Foot Locker 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

During 2006, the Company purchased and retired $38 million of the $200 million 8.50 percent debentures payable

in 2022 at a $2 million discount from face value bringing the outstanding amount to $134 million as of February 3, 2007.

The Company has various interest rate swap agreements, which convert $100 million of the 8.50 percent debentures

from a fixed interest rate to a variable interest rate, which are collectively classified as a fair value hedge. The net fair

value of the interest rate swaps at February 3, 2007 was a liability of $4 million, which was included in other liabilities,

the carrying value of the 8.50 percent debentures was decreased by the corresponding amount. The net fair value of the

interest rate swaps at January 28, 2006 was a liability $1 million, of which $1 million was included in other assets and

$2 million was included in other liabilities. Accordingly, the fair value of the interest rate swaps decreased the carrying

value of the 8.50 percent debentures at January 28, 2006 by $1 million.

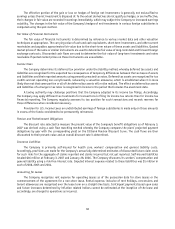

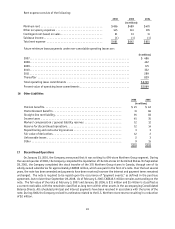

Following is a summary of long-term debt and obligations under capital leases:

2006 2005

(in millions)

8.50% debentures payable 2022 ...................................... $130 $171

$175 million term loan ............................................. 90 140

Total long-term debt ............................................ 220 311

Obligations under capital leases ...................................... 14 15

234 326

Less: Current portion ............................................ 14 51

$220 $275

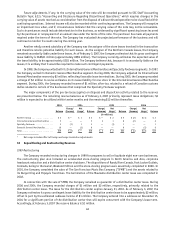

Maturities of long-term debt and minimum rent payments under capital leases in future periods are:

Long-Term

Debt

Capital

Leases Total

(in millions)

2007 .............................................. $ — $14 $ 14

2008 .............................................. 2 — 2

2009 .............................................. 88 — 88

2010 .............................................. — — —

2011 .............................................. — — —

Thereafter ......................................... 130 — 130

220 14 234

Less: Current portion ................................. — 14 14

$220 $— $220

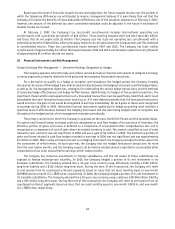

Interest expense related to long-term debt and capital lease obligations, including the effect of the interest

rate swaps and the amortization of the associated debt issuance costs was $20 million in both 2006 and 2005, and $19

million in 2004. The effect of the interest rate swaps was not significant for the year ended February 3, 2007. The effect

of the interest rate swaps resulted in a combined reduction in interest expense of $1 million in 2005, and $3 million in

2004.

15 Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store leases

contain renewal options with varying terms and conditions. Management expects that in the normal course of business,

expiring leases will generally be renewed or, upon making a decision to relocate, replaced by leases on other premises.

Operating lease periods generally range from 5 to 10 years. Certain leases provide for additional rent payments based

on a percentage of store sales. Rent expense includes real estate taxes, insurance, maintenance, and other costs as

required by some of the Company’s leases. The present value of operating leases is discounted using various interest

rates ranging from 4 percent to 13 percent.