Energy Transfer 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

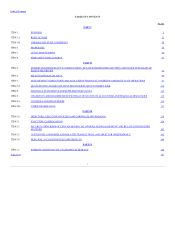

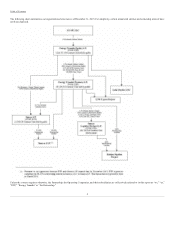

Table of Contents

Significant Achievements in 2015 and Beyond

Strategic Transactions

Our significant strategic transactions in 2015 and beyond included the following, as discussed in more detail herein:

• ETP, as a member of a consortium, was awarded two pipeline projects for the transportation of natural gas for Mexico's state power company, CFE, under

long-term contracts. The Trans-Pecos pipeline is an approximately 143-mile, 42-inch pipeline that will deliver at least 1.356 Bcf/d of natural gas from

the Waha Hub to the US/Mexico border near Presidio, Texas. The Comanche Trail pipeline is an approximately 195-mile, 42-inch pipeline that will

deliver at least 1.135 Bcf/d of natural gas from the Waha Hub to the US/Mexico border near San Elizario, Texas. ETP will be the construction manager

and operator of both pipelines. The expected all-in cost for these two pipelines is anticipated to be approximately $1.3 billion, and we expect both

pipelines to be in-service in the first quarter of 2017.

• In December 2015, ETP announced that the Lake Charles LNG Project has received approval from the FERC to site, construct and operate a natural gas

liquefaction and export facility in Lake Charles, Louisiana. On February 15, 2016, Royal Dutch Shell plc completed its acquisition of BG Group plc.

Final investment decisions from Royal Dutch Shell plc and LCL are expected to be made in 2016, with construction to start immediately following an

affirmative investment decision and first LNG export anticipated about four years later.

• In November 2015, ETP and Sunoco LP announced ETP’s contribution to Sunoco LP of the remaining 68.42% interest in Sunoco, LLC and 100%

interest in the legacy Sunoco, Inc. retail business for $2.23 billion. Sunoco LP will pay ETP $2.03 billion in cash, subject to certain working capital

adjustments, and will issue to ETP 5.7 million Sunoco LP common units. The transaction will be effective January 1, 2016, and is expected to close in

March 2016.

• In October 2015, Sunoco Logistics completed the previously announced acquisition of a 40% membership interest (the “Bakken Membership Interest”)

in Bakken Holdings Company LLC (“Bakken Holdco”). Bakken Holdco, through its wholly-owned subsidiaries, owns a 75% membership interest in

each of Dakota Access, LLC and Energy Transfer Crude Oil Company, LLC, which together intend to develop the Bakken Pipeline system to deliver

crude oil from the Bakken/Three Forks production area in North Dakota to the Gulf Coast. ETP transferred the Bakken Membership Interest to Sunoco

Logistics in exchange for approximately 9.4 million Class B Units representing limited partner interests in Sunoco Logistics and the payment by Sunoco

Logistics to ETP of $382 million of cash, which represented reimbursement for its proportionate share of the total cash contributions made in the Bakken

Pipeline project as of the date of closing of the exchange transaction.

• In July 2015, in exchange for the contribution of 100% of Susser from ETP to Sunoco LP, Sunoco LP paid approximately $970 million in cash and

issued to ETP subsidiaries 22 million Sunoco LP Class B units valued at approximately $970 million. The Sunoco Class B units did not receive second

quarter 2015 cash distributions from Sunoco LP and converted on a one-for-one basis into Sunoco LP common units on the day immediately following

the record date for Sunoco LP’s second quarter 2015 distribution. In addition, (i) a Susser subsidiary exchanged its 79,308 Sunoco LP common units for

79,308 Sunoco LP Class A units, (ii) approximately 11 million Sunoco LP subordinated units owned by Susser subsidiaries were converted into

approximately 11 million Sunoco LP Class A units and (iii) Sunoco LP issued 79,308 Sunoco LP common units and approximately 11 million Sunoco

LP subordinated units to subsidiaries of ETP. The Sunoco LP Class A units were contributed to Sunoco LP as part of the transaction. Sunoco LP

subsequently contributed its interests in Susser to one of its subsidiaries.

• Effective July 1, 2015, ETE acquired 100% of the membership interests of Sunoco GP, the general partner of Sunoco LP, and all of the IDRs of Sunoco

LP from ETP, and in exchange, ETE transferred to ETP 21 million ETP common units. In connection with ETP’s 2014 acquisition of Susser, ETE agreed

to provide ETP a $35 million annual IDR subsidy for 10 years, which terminated upon the closing of ETE’s acquisition of Sunoco GP. In connection

with the exchange and repurchase, ETE will provide ETP a $35 million annual IDR subsidy for two years beginning with the quarter ended September

30, 2015. In connection with this transaction, the Partnership deconsolidated Sunoco LP. The Partnership continues to hold 37.8 million Sunoco LP

common units accounted for under the equity method.

• On April 30, 2015, a wholly-owned subsidiary of the Partnership merged with Regency, with Regency surviving as a wholly-owned subsidiary of the

Partnership (the “Regency Merger”). Each Regency common unit and Class F unit was converted into the right to receive 0.4124 Partnership common

units. ETP issued 172.2 million ETP common units to Regency unitholders, including 15.5 million units issued to Partnership subsidiaries. The

1.9 million outstanding Regency series A preferred units were converted into corresponding new Partnership Series A Preferred Units on a one-for-one

basis.

• In March 2015, ETE transferred 30.8 million ETP common units, ETE’s 45% interest in the Bakken Pipeline project, and $879 million in cash to the

Partnership in exchange for 30.8 million newly issued Class H Units of ETP that, when combined with the 50.2 million previously issued Class H Units,

generally entitle ETE to receive 90.05% of the cash distributions and other economic attributes of the general partner interest and IDRs of Sunoco

Logistics. In connection with this transaction, the Partnership also issued to ETE 100 Class I Units that provide distributions to ETE to offset IDR

subsidies previously

3