Experian 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

44

The increase in Group total equity of

US$270m includes actuarial gains of

US$77m in respect of defined benefit

pension plans and currency translation

gains of US$142m, mainly as a result of the

weakening of the US dollar. These items are

shown net of related tax.

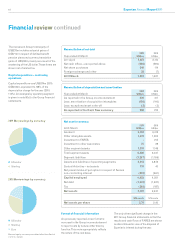

Capital expenditure – continuing

operations

Capital expenditure was US$374m (2010:

US$314m), equivalent to 128% of the

depreciation charge for the year (2010:

114%). An analysis by operating segment

is given in note 9(b) to the Group financial

statements.

Financial review continued

Reconciliation of net debt

Year ended 31 March 2011

US$m 2010

US$m

At 1 April 1,627 2,110

Net cash inflow – as reported above (508) (590)

Net share purchases 349 114

Foreign exchange and other 33 (7)

At 31 March 1,501 1,627

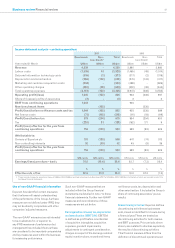

Net assets summary

At 31 March 2011

US$m 2010

US$m

Goodwill 3,761 3,412

Other intangible assets 1,374 1,233

Investment in FARES -214

Investment in other associates 27 29

Other segment assets 1,318 1,149

Total segment assets 6,480 6,037

Segment liabilities (1,267) (1,165)

Assets and liabilities of operating segments 5,213 4,872

Central Activities – net assets 110 40

Net present value of put option in respect of Serasa

non-controlling interest (870) (661)

Capital employed 4,453 4,251

Net debt (1,501) (1,627)

Tax (245) (187)

Net assets 2,707 2,437

US cents US cents

Net assets per share 2.74 2.40

Reconciliation of depreciation and amortisation

Year ended 31 March 2011

US$m 2010

US$m

As reported in the Group income statement 420 417

Less: amortisation of acquisition intangibles (129) (140)

Less: exceptional asset write-off (3) (3)

As reported in the Cash flow summary 288 274

2011 Borrowings by currency

US dollar

Sterling

2010 Borrowings by currency

US dollar

Sterling

Euro

Borrowings by currency are stated after the effect of

currency swaps

Format of financial information

As previously reported, a new format is

now used in the Group income statement

to report costs by nature rather than by

function. This more appropriately reflects

the nature of the cost base.

The only other significant change in the

2011 Group financial statements is that the

results and cash flows of FARES are shown

as discontinued in view of the disposal of

Experian’s interest during the year.