Foot Locker 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Based upon the level of historical taxable income and projections for future taxable income over the periods in

which the temporary differences are anticipated to reverse, management believes it is more likely than not that the

Company will realize the benefits of these deductible differences, net of the valuation allowances at February 3, 2007.

However, the amount of the deferred tax asset considered realizable could be adjusted in the future if estimates of

taxable income are revised.

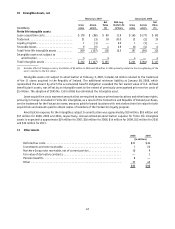

At February 3, 2007, the Company’s tax loss/credit carryforwards includes international operating loss

carryforwards with a potential tax benefit of $26 million. Those expiring between 2007 and 2013 total $23 million

and those that do not expire total $3 million. The Company also has state net operating loss carryforwards with a

potential tax benefit of $18 million, which principally relate to the 16 states where the Company does not file combined

or consolidated returns. These loss carryforwards expire between 2007 and 2025. The Company has state credits

carryforwards of approximately $1 million that expire between 2010 and 2013 and Canadian capital loss carryforwards

of approximately $11 million that do not expire.

20 Financial Instruments and Risk Management

Foreign Exchange Risk Management — Derivative Holdings Designated as Hedges

The Company operates internationally and utilizes certain derivative financial instruments to mitigate its foreign

currency exposures, primarily related to third party and intercompany forecasted transactions.

For a derivative to qualify as a hedge at inception and throughout the hedged period, the Company formally

documents the nature of the hedged items and the relationships between the hedging instruments and the hedged items,

as well as its risk-management objectives, strategies for undertaking the various hedge transactions, and the methods

of assessing hedge effectiveness and hedge ineffectiveness. Additionally, for hedges of forecasted transactions, the

significant characteristics and expected terms of a forecasted transaction must be specifically identified, and it must

be probable that each forecasted transaction would occur. If it were deemed probable that the forecasted transaction

would not occur, the gain or loss would be recognized in earnings immediately. No such gains or losses were recognized

in earnings during 2006 or 2005. Derivative financial instruments qualifying for hedge accounting must maintain a

specified level of effectiveness between the hedging instrument and the item being hedged, both at inception and

throughout the hedged period, which management evaluates periodically.

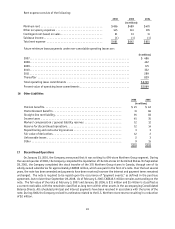

The primary currencies to which the Company is exposed are the euro, the British Pound, and the Canadian Dollar.

For option and forward foreign exchange contracts designated as cash flow hedges of the purchase of inventory, the

effective portion of gains and losses is deferred as a component of accumulated other comprehensive loss and is

recognized as a component of cost of sales when the related inventory is sold. The amount classified to cost of sales

related to such contracts was not significant in 2006 and was a gain of $2 million in 2005. The ineffective portion of

gains and losses related to cash flow hedges recorded to earnings in 2006 was not significant and was approximately

$1 million in 2005. When using a forward contract as a hedging instrument, the Company excludes the time value from

the assessment of effectiveness. At each year-end, the Company had not hedged forecasted transactions for more

than the next twelve months, and the Company expects all derivative-related amounts reported in accumulated other

comprehensive loss to be reclassified to earnings within twelve months.

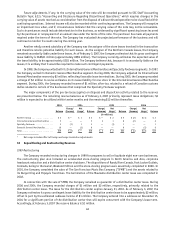

The Company has numerous investments in foreign subsidiaries, and the net assets of those subsidiaries are

exposed to foreign exchange-rate volatility. In 2005, the Company hedged a portion of its net investment in its

(WTQRGÜPUWDUKFKÜTKGU7JG&QORÜP[GPVGTGFKPVQÜ[GÜTETQUUEWTTGPE[UYÜRGHHGEVKXGN[ETGÜVKPIÜaOKNNKQP

long-term liability and a $122 million long-term asset. During the term of this transaction, the Company will remit

to and receive from its counterparty interest payments based on rates that are reset monthly equal to one-month

EURIBOR and one-month U.S. LIBOR rates, respectively. In 2006, the Company hedged a portion of its net investment in

its Canadian subsidiaries. The Company entered into a 10-year cross currency swap, creating a CAD $40 million liability

and a $35 million long-term asset. During the term of this transaction, the Company will remit to and receive from its

counterparty interest payments based on rates that are reset monthly equal to one-month CAD B.A. and one-month

U.S. LIBOR rates, respectively.