Foot Locker 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

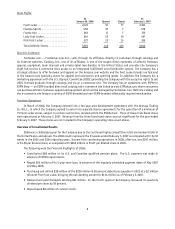

Store Profile

At

January 28, 2006 Opened Closed

At

February 3, 2007

Foot Locker ................... 2,121 57 77 2,101

Champs Sports ................ 556 27 7 576

Footaction ................... 363 17 7 373

Lady Foot Locker ............... 554 22 19 557

Kids Foot Locker ............... 327 23 15 335

Total Athletic Stores ............ 3,921 146 125 3,942

Direct-to-Customers

Footlocker.com — Footlocker.com, Inc., sells, through its affiliates, directly to customers through catalogs and

its Internet websites. Eastbay, Inc., one of its affiliates, is one of the largest direct marketers of athletic footwear,

apparel, equipment, team licensed and private-label merchandise in the United States and provides the Company’s

eight full-service e-commerce sites access to an integrated fulfillment and distribution system. The Company has a

strategic alliance to offer footwear and apparel on the Amazon.com website and the Foot Locker brands are featured

in the Amazon.com specialty stores for apparel and accessories and sporting goods. In addition, the Company has a

marketing agreement with the U.S. Olympic Committee (USOC) providing the Company with the exclusive rights to sell

USOC licensed products through catalogs and via an e-commerce site. The Company has an agreement with ESPN for

ESPN Shop — an ESPN-branded direct mail catalog and e-commerce site linked to www.ESPNshop.com, where consumers

can purchase athletic footwear, apparel and equipment which will be managed by Footlocker.com. Both the catalog and

the e-commerce site feature a variety of ESPN-branded and non-ESPN-branded athletically inspired merchandise.

Franchise Operations

In March of 2006, the Company entered into a ten-year area development agreement with the Alshaya Trading

Co. W.L.L., in which the Company agreed to enter into separate license agreements for the operation of a minimum of

75 Foot Locker stores, subject to certain restrictions, located within the Middle East. Three of these franchised stores

were operational at February 3, 2007. Revenue from the three franchised stores was not significant for the year-ended

February 3, 2007. These stores are not included in the Company’s operating store count above.

Overview of Consolidated Results

2006 was a challenging year for the Company due to the continued highly competitive retail environment both in

the United States and abroad. The 2006 results represent the 53 weeks ended February 3, 2007 as compared with the 52

weeks in the 2005 and 2004 reporting years. Income from continuing operations in 2006, after-tax, was $247 million,

or $1.58 per diluted share, as compared with $263 million or $1.67 per diluted share in 2005.

The following were the financial highlights of 2006:

• Contributed $68 million to its U.S. and Canadian qualified pension plans. The U.S. payment was made in

advance of ERISA requirements.

•Repaid $50 million of its 5-year term loan, in advance of the regularly scheduled payment dates of May 2007

and May 2008.

• Purchased and retired $38 million of the $200 million 8.50 percent debentures payable in 2022 at a $2 million

discount from face value, bringing the outstanding amount to $134 million as of February 3, 2007.

•Declared and paid dividends totaling $61 million. In the fourth quarter the Company increased its quarterly

dividend per share by 39 percent.

• Repurchased $8 million of common stock.