Experian 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Experian Annual Report 2011

Notes to the Group nancial statements continued

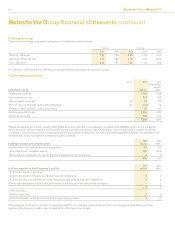

5. Signicant accounting policies (continued)

Dened contribution pension arrangements

The assets of dened contribution plans are held separately from those of the Group in independently administered funds. The pension cost

recognised in the Group income statement represents the contributions payable by the Group to these funds in respect of the year.

Post-retirement healthcare obligations

Obligations in respect of post-retirement healthcare plans are calculated annually by independent qualied actuaries using an actuarial

methodology similar to that for the funded dened benet pension arrangements.

Actuarial gains and losses arising from experience adjustments, and changes in actuarial assumptions, are recognised in the Group statement of

comprehensive income. The pension cost recognised in the Group income statement only comprises interest on the dened benet obligation.

Share-based payments

The Group has a number of equity settled, share-based employee incentive plans. The fair value of options and shares granted is recognised as

an expense in the Group income statement on a straight line basis over the vesting period, after taking into account the Group’s best estimate of

the number of awards expected to vest. The Group revises the vesting estimate at each balance sheet date. Non-market performance conditions

are included in the vesting estimates. Expenses are incurred over the vesting period. Fair value is measured at the date of grant using whichever

of the Black-Scholes model, Monte Carlo model and closing market price is most appropriate to the award. Market-based performance

conditions are included in the fair value measurement on grant date and are not revised for actual performance.

(t) Acquisition expenses

As required by IFRS 3 (revised), acquisition expenses are now charged to the Group income statement.

(u) Discontinued operations

A discontinued operation is a component of the Group’s business that represents a separate geographic area of operation or a separate major

line of business. Classication as a discontinued operation occurs upon disposal or earlier, if the operation meets the criteria to be classied as

held for sale under IFRS 5.

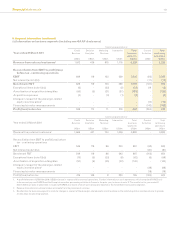

6. Critical accounting estimates and judgments

(a) Critical accounting estimates and assumptions

In preparing the Group nancial statements, management is required to make estimates and assumptions that affect the reported amount

of revenues, expenses, assets and liabilities and the disclosure of contingent liabilities. The resulting accounting estimates, which are based

on management’s best judgment at the date of the Group nancial statements, will, by denition, seldom equal the related actual results. The

estimates and assumptions that have a signicant risk of causing a material adjustment to the carrying amounts of assets and liabilities within

the next nancial year are discussed below.

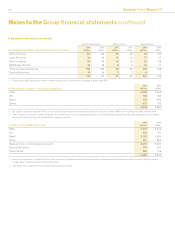

Taxes

The Group is subject to taxes in numerous jurisdictions. Signicant judgment is required in determining the related provision for income taxes

as there are transactions in the ordinary course of business and calculations for which the ultimate tax determination is uncertain. The Group

recognises liabilities based on estimates of whether additional taxes will be due. Where the nal tax outcome of these matters is different from

the amounts that were initially recognised, such differences will impact on the results for the year and the respective income tax and deferred

tax assets or provisions in the year in which such determination is made.

Pension benets

The present value of the dened benet assets and obligations depends on factors that are determined on an actuarial basis using a number

of assumptions. The assumptions used in determining the dened benet assets and obligations and net pension costs include the expected

long-term rate of return on the plan assets and the discount rate. Any changes in these assumptions may impact on the amounts disclosed in

the Group nancial statements.

The expected return on plan assets is calculated by reference to the plan investments at the balance sheet date and is a weighted average of the

expected returns on each main asset type based on market yields available on these asset types at the balance sheet date.

The Group determines the appropriate discount rate at the end of each year. This is the interest rate used to calculate the present value of

estimated future cash outows expected to be required to settle the dened benet obligations. In determining the discount rate, the Group

has considered the prevailing market yields of high-quality corporate bonds that are denominated in the currency in which the benets will be

paid, and that have terms to maturity consistent with the estimated average term of the related pension liability. In determining the discount

rate, management has accordingly derived an appropriate discount rate by consideration of an AA rated corporate bond yield curve and the

estimated future cash outows.

Other key assumptions for dened benet obligations and pension costs are based in part on market conditions at the relevant balance sheet

dates and additional information is given in note 34.

Fair value of derivatives and other nancial instruments

The fair value of derivatives and other nancial instruments that are not traded in an active market (for example, over-the-counter derivatives)

is determined using valuation techniques. The Group uses its judgment to select a variety of methods and makes assumptions that are mainly

based on market conditions existing at each balance sheet date.

The assumptions in respect of the valuation of the put option associated with the remaining 30% stake in Serasa are set out in note 8.