Experian 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 Experian Annual Report 2011

Notes to the Group nancial statements continued

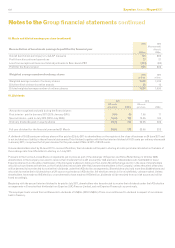

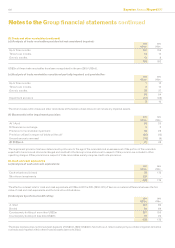

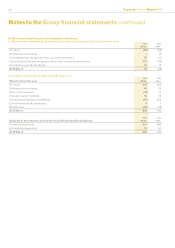

28. Loans and borrowings (continued)

(c) Analysis by currency:

2011

US$m

2010

US$m

US dollar 1,348 941

Sterling 576 561

Brazilian real 37

Euro -342

1,927 1,851

The above analysis takes account of forward foreign exchange contracts and cross currency swaps.

(d) Finance lease obligations - minimum lease payments due:

2011

US$m

2010

US$m

In less than one year 35

In one to ve years 14

Total minimum lease payments 4 9

Future nance charges -(1)

Present value of nance leases 4 8

The present value of nance leases falls due in:

Less than one year 35

Between one and ve years 13

Present value of nance leases 4 8

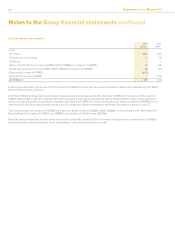

(e) Borrowing facilities

At 31 March 2011, the Group had undrawn committed borrowing facilities of US$1,700m, of which US$1,640m expire in December 2015 and

US$60m in March 2016. At 31 March 2010, the Group’s undrawn committed borrowing facilities were US$1,932m and these facilities were

replaced during the current year. Such facilities are for general corporate purposes, including the nancing of acquisitions.

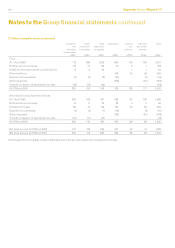

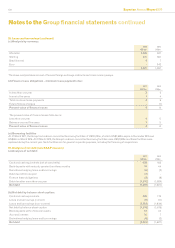

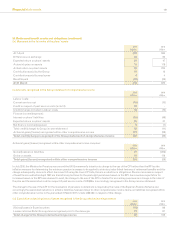

29. Analysis of net debt (non-GAAP measure)

(a) Analysis of net debt:

2011

US$m

2010

US$m

Cash and cash equivalents (net of overdrafts) 408 163

Bank deposits with maturity greater than three months 14 44

Derivatives hedging loans and borrowings (6) (2)

Debt due within one year (3) -

Finance lease obligations (4) (8)

Debt due after more than one year (1,910) (1,824)

Net debt (1,501) (1,627)

(b) Net debt by balance sheet caption:

Cash and cash equivalents 408 175

Loans and borrowings (current) (6) (17)

Loans and borrowings (non-current) (1,921) (1,834)

Net debt by balance sheet caption (1,519) (1,676)

Bank deposits within nancial assets 14 44

Accrued interest 10 7

Derivatives hedging loans and borrowings (6) (2)

Net debt (1,501) (1,627)