

affordability to the U.S. housing market. We do this primarily by purchasing residential mortgages originated by mortgage

lenders. In most instances, we package these mortgage loans into mortgage-related securities, which are guaranteed by us and

sold in the global capital markets. We also invest in mortgage loans and mortgage-related securities. We do not originate

mortgage loans or lend money directly to consumers.

We support the U.S. housing market and the overall economy by: (a) providing America’s families with access to

mortgage funding at lower rates; (b) helping distressed borrowers keep their homes and avoid foreclosure; and (c) providing

consistent liquidity to the multifamily mortgage market, which includes providing financing for affordable rental housing. We

are also working with FHFA, our customers and the industry to build a stronger housing finance system for the nation.

Conservatorship and Government Support for Our Business

Since September 2008, we have been operating in conservatorship, with FHFA acting as our Conservator. The

conservatorship and related matters significantly affect our management, business activities, financial condition, and results of

operations. Our future is uncertain, and the conservatorship has no specified termination date. We do not know what changes

may occur to our business model during or following conservatorship, including whether we will continue to exist.

Our Purchase Agreement with Treasury and the terms of the senior preferred stock we issued to Treasury constrain our

business activities. We are dependent upon the continued support of Treasury and FHFA in order to continue operating our

business. We cannot retain capital from the earnings generated by our business operations or return capital to stockholders other

than Treasury. For more information on the conservatorship and government support for our business, see “Conservatorship

and Related Matters.”

Consolidated Financial Results

Comprehensive income was $9.4 billion for 2014 compared to $51.6 billion for 2013. Comprehensive income for 2014

consisted of $7.7 billion of net income and $1.7 billion of other comprehensive income. The main drivers of our results for

2014 include: (a) net interest income; (b) declines in the fair value of our derivatives; and (c) income from settlements of

lawsuits regarding our investments in certain non-agency mortgage-related securities. Our net income for 2013 was

substantially higher than in 2014 primarily because in 2013 we recorded a benefit for federal income taxes of $23.3 billion

from the release of the valuation allowance against our deferred tax assets. Our 2013 results also benefited from larger home

price appreciation.

Our total equity was $2.7 billion at December 31, 2014. Because our net worth was positive at December 31, 2014, we

are not requesting a draw from Treasury under the Purchase Agreement for the fourth quarter of 2014. Through December 31,

2014, we have received aggregate funding of $71.3 billion from Treasury under the Purchase Agreement, and have paid $91.0

billion in aggregate cash dividends to Treasury.

Sustainability and Variability of Earnings

The level of our earnings in 2013 and 2014 is not sustainable over the long term. Our 2013 financial results included a

very large benefit related to the release of the valuation allowance against our deferred tax assets. Our 2013 and 2014 financial

results included large amounts of income from settlements of representation and warranty claims arising out of our loan

purchases and settlements of non-agency mortgage-related securities litigation. We do not expect any future settlements of

representation and warranty claims related to our pre-conservatorship loan purchases to have a significant effect on our

financial results. Our 2013 financial results, particularly the level of loan loss provisioning, benefited from a high level of home

price appreciation. In addition, declines in the size of our mortgage-related investments portfolio, as required by FHFA and the

Purchase Agreement, will reduce our earnings over the long term.

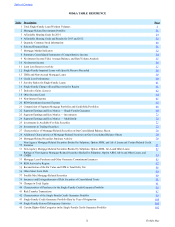

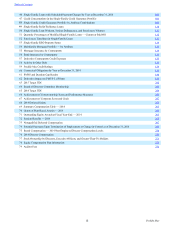

Table of Contents