Foot Locker 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

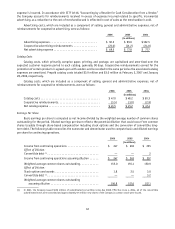

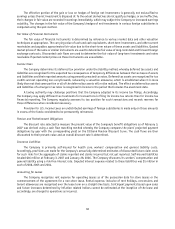

The following table illustrates the effect on net income and earnings per common share as if the Company had

applied the fair value method to measure stock-based compensation, as required under the disclosure provisions of

SFAS No. 123:

2005 2004

Net income:

As reported................................................ $ 264 $ 293

Compensation expense included in reported net income,

net of income tax benefit .................................. 4 5

Total compensation expense under fair value method for

all awards, net of income tax benefit .......................... (9) (13)

Pro forma................................................. $ 259 $ 285

Basic earnings per share:

As reported................................................ $1.71 $1.94

Pro forma................................................. $1.67 $1.89

Diluted earnings per share:

As reported................................................ $1.68 $1.88

Pro forma................................................. $1.64 $1.83

Cash and Cash Equivalents

The Company considers all highly liquid investments with original maturities of three months or less, including

commercial paper and money market funds, to be cash equivalents. Amounts due from third party credit card processors

for the settlement of debit and credit cards transactions are included as cash equivalents as they are generally collected

within three business days. Cash equivalents at February 3, 2007 and January 28, 2006 were $208 million and $237

million, respectively.

Short-Term Investments

The Company accounts for its short-term investments in accordance with SFAS No. 115, “Accounting for Certain

Investments in Debt and Equity Securities.” At February 3, 2007, all of the Company’s investments were classified as

available for sale, and accordingly are reported at fair value. Short-term investments comprise auction rate securities.

Auction rate securities are perpetual preferred or long-dated securities whose dividend/coupon resets periodically

through a Dutch auction process. A Dutch auction is a competitive bidding process designed to determine a rate for

the next term, such that all sellers sell at par and all buyers buy at par. Accordingly, there were no realized or unrealized

gains or losses for any of the periods presented.

Merchandise Inventories and Cost of Sales

Merchandise inventories for the Company’s Athletic Stores are valued at the lower of cost or market using the retail

inventory method. Cost for retail stores is determined on the last-in, first-out (LIFO) basis for domestic inventories

and on the first-in, first-out (FIFO) basis for international inventories. Merchandise inventories of the Direct-to-

Customers business are valued at the lower of cost or market using weighted-average cost, which approximates FIFO.

Transportation, distribution center and sourcing costs are capitalized in merchandise inventories. In 2006, the Company

adopted SFAS No. 151, “Inventory Costs- An Amendment of ARB 43, Chapter 4.” This standard amends the guidance to

clarify that abnormal amounts of idle facility expense, freight, handling costs, and wasted materials (spoilage) should

be recognized as current-period charges. With the adoption of this standard the Company no longer capitalized the

freight associated with transfers between its store locations.

Cost of sales is comprised of the cost of merchandise, occupancy, buyers’ compensation and shipping and

handling costs. The cost of merchandise is recorded net of amounts received from vendors for damaged product returns,

markdown allowances and volume rebates, as well as cooperative advertising reimbursements received in excess of

specific, incremental advertising expenses. Occupancy reflects the amortization of amounts received from landlords

for tenant improvements.