Freddie Mac 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7Freddie Mac

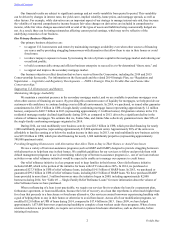

• Common Securitization Platform: We continue to work with FHFA, Fannie Mae, and Common Securitization

Solutions, LLC (or CSS) on the development of a new common securitization platform. CSS is equally owned by us

and Fannie Mae, and was formed to build and operate the platform. We and FHFA expect this will be a multi-year

effort. In November 2014, we and Fannie Mae announced that a chief executive officer had been named for CSS.

Additionally, we and Fannie Mae each appointed two executives to the CSS Board of Managers and signed

governance and operating agreements for CSS.

• Single-Security Initiative: FHFA is seeking ways to improve the liquidity of mortgage-backed securities issued by us

and Fannie Mae and reduce the disparities in trading value between our PCs and Fannie Mae's single-class mortgage-

backed securities. Part of this effort is the proposed single (common) security, which would be issued and guaranteed

by either Freddie Mac or Fannie Mae. The proposed single security would use the features of the current Fannie Mae

mortgage-backed security and the disclosure framework of the current Freddie Mac PC. One of the goals for the

proposed single security is for Freddie Mac PCs and Fannie Mae mortgage-backed securities to be fungible with the

single security to facilitate trading in a single TBA market for these securities. In August 2014, FHFA requested public

input on the single security project as further discussed in "Regulation and Supervision — Legislative and Regulatory

Developments — FHFA Request for Input on Proposed Single Security Structure." We continue to work on a detailed

implementation plan, and we expect that the implementation will be a multi-year effort.

• Uniform Mortgage Data Program: We and Fannie Mae continue to collaborate with the industry to develop and

implement uniform data standards for single-family mortgages. This includes active support for the following

mortgage data standardization initiatives: (a) the Uniform Closing Disclosure Dataset; and (b) the Uniform Loan

Application Dataset. We have also made improvements to the Uniform Collateral Data Portal, which provides

standardized appraisal data for loans we purchase and provides our sellers with real-time feedback that is intended to

help them evaluate the quality of property appraisals.

• Improve mortgage industry standards: We continue to: (a) develop approaches to reduce borrower costs for lender

placed insurance; (b) align mortgage insurer eligibility requirements; and (c) enhance our representation and warranty

framework that governs our contractual obligations with our seller/servicers. We announced changes in servicing

standards for situations in which servicers obtain property hazard insurance on properties securing single-family loans

we own or guarantee. As a result, beginning in June 2014, our seller/servicers may not receive compensation or other

payment from insurance carriers nor may they use their own or affiliated entities to insure or reinsure a property.

During 2014, we continued to develop counterparty risk management standards for mortgage insurers, including: (a)

revised eligibility requirements that include financial requirements under a risk-based framework; and (b) revised

master policies that provide greater certainty of coverage and facilitate timely claims processing. The revised

standards are designed to promote the ability of mortgage insurers to fulfill their intended role of providing private

capital to the mortgage market even under a stressful economic scenario. The revised master policies were

implemented in October 2014. FHFA published draft insurer eligibility requirements for public input during a

comment period that concluded in September 2014. We expect to publish new eligibility requirements in early 2015.

• Improve the underwriting processes with our single-family sellers: We continued our initiative for enhanced early-risk

assessment by sellers through the use of Loan Prospector and Loan Quality Advisor, our automated tools for use in

evaluating the credit and product eligibility of loans and identifying non-compliance issues. We implemented

requirements for our sellers and servicers in response to certain final rules from the CFPB. We also used our loan

sampling strategy, appeal requirements, alternative remedies for resolving repurchase obligations, and our recently

implemented standard timelines for reviews and appeals as part of our efforts to enhance post-delivery quality control

practices and our representation and warranty framework.

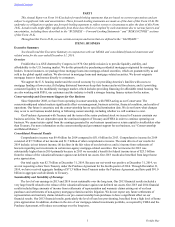

Our Business

Our Charter

Our charter forms the framework for our business activities. Our statutory mission as defined in our charter is to:

• provide stability in the secondary market for residential mortgages;

• respond appropriately to the private capital market;

• provide ongoing assistance to the secondary market for residential mortgages (including activities relating to

mortgages for low- and moderate-income families, involving a reasonable economic return that may be less than the

return earned on other activities); and

• promote access to mortgage credit throughout the U.S. (including central cities, rural areas, and other underserved

areas).

Our charter does not permit us to originate mortgage loans or lend money directly to consumers in the primary mortgage

market. Our charter limits our purchase of single-family loans to the conforming loan market. Conforming loans are loans

originated with UPBs at or below limits determined annually based on changes in FHFA’s housing price index. Since 2006, the

base conforming loan limit for a one-family residence has been set at $417,000, and higher limits have been established in

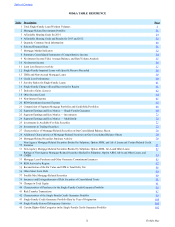

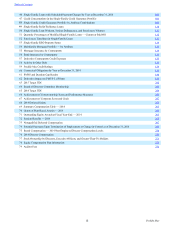

Table of Contents