Energy Transfer 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ýANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-11727

ENERGY TRANSFER PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

Delaware

73-1493906

(state or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

8111 Westchester Drive, Suite 600, Dallas, Texas 75225

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (214) 981-0700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Name of each exchange on which registered

Common Units

New York Stock Exchange

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The aggregate market value as of June 30, 2015, of the registrant’s Common Units held by non-affiliates of the registrant, based on the reported closing price of such Common

Units on the New York Stock Exchange on such date, was $24.43 billion. Common Units held by each executive officer and director and by each person who owns 5% or more of

the outstanding Common Units have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive

determination for other purposes.

At February 19, 2016, the registrant had 507,740,653 Common Units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of contents

-

Page 1

... TRANSFER PARTNERS, L.P. (Exact name of registrant as specified in its charter) Delaware (state or other jurisdiction of incorporation or organization) 73-1493906 (I.R.S. Employer Identification No.) 8111 Westchester Drive, Suite 600, Dallas, Texas 75225 (Address of principal executive offices... -

Page 2

... UNITS, RELATED UNITHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES SELECTED FINANCIAL DATA MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA CHANGES... -

Page 3

... thermal unit, an energy measurement used by gas companies to convert the volume of gas used to its heat equivalent, and thus calculate the actual energy used capacity of a pipeline, processing plant or storage facility refers to the maximum capacity under normal operating conditions and, with... -

Page 4

... Offered Rate Liquefied natural gas Lone Star NGL LLC liquefied petroleum gas Mid-Atlantic Convenience Stores, LLC Midcontinent Express Pipeline LLC Missouri Gas Energy Mi Vida JV LLC million British thermal units million cubic feet methyl tertiary butyl ether New England Gas Company natural gas... -

Page 5

-

Page 6

...Commission Southern Union Company Pan Gas Storage, LLC Southern Union Gas Services Sunoco GP LLC, the general partner of Sunoco LP Sunoco Logistics Partners L.P. Sunoco Partners LLC, the general partner of Sunoco Logistics Susser Holdings Corporation Transwestern Pipeline Company, LLC Texas Railroad... -

Page 7

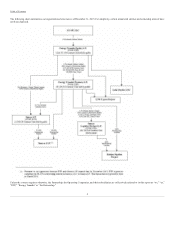

...and ET Rover Pipeline LLC. Panhandle is the parent company of the Trunkline and Sea Robin transmission systems. ETP owns a 50% interest in MEP. • • Liquids operations, including NGL transportation, storage and fractionation services primarily through Lone Star. Product and crude oil operations... -

Page 8

... 31, 2015. For simplicity, certain immaterial entities and ownership interest have not been depicted. Unless the context requires otherwise, the Partnership, the Operating Companies, and their subsidiaries are collectively referred to in this report as "we," "us," "ETP," "Energy Transfer" or... -

Page 9

... Pipeline system to deliver crude oil from the Bakken/Three Forks production area in North Dakota to the Gulf Coast. ETP transferred the Bakken Membership Interest to Sunoco Logistics in exchange for approximately 9.4 million Class B Units representing limited partner interests in Sunoco Logistics... -

Page 10

... July 2015, ETP, Sunoco Logistics, and Phillips 66 formed Bayou Bridge Pipeline, LLC to construct the Bayou Bridge pipeline, which will deliver crude oil from the Phillips 66 and Sunoco Logistics terminals in Nederland, Texas to refinery markets in Louisiana. Phillips 66 Partners LP, which acquired... -

Page 11

... rate agreements. We are currently in the process of converting a portion of the Trunkline gas pipeline to crude oil transportation. The results from our interstate transportation and storage segment are primarily derived from the fees we earn from natural gas transportation and storage services... -

Page 12

... and storage assets. Our midstream segment also includes a 60% interest in ELG, which operates natural gas gathering, oil pipeline, and oil stabilization facilities in South Texas, a 33.33% membership interest in Ranch Westex JV LLC, which processes natural gas delivered from the NGLs-rich... -

Page 13

... as third-party assets, to service crude oil markets principally in the mid-continent United States. Sunoco Logistics' NGLs operations transports, stores, and executes acquisition and marketing activities utilizing a complementary network of pipelines, storage and blending facilities, and strategic... -

Page 14

... United States and is comprised of intrastate natural gas pipeline and related natural gas storage facilities. The ET Fuel System has many interconnections with pipelines providing direct access to power plants, other intrastate and interstate pipelines, and is strategically located near high-growth... -

Page 15

... natural gas pipelines, an underground Bammel storage reservoir and related transportation assets. The system has access to multiple sources of historically significant natural gas supply reserves from South Texas, the Gulf Coast of Texas, East Texas and the western Gulf of Mexico, and is directly... -

Page 16

...'s customers include local distribution companies, producers, marketers, electric power generators and industrial end-users. Panhandle Eastern Pipe Line Capacity of 2.8 Bcf/d Approximately 6,000 miles of interstate natural gas pipeline Bi-directional capabilities Five natural gas storage fields... -

Page 17

... natural gas service to crude oil service, coinciding with the transfer of the assets to a related company. Tiger Pipeline Capacity of 2.4 Bcf/d Approximately 195 miles of interstate natural gas pipeline Bi-directional capabilities The Tiger pipeline is an approximately 195-mile interstate natural... -

Page 18

... markets through interconnects with several pipelines, including our Tiger pipeline. Our Northern Louisiana assets include the Bistineau, Creedence, and Tristate Systems. Eagle Ford System Approximately 1,090 miles of natural gas pipeline Four processing plants (Chisholm, Kenedy, Jackson and King... -

Page 19

... the south Texas gathering systems is derived from a combination of natural gas wells located in a mature basin that generally have long lives and predictable gas flow rates, including the Frio, Vicksburg, Miocene, Canyon Sands and Wilcox formations, and the NGLs-rich and oil-rich Eagle Ford shale... -

Page 20

... the Cadiz processing plant and Harrison County wellhead production. Other Midstream Assets The midstream segment also includes our interests in various midstream assets located in Texas, New Mexico and Louisiana, with approximately 60 miles of gathering pipelines aggregating a combined capacity of... -

Page 21

... 82 miles of crude oil transmission pipeline In 2014, we converted approximately 80 miles of natural gas pipeline from our HPL and Southeast Texas Systems to crude service and constructed approximately 3 miles of new crude oil pipeline. Mont Belvieu Facilities Working storage capacity of... -

Page 22

...Oklahoma system to Cushing and is one of the largest purchasers of crude oil from producers in the state. Midwest United States Pipelines. The Midwest United States pipeline system includes Sunoco Logistics' majority interest in the Mid-Valley Pipeline Company which originates in Longview, Texas and... -

Page 23

..., blending services and storage. Crude Oil Acquisition and Marketing Sunoco Logistics' crude oil acquisition and marketing activities include the gathering, purchasing, marketing and selling of crude oil primarily in the midcontinent United States. The operations are conducted using Sunoco Logistics... -

Page 24

... grades of gasoline, and middle distillates, such as heating oil, diesel and jet fuel. In addition to the consolidated pipeline assets, Sunoco Logistics owns equity interests in four common carrier refined products pipelines including: Explorer Pipeline Company, Yellowstone Pipe Line Company, West... -

Page 25

...is positioned as a premium fuel brand. Brand improvements in recent years have focused on physical image, customer service and product offerings. In addition, Sunoco, Inc. believes its brands and high performance gasoline business have benefited from its sponsorship agreements with NASCAR®, INDYCAR... -

Page 26

... 2016. In December 2015, ETP announced that the Lake Charles LNG Project has received approval from the FERC to site, construct and operate a natural gas liquefaction and export facility in Lake Charles, Louisiana. On February 15, 2016, Royal Dutch Shell plc completed its acquisition of BG Group plc... -

Page 27

... and market demand. Similar to pipelines carrying products, the high capital costs deter competitors for the crude oil pipeline systems from building new pipelines. Competitive factors in crude oil purchasing and marketing include price and contract flexibility, quantity and quality of services, and... -

Page 28

.... Our natural gas transportation and midstream revenues are derived significantly from companies that engage in exploration and production activities. The discovery and development of new shale formations across the United States has created an abundance of natural gas and crude oil resulting in... -

Page 29

... of a local distribution company or an interstate natural gas pipeline. The rates and terms and conditions of some transportation and storage services provided on the Oasis pipeline, HPL System, East Texas pipeline and ET Fuel System are subject to FERC regulation pursuant to Section 311 of the NGPA... -

Page 30

... Operations Section of the Department of Natural Resources' Office of Conservation is generally responsible for regulating intrastate pipelines and gathering facilities in Louisiana and has authority to review and authorize natural gas transportation transactions and the construction, acquisition... -

Page 31

... regulatory changes. Regulation of Interstate Crude Oil and Products Pipelines. Interstate common carrier pipeline operations are subject to rate regulation by the FERC under the ICA, the EPAct of 1992, and related rules and orders. The ICA requires that tariff rates for petroleum pipelines be "just... -

Page 32

...of processing plants, pipelines and associated facilities, including compression, in connection with the gathering, processing, storage and transmission of natural gas and the storage and transportation of NGLs, crude oil and products is subject to stringent federal, tribal, state and local laws and... -

Page 33

...our capital expenditures or plant operating and maintenance expense. We currently own or lease sites that have been used over the years by prior owners and lessees and by us for various activities related to gathering, processing, storage and transmission of natural gas, NGLs, crude oil and products... -

Page 34

...remediation strategy in the future. The Partnership currently owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such certain of releases at these sites and at formerly owned... -

Page 35

... operations are subject to the federal Clean Air Act, as amended, and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our processing plants, and also impose various monitoring and reporting requirements... -

Page 36

..., including onshore oil and natural gas production, processing, transmission, storage and distribution facilities. On October 22, 2015, the EPA published a final rule that expands the petroleum and natural gas system sources for which annual greenhouse gas emissions reporting is currently required... -

Page 37

...be reviewed for further information. The risk factors set forth below, and those included in Panhandle's and Sunoco Logistics' Annual Report on Form 10-K, are not all the risks we face and other factors currently considered immaterial or unknown to us may impact our future operations. Risks Inherent... -

Page 38

...and products; the relationship between natural gas, NGL and crude oil prices; the amount of cash distributions we receive with respect to the Sunoco LP and Sunoco Logistics common units that we or our subsidiaries own; the weather in our operating areas; the level of competition from other midstream... -

Page 39

...capital expenditures, acquisitions and general partnership, corporate or limited liability company purposes, as applicable, may be limited; we may be at a competitive disadvantage relative to similar companies that have less debt; we may be more vulnerable to adverse economic and industry conditions... -

Page 40

... certain steps in our organizational structure, financial reporting and contractual relationships to reflect the separateness of us, ETP GP and ETP LLC from the entities that control ETP GP (ETE and its general partner), our credit ratings and business risk profile could be adversely affected if the... -

Page 41

... General Partner interest in Sunoco Logistics and our Sunoco Logistics common units. Sunoco Logistics is not prohibited from competing with us. Neither our partnership agreement nor the partnership agreements of Sunoco Logistics prohibits Sunoco Logistics from owning assets or engaging in businesses... -

Page 42

... Unitholders or to pay interest or principal on our debt when due. We do not have the same flexibility as other types of organizations to accumulate cash, which may limit cash available to service our debt or to repay debt at maturity. Unlike a corporation, our partnership agreement requires us to... -

Page 43

... become a limited partner of our partnership, a Unitholder is required to agree to be bound by the provisions in our partnership agreement, including the provisions discussed above. Some of our executive officers and directors face potential conflicts of interest in managing our business. Certain of... -

Page 44

... to Unitholders and to ETE. Neither our partnership agreement nor any other agreement requires ETE or its affiliates to pursue a business strategy that favors us. The directors and officers of the general partners of ETE have a fiduciary duty to make decisions in the best interest of their members... -

Page 45

... and storage of natural gas and NGLs. The principal elements of competition among pipelines are rates, terms of service, access to sources of supply and the flexibility and reliability of service. Natural gas and NGLs also competes with other forms of energy, including electricity, coal, fuel oils... -

Page 46

... retention or replacement of existing customers and the volume of services that we provide at rates sufficient to maintain or increase current revenues and cash flows depends on a number of factors beyond our control, including the price of and demand for oil, natural gas, and NGLs in the markets we... -

Page 47

...processing, transportation and storage operations are largely dependent upon natural gas commodity prices, price spreads between two or more physical locations and market demand for natural gas and NGLs. For a portion of the natural gas gathered on our systems, we purchase natural gas from producers... -

Page 48

... directly affected by changes in natural gas prices. Decreases in natural gas prices tend to decrease our fuel retention fees and the value of retained gas. In addition, we receive revenue from our off-gas processing and fractionating system in south Louisiana primarily through customer agreements... -

Page 49

... in the Transwestern reporting unit due primarily to the market declines in current and expected future commodity prices in the fourth quarter of 2015 and (ii) $106 million in the Lone Star Refinery Services reporting unit due primarily to changes in assumptions related to potential future revenues... -

Page 50

... in fact adversely affect our results of operations or result in a decrease in distributable cash flow per unit. Any acquisition involves potential risks, including the risk that we may fail to realize anticipated benefits, such as new customer relationships, cost-savings or cash flow enhancements... -

Page 51

... project will likely depend upon the level of oil and natural gas exploration and development drilling activity and the demand for pipeline transportation in the areas proposed to be serviced by the project as well as our ability to obtain commitments from producers in the area to utilize the... -

Page 52

... interstate natural gas pipelines, including terms and conditions of service; the types of services interstate pipelines may or must offer their customers; construction of new facilities; acquisition, extension or abandonment of services or facilities; reporting and information posting requirements... -

Page 53

... and storage services in tariffs filed with the TRRC, although such rates are deemed just and reasonable under Texas law unless challenged in a complaint. We are subject to other forms of state regulation, including requirements to obtain operating permits, reporting requirements, and safety rules... -

Page 54

... the use of leak detection systems on pipelines in all locations, including outside of high consequence areas. Federal and state legislative and regulatory initiatives relating to pipeline safety that require the use of new or more stringent safety controls or result in more stringent enforcement... -

Page 55

... and storage facilities in the United States, which includes certain of our operations. More recently, on October 22, 2015, the EPA published a final rule that expands the petroleum and natural gas system sources for which annual greenhouse gas emissions reporting is currently required to include... -

Page 56

... 2015, the EPA announced proposed rules, expected to be finalized in 2016, that would establish new controls for methane emissions from certain new, modified or reconstructed equipment and processes in the oil and natural gas source category, including oil and natural gas production and natural gas... -

Page 57

... or disrupt our customers operations, increase the risk of expired leases due to the time required to develop new technology, result in increased supplemental bonding and costs, limit activities in certain areas, or cause our customers' to incur penalties, or shut-in production or lease cancellation... -

Page 58

... and stored in our pipeline systems and terminal facilities and could require the construction of additional storage to segregate products with different specifications. We may be unable to recover these costs through increased revenues. In addition, our patented butane blending services are... -

Page 59

... business. Our operations could be disrupted if our information systems fail, causing increased expenses and loss of sales. Our business is highly dependent on financial, accounting and other data processing systems and other communications and information systems, including our enterprise resource... -

Page 60

... of operations and could damage our customer relationships. Mergers among Sunoco Logistics' customers and competitors could result in lower volumes being shipped on its pipelines or products stored in or distributed through its terminals, or reduced crude oil marketing margins or volumes. Mergers... -

Page 61

...the PHMSA, issued a rule implementing new rail car standards and railroad operating procedures. Changing operating practices, as well as new regulations on tank car standards and shipper classifications, could increase the time required to move crude oil from production areas of facilities, increase... -

Page 62

...federal income tax purposes. Despite the fact that we are a limited partnership under Delaware law, we would be treated as a corporation for federal income tax purposes unless we satisfy a "qualifying income" requirement. Based upon our current operations, we believe we satisfy the qualifying income... -

Page 63

... Schedules K-1 to our partners with respect to an audited and adjusted return, the IRS may assess and collect taxes (including any applicable penalties and interest) directly from us in the year in which the audit is completed under the new rules. If we are required to pay taxes, penalties and... -

Page 64

... tax purposes and subject to corporate-level income taxes. Even though we (as a partnership for U.S. federal income tax purposes) are not subject to U.S. federal income tax, some of our operations are currently, and our acquisition of Sunoco, Inc. and the ETP Holdco restructuring resulted in an... -

Page 65

... be required to file state and local income tax returns and pay state and local income taxes in some or all of the jurisdictions. We currently own property or conduct business in many states, most of which impose an income tax on individuals, corporations and other entities. As we make acquisitions... -

Page 66

... on which our pipelines were built were purchased in fee. We also own and operate multiple natural gas and NGL storage facilities and own or lease other processing, treating and conditioning facilities in connection with our midstream operations. ITEM 3. LEGAL PROCEEDINGS Sunoco, Inc., along with... -

Page 67

... ("NOPV") related to Sunoco Logistics' West Texas Gulf pipeline in connection with repairs being carried out on the pipeline. The NOPVs propose penalties in excess of $0.1 million, and Sunoco Logistics is currently in discussions with PHMSA to resolve these matters. The timing or outcome of these... -

Page 68

... financial statements. Although no plans are currently in place, management may evaluate whether to retire the Class E Units at a future date. Class G Units In conjunction with the Sunoco Merger, we amended our partnership agreement to create Class F Units. The number of Class F Units issued... -

Page 69

... IDRs and general partner interest in Sunoco Logistics held by Sunoco Partners for such quarter and, to the extent not previously distributed to holders of the Class H Units, for any previous quarters. Bakken Pipeline Transaction In March 2015, ETE transferred 30.8 million ETP Common Units, ETE's 45... -

Page 70

... equal to 90.05% of all distributions to ETP by Sunoco Partners LLC with respect to the incentive distribution rights and general partner interest in Sunoco Logistics, calculated on a cumulative basis beginning October 31, 2013. We are also required to make incremental cash distributions to the... -

Page 71

... Cash from capital surplus as if they were from operating surplus. Our Partnership Agreement treats a distribution of capital surplus as the repayment of the initial unit price from the initial public offering, which is a return of capital. The initial public offering price per Common Unit less any... -

Page 72

... acquired Southern Union) and the retrospective consolidation of Regency into ETP beginning May 26, 2010 (the date ETE obtained control of Regency). These changes only impacted interim periods in 2012, and no prior annual amounts have been adjusted for the ETP Holdco Transaction. The Regency Merger... -

Page 73

...and ET Rover Pipeline LLC. Panhandle is the parent company of the Trunkline and Sea Robin transmission systems. ETP owns a 50% interest in MEP. • • Liquids operations, including NGL transportation, storage and fractionation services primarily through Lone Star. Product and crude oil operations... -

Page 74

... Pipeline system to deliver crude oil from the Bakken/Three Forks production area in North Dakota to the Gulf Coast. ETP transferred the Bakken Membership Interest to Sunoco Logistics in exchange for approximately 9.4 million Class B Units representing limited partner interests in Sunoco Logistics... -

Page 75

...usage rates and overrun rates paid by firm shippers based on their actual capacity usage. Midstream - Revenue is principally dependent upon the volumes of natural gas gathered, compressed, treated, processed, purchased and sold through our pipelines as well as the level of natural gas and NGL prices... -

Page 76

... time of purchase. Retail marketing - Revenue is principally generated from the sale of gasoline and middle distillates and the operation of convenience stores in 14 states, primarily on the east coast and in the southern regions of the United States. These stores complement sales of fuel products... -

Page 77

... involving natural gas exports, including the Rover pipeline project (to Canada), the Trans-Pecos and Comanche Trail pipelines (to Mexico), and waterborne NGL exports, as well as our participation in the Lake Charles LNG liquefaction project. We are also developing the Bakken pipeline project... -

Page 78

... and storage Interstate transportation and storage Midstream Liquids transportation and services Investment in Sunoco Logistics Retail marketing All other Total Depreciation, depletion and amortization Interest expense, net of interest capitalized Gain on sale of AmeriGas common units Impairment... -

Page 79

... (losses) on commodity risk management activities included in "Segment Operating Results" below. Inventory Valuation Adjustments. Inventory valuation reserve adjustments were recorded for the inventory associated with Sunoco Logistics' crude oil, NGLs and refined products inventories and our retail... -

Page 80

... information related to unconsolidated affiliates: Years Ended December 31, 2015 Equity in earnings (losses) of unconsolidated affiliates: Citrus FEP PES MEP HPC AmeriGas Sunoco, LLC Sunoco LP Other Total equity in earnings of unconsolidated affiliates $ 97 55 52 45 32 (3) (10) 202 (1) 469 $ 2014... -

Page 81

... Transportation and Storage Years Ended December 31, 2015 Natural gas transported (MMBtu/d) Revenues Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative... -

Page 82

... driven gains in 2014 not reoccurring in 2015, a $4 million decrease from processing and producer marketing services on our Houston Pipeline System, offset by $10 million in lower losses due to volume adjustments across our pipeline system; a decrease of $17 million in storage margin, as discussed... -

Page 83

...Midstream Years Ended December 31, 2015 Gathered volumes (MMBtu/d) NGLs produced (Bbls/d) Equity NGLs (Bbls/d) Revenues Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general... -

Page 84

...and NGL due to lower natural gas prices and lower crude oil and NGL prices; and an increase of $135 million in operating expenses primarily due to assets recently placed in service, including the Rebel system in west Texas and the King Ranch system in South Texas, as well as the acquisition of Eagle... -

Page 85

... liquids transportation and services segment increased due to the net impacts of the following: • an increase of $69 million in transportation margin primarily due to higher volumes transported out of West Texas and the Eagle Ford producing regions. Increased volumes out of West Texas led to $47... -

Page 86

... of Contents Investment in Sunoco Logistics Years Ended December 31, 2015 Revenue Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative expenses, excluding... -

Page 87

... Merchandise sales (in millions) Retail merchandise margin % Revenue Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative expenses, excluding non-cash... -

Page 88

...acquisition of those operations in March 2014. In connection with the Lake Charles LNG Transaction, ETP agreed to continue to provide management services for ETE through 2015 in relation to both Lake Charles LNG's regasification facility and the development of a liquefaction project at Lake Charles... -

Page 89

...placed in service and recent acquisitions, including Regency's acquisitions in 2014, partially offset by a decrease in depreciation and amortization of $39 million related to the Lake Charles LNG Transaction. Gain on Sale of AmeriGas Common Units. During the year ended December 31, 2014 and 2013, we... -

Page 90

... unrealized gains on commodity risk management activities included in "Segment Operating Results" below. Inventory Valuation Adjustments. Inventory valuation reserve adjustments were recorded for the inventory associated with Sunoco Logistics' crude oil, NGLs and refined products inventories and our... -

Page 91

... information related to unconsolidated affiliates: Years Ended December 31, 2014 Equity in earnings (losses) of unconsolidated affiliates: Citrus FEP PES MEP HPC AmeriGas Other Total equity in earnings of unconsolidated affiliates $ 96 55 59 45 28 21 28 332 $ 2013 87 55 (48) 40 30 50 22 236 $ Change... -

Page 92

... Transportation and Storage Years Ended December 31, 2014 Natural gas transported (MMBtu/d) Revenues Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative... -

Page 93

... Adjusted EBITDA related to our interstate transportation and storage segment decreased due to the net impacts of the following: • a decrease of $216 million in revenues from the deconsolidation of Lake Charles LNG effective January 1, 2014 and the recognition in 2013 of $52 million received in... -

Page 94

...Midstream Years Ended December 31, 2014 Gathered volumes (MMBtu/d): NGLs produced (Bbls/d): Equity NGLs (Bbls/d): Revenues Cost of products sold Gross margin Unrealized (gains) losses on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general... -

Page 95

... and services segment increased due to the net impacts of the following: • an increase of $69 million in transportation margin due to higher volumes transported from West Texas and the Eagle Ford Shale on our Lone Star pipeline system and a $56 million increase due to in NGL production from... -

Page 96

... to an increase in employee-related costs. Investment in Sunoco Logistics Years Ended December 31, 2014 Revenue Cost of products sold Gross margin Unrealized gains on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative... -

Page 97

...for all gallons Merchandise sales (in millions) Retail merchandise margin % Revenue Cost of products sold Gross margin Unrealized gains on commodity risk management activities Operating expenses, excluding non-cash compensation expense Selling, general and administrative expenses, excluding non-cash... -

Page 98

... of AmeriGas common units in 2014 and 2013; a refund of insurance premiums of $6 million included in the year ended December 31, 2014; and Southern Union corporate expenses of $14 million that were no longer included in the all other segment subsequent to the merger of Southern Union, PEPL Holdings... -

Page 99

... may issue debt or equity securities prior to that time as we deem prudent to provide liquidity for new capital projects, to maintain investment grade credit metrics or other partnership purposes. Sunoco Logistics' primary sources of liquidity consist of cash generated from operating activities and... -

Page 100

... purchase and sales of inventories, and the timing of advances and deposits received from customers. Following is a summary of operating activities by period: Year Ended December 31, 2015 Cash provided by operating activities in 2015 was $2.75 billion and net income was $1.52 billion. The difference... -

Page 101

..., Susser Merger and the acquisition of a noncontrolling interest. In addition, we received $814 million in cash from sale of AmeriGas common units. Year Ended December 31, 2013 Cash used in investing activities in 2013 was $3.64 billion. Total capital expenditures (excluding the allowance for equity... -

Page 102

...31, 2014: Direct(1): Intrastate transportation and storage Interstate transportation and storage Midstream Liquids transportation and services Retail marketing (3) All other (including eliminations) Total direct capital expenditures Indirect(1): Investment in Sunoco Logistics Investment in Sunoco LP... -

Page 103

...used to repay outstanding borrowings under the ETP Credit Facility, to fund capital expenditures, and acquisitions, as well as for general partnership purposes. In 2014, we had a net increase in our debt level of $2.65 billion primarily due to Sunoco Logistics' issuance of $2.00 billion in aggregate... -

Page 104

... $2.50 billion Revolving Credit Facility. In connection with ETE's acquisition of Sunoco GP, the general partner of Sunoco LP, on July 1, 2015, ETP deconsolidated Sunoco LP. On April 30, 2015, in connection with the Regency Merger, the Regency Revolving Credit Facility was paid off in full and... -

Page 105

... from common unit offerings or long-term notes offerings. The timing of borrowings depends on the Partnership's activities and the cash available to fund those activities. The repayments of amounts outstanding under the ETP Credit Facility depend on multiple factors, including market conditions and... -

Page 106

...' working capital requirements, to finance acquisitions and capital projects, to pay distributions and for general partnership purposes. The Sunoco Logistics Credit Facility bears interest at LIBOR or the Base Rate, each plus an applicable margin. The credit facility may be prepaid at any time... -

Page 107

... credit agreement, of 5.0 to 1, which can generally be increased to 5.5 to 1 during an acquisition period. Sunoco Logistics' ratio of total consolidated debt, excluding net unamortized fair value adjustments, to consolidated Adjusted EBITDA was 3.6 to 1 at December 31, 2015, as calculated in... -

Page 108

... 31, 2015. To the extent interest rates change, our contractual obligations for interest payments will change. See "Item 7A. Quantitative and Qualitative Disclosures About Market Risk" for further discussion. We define a purchase commitment as an agreement to purchase goods or services that is... -

Page 109

..., including distributions on Class I Units: Total Year 2016 2017 2018 2019 Cash Distributions Paid by Sunoco Logistics Sunoco Logistics is required by its partnership agreement to distribute all cash on hand at the end of each quarter, less appropriate reserves determined by its general partner... -

Page 110

... December 31, 2015 Limited Partners: Common units held by public Common units held by ETP General Partner interest held by ETP Incentive distributions held by ETP Total distributions declared New Accounting Standards In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting... -

Page 111

... the energy industry, and other issues. Results from the midstream segment are determined primarily by the volumes of natural gas gathered, compressed, treated, processed, purchased and sold through our pipeline and gathering systems and the level of natural gas and NGL prices. We generate midstream... -

Page 112

... off-system gas. For both on-system and off-system gas, we purchase natural gas from natural gas producers and other supply points and sell that natural gas to utilities, industrial consumers, other marketers and pipeline companies, thereby generating gross margins based upon the difference between... -

Page 113

... process in a period different from the period in which they would have been reflected in the consolidated statement of operations by an unregulated company. These deferred assets and liabilities will be reported in results of operations in the period in which the same amounts are included in rates... -

Page 114

... use of natural gas in industrial and power generation activities, management expects supply and demand to exist for the foreseeable future. We have in place a rigorous repair and maintenance program that keeps the pipelines and the natural gas gathering and processing systems in good working order... -

Page 115

...of high-quality debt instruments that would provide the necessary cash flows to pay the benefits when due. Net periodic benefit cost and benefit obligation increases and equity correspondingly decreases as the discount rate is reduced. The expected rate of return on plan assets is based on long-term... -

Page 116

..., processing, storage and transportation services; the prices and market demand for, and the relationship between, natural gas and NGLs; energy prices generally; the prices of natural gas and NGLs compared to the price of alternative and competing fuels; the general level of petroleum product demand... -

Page 117

...; changes to, and the application of, regulation of tariff rates and operational requirements related to our interstate and intrastate pipelines; hazards or operating risks incidental to the gathering, treating, processing and transporting of natural gas and NGLs; competition from other midstream... -

Page 118

... sales of NGL and condensate equity volumes we retain for fees in our midstream segment whereby our subsidiaries generally gather and process natural gas on behalf of producers, sell the resulting residue gas and NGL volumes at market prices and remit to producers an agreed upon percentage of the... -

Page 119

... instrument settles and the location to which the financial instrument is tied (i.e., basis swaps) and the relationship between prompt month and forward months. Interest Rate Risk As of December 31, 2015, we had $3.59 billion of floating rate debt outstanding. A hypothetical change of 100 basis... -

Page 120

... consist of a diverse portfolio of customers across the energy industry, including petrochemical companies, commercial and industrials, oil and gas producers, municipalities, gas and electric utilities, midstream companies and independent power generators. Our overall exposure may be affected... -

Page 121

..., including the Chief Executive Officer and Chief Financial Officer of ETP LLC, concluded that our disclosure controls and procedures were adequate and effective as of December 31, 2015. Management's Report on Internal Control over Financial Reporting The management of Energy Transfer Partners... -

Page 122

... FIRM Partners Energy Transfer Partners, L.P. We have audited the internal control over financial reporting of Energy Transfer Partners, L.P. (a Delaware limited partnership) and subsidiaries (the "Partnership") as of December 31, 2015, based on criteria established in the 2013 Internal Control... -

Page 123

... internal control over financial reporting. ITEM 9B. OTHER INFORMATION On February 25, 2016, in connection with his removal as Group Chief Financial Officer and Head of Business Development of ETE and his termination of employment with our General Partner, the members of the General Partner removed... -

Page 124

... requirements. Our current directors who are not independent consist of Kelcy L. Warren, ETP LLC's Chief Executive Officer, and Matthew S. Ramsey, ETP LLC's President and Chief Operating Officer, as well as Tom Long, the Group Chief Financial Officer of ETE's general partner and Marshall S. McCrea... -

Page 125

...the General Partner or its Board of Directors of any duties they may owe the Partnership or the Unitholders. These duties are limited by our Partnership Agreement (see "Risks Related to Conflicts of Interest" in Item 1A. Risk Factors in this annual report). Audit Committee The Board of Directors has... -

Page 126

... of director, CEO or executive officer compensation; and perform other duties as deemed appropriate by the Board of Directors. Matters relating to the nomination of directors or corporate governance matters are addressed to and determined by the full Board of Directors. Code of Business Conduct and... -

Page 127

... certain information with respect to the executive officers and members of the Board of Directors of our General Partner as of February 29, 2016. Executive officers and directors are elected for one-year terms. Name Kelcy L. Warren Matthew S. Ramsey Thomas E. Long Marshall S. (Mackie) McCrea, III... -

Page 128

... - Business Development and Producer Services of the general partner of ETC OLP and ET Company I, Ltd., having served in that capacity since 1997. Mr. McCrea also currently serves on the Board of Directors of the general partner of ETE, of Sunoco Logistics and of Sunoco LP. The Board of Directors... -

Page 129

... production company. As an energy professional, active oil and gas producer and successful business owner, Mr. Skidmore possesses valuable first-hand knowledge of the energy transportation business and market conditions affecting its economics. Compensation of the General Partner Our General Partner... -

Page 130

... Class H and Class I Units. All of our employees are employed by and receive employee benefits from our Operating Companies. Compensation Discussion and Analysis Named Executive Officers We do not have officers or directors. Instead, we are managed by the board of directors of our General Partner... -

Page 131

... for the direct payment of the compensation of our named executive officers as employees of ETP or its controlled affiliates, ETP does not participate or have any input in any decisions as to the compensation policies of our General Partner or the compensation levels of the executive officers of our... -

Page 132

... officers and key management employees employed by publicly traded limited partnerships of similar size and in similar lines of business; motivate executive officers and key employees to achieve strong financial and operational performance; emphasize performance-based or "at-risk" compensation... -

Page 133

...party consultant, the ETP Compensation Committee also utilizes information obtained from other sources, such as annual third party surveys, in its determination of compensation levels for our named executive officers. In respect of Sunoco Logistics, during 2015 Longnecker reviewed various metrics in... -

Page 134

..., including annual base salary, annual short-term cash bonus and long-term incentive awards for the senior executives for certain companies in the oil and gas industry. The compensation committee of the general partner of Sunoco Logistics ("SXL Compensation Committee") utilized the information... -

Page 135

... key initiatives, including (a) the drop-down transactions by and between ETP and Sunoco LP, (b) the proposed merger transaction between the ETE and The Williams Companies, Inc., (c) ETE's liquefied natural gas (LNG) export project, and (d) the simplification of the overall Energy Transfer family... -

Page 136

...% to the Sunoco LP equity plan. Mr. Long serves as a financial advisor in matters related to mergers and acquisitions and financing activities to both Sunoco Logistics and Sunoco LP. It is expected that future long-term incentive awards to the named executive officers of the Partnership and ETE will... -

Page 137

... of the named executive officer or in the event of a change in control of the Partnership as that term is defined under the 2008 Incentive Plan. In the case of Mr. Hennigan, he received a long-term incentive awards under the Sunoco Logistics Plan for 2015. The award of 116,750 restricted units was... -

Page 138

... and Mason under the Sunoco Logistics and Sunoco LP equity plans are identical to the terms and conditions of the restricted unit awards under our equity plan applicable to Messrs. McCrea, Long and Mason. Qualified Retirement Plan Benefits. The Energy Transfer Partners GP, L.P. 401(k) Plan (the "ETP... -

Page 139

... unit awards in the event of a change of control, as defined in the applicable plan. Please refer to "Compensation Tables - Potential Payments Upon a Termination or Change of Control" for additional information. In addition, our General Partner has also adopted the ETP GP Severance Plan and Summary... -

Page 140

... management of ETP. Based on this review and discussion, we have recommended to the board of directors of our General Partner that the Compensation Discussion and Analysis be included in this annual report on Form 10-K. The Compensation Committee of the Board of Directors of Energy Transfer Partners... -

Page 141

...Mackie) McCrea, III Group Chief Operating Officer and Chief Commercial Officer Thomas P. Mason Executive Vice President and General Counsel Michael J. Hennigan (7) 2015 2014 840,385 800,000 1,294,192 1,120,000 6,646,354 5,829,111 - - - - - - 14,282 14,072 8,795,213 7,763,183 2013 2015 2014... -

Page 142

... 2015, which vested April 29, 2015 in connection with ETP's acquisition of Regency. Mr. Ramsey's January 2015 unit award from Sunoco LP represents his award as a non-employee director prior to his November appointment with our General Partner. (2) (3) Narrative Disclosure to Summary Compensation... -

Page 143

... Hennigan N/A - - Sunoco Logistics Unit Awards: Thomas E. Long Martin Salinas, Jr. (4) Marshall S. (Mackie) McCrea, III 12/4/2015 N/A 12/4/2015 12/5/2014 12/3/2013 1/24/2013 Thomas P. Mason 12/4/2015 12/5/2014 Michael J. Hennigan 12/4/2015 12/5/2014 1/29/2014 12/5/2013 1/24/2013 12/5/2012 11,208... -

Page 144

... Option Exercises and Units Vested Table Unit Awards Number of Units Acquired on Vesting (1) (2) Name ETP Unit Awards: Kelcy L. Warren Thomas E. Long Martin Salinas, Jr. (3) Matthew S. Ramsey (4) Marshall S. (Mackie) McCrea Thomas P. Mason Michael J. Hennigan Sunoco Logistics Unit Awards: Martin... -

Page 145

... the named executive officers in 2015 under the DC Plan and, in the case of Mr. Hennigan, the ETP Deferred Compensation Plan for Former Sunoco Executives. Registrant Contributions in Last FY Name Kelcy L. Warren Thomas E. Long Martin Salinas, Jr. Matthew S. Ramsey Marshall S. (Mackie) McCrea, III... -

Page 146

...Sunoco Executives as any change in control event within the meaning of Treasury Regulation Section 1.409A-3(i)(5). Director Compensation The Compensation Committee periodically reviews and makes recommendations regarding the compensation of the directors of our General Partner. In 2015, non-employee... -

Page 147

... directors and executive officers of our General Partner as a group. The General Partner knows of no other person not disclosed herein who beneficially owns more than 5% of our Common Units. Title of Class Common Units Name and Address of Beneficial Owner(1) Kelcy L. Warren Thomas E. Long Marshall... -

Page 148

... Partnership or the Unitholders (see "Risks Related to Conflicts of Interest" in Item 1A. Risk Factors in this annual report). ETE owns directly and indirectly the general partner interest in ETP GP, 100% of the ETP Incentive Distribution Rights, 2.6 million ETP Common Units and 81.0 million Class... -

Page 149

...to the IDRs and general partner interest in Sunoco Logistics held by Sunoco Partners for such quarter and, to the extent not previously distributed to holders of the Class H Units, for any previous quarters. On February 19, 2014, ETP completed the transfer to ETE of Lake Charles LNG, the entity that... -

Page 150

... Sunoco GP, the general partner of Sunoco LP, and all of the IDRs of Sunoco LP from ETP, and in exchange, ETP repurchased from ETE 21 million ETP common units owned by ETE (the "Sunoco LP Exchange"). In connection with ETP's 2014 acquisition of Susser, ETE agreed to provide ETP a $35 million annual... -

Page 151

... auditors encountered in the course of their audit work, and, at least annually, uses its reasonable efforts to obtain and review a report from the external auditors addressing the following (among other items the auditors' internal quality-control procedures; any material issues raised by the most... -

Page 152

...Contents PART IV ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES (a) The following documents are filed as a part of this Report: (1) Financial Statements - see Index to Financial Statements appearing on page F-1. (2) Financial Statement Schedules - None. (3) Exhibits - see Index to Exhibits set... -

Page 153

... Partners GP, L.P, its general partner. Energy Transfer Partners, L.L.C., its general partner /s/ Kelcy L. Warren Kelcy L. Warren Chief Executive Officer and officer duly authorized to sign on behalf of the registrant Pursuant to the requirements of the Securities Exchange Act of 1934, this report... -

Page 154

... Transfer Equity, L.P. Southern Union Company and CrossCountry Energy, LLC (incorporated by reference to Exhibit 2.1 to the Registrant's Form 8-K filed July 20, 2011). Agreement and Plan of Merger, dated as of April 29, 2012 by and among Energy Transfer Partners, L.P., Sam Acquisition Corporation... -

Page 155

...Amended and Restated Limited Liability Company Agreement of Energy Transfer Partners, L.L.C., dated as of August 10, 2010 (incorporated by reference to Exhibit 3.3 to Registrant's Form 8-K filed on March 28, 2012). Certificate of Limited Partnership of Sunoco Logistics Partners L.P. (incorporated by... -

Page 156

... Limited Partnership of Energy Transfer Partners, L.P. dated as of August 21, 2015 (incorporated by reference to Exhibit 3.1 to the Registrant's Form 8-K filed August 27, 2015). Registration Rights Agreement, dated April 30, 2013, by and between Southern Union Company and Regency Energy Partners LP... -

Page 157

... Grant Agreement under the Energy Transfer Partners, L.P. Amended and Restated 2004 Unit Plan and the 2008 Energy Transfer Partners, L.P. Long-Term Incentive Plan (incorporated by reference to Exhibit 10.1 to the Registrant's Form 8-K filed November 1, 2004). Energy Transfer Partners, L.L.C. Annual... -

Page 158

... Partners, L.P., Drive Acquisition Corporation, Sam L. Susser and Susser Family Limited Partnership (incorporated by reference to Exhibit 10.1 to the Registrant's Form 8-K filed on April 28, 2014). Exchange and Redemption Agreement by and among Energy Transfer Partners, L.P., Energy Transfer Equity... -

Page 159

...and among Energy Transfer Equity, L.P., Sigma Acquisition Corporation and Southern Union Company (incorporated by reference to Exhibit 10.1 to the Registrant's Form 8-K filed September 15, 2011). Second Amended and Restated Credit Agreement dated as of October 27, 2011 among Energy Transfer Partners... -

Page 160

... respect to Section 11.19 and other provisions related thereto, Energy Transfer Partners, L.P. (incorporated by reference to Exhibit 10.1 to the Registrant's Form 8-K filed November 19, 2015). Energy Transfer Partners Deferred Compensation Plan for Former Sunoco Executives effective October 5, 2012... -

Page 161

... financial statements of Susser Holdings Corporation. Interactive data files pursuant to Rule 405 of Regulation S-T: (i) our Consolidated Balance Sheets as of December 31, 2015 and December 31, 2014; (ii) our Consolidated Statements of Operations for the years ended December 31, 2015, 2014 and 2013... -

Page 162

... STATEMENTS Energy Transfer Partners, L.P. and Subsidiaries Page F-2 F-3 F-5 F-6 F-7 F-9 F - 11 Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Comprehensive Income Consolidated Statements of Equity... -

Page 163

... LP and Susser Holdings Corporation as of December 31, 2014 and for the period from September 1, 2014 to December 31, 2014, is based solely on the reports of the other auditors. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 164

Table of Contents ENERGY TRANSFER PARTNERS, L.P. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Dollars in millions) December 31, 2015 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Accounts receivable from related companies Inventories Exchanges receivable Derivative ... -

Page 165

...Long-term debt, less current maturities Long-term notes payable - related company Non-current derivative liabilities Deferred income taxes Other non-current liabilities Commitments and contingencies Series A Preferred Units Redeemable noncontrolling interests Equity: General Partner Limited Partners... -

Page 166

Table of Contents ENERGY TRANSFER PARTNERS, L.P. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in millions, except per unit data) Years Ended December 31, 2015 REVENUES: Natural gas sales NGL sales Crude sales Gathering, transportation and other fees Refined product sales Other ... -

Page 167

Table of Contents ENERGY TRANSFER PARTNERS, L.P. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Dollars in millions) Years Ended December 31, 2015 Net income $ Other comprehensive income (loss), net of tax: Reclassification to earnings of gains and losses on derivative ... -

Page 168

... units issued for cash Capital contributions from noncontrolling interest Lake Charles LNG Transaction Susser Merger Sunoco Logistics acquisition of a noncontrolling interest Predecessor distributions to partners Predecessor units issued for cash Predecessor equity issued for acquisitions, net... -

Page 169

... issued for cash Capital contributions from noncontrolling interest Regency Merger Bakken Pipeline Transaction Sunoco LP Exchange Transaction Susser Exchange Transaction Acquisition and disposition of noncontrolling interest Other comprehensive income, net of tax Other, net Net income (loss) Balance... -

Page 170

... Net cash provided by operating activities INVESTING ACTIVITIES: Proceeds from Bakken Pipeline Transaction Proceeds from Susser Exchange Transaction Proceeds from sale of noncontrolling interest Proceeds from the sale of AmeriGas common units Cash transferred to ETE in connection with the Sunoco LP... -

Page 171

... Subsidiary units issued for cash Predecessor units issued for cash Capital contributions from noncontrolling interest Distributions to partners Predecessor distributions to partners Distributions to noncontrolling interest Debt issuance costs Other Net cash provided by financing activities Increase... -

Page 172

... states of Texas, Louisiana, New Mexico and West Virginia. The Partnership owns and operates interstate pipelines, either directly or through equity method investments, that transport natural gas to various markets in the United States. The Partnership owns a controlling interest in Sunoco Logistics... -

Page 173

... the reporting period. The natural gas industry conducts its business by processing actual transactions at the end of the month following the month of delivery. Consequently, the most current month's financial results for the midstream, NGL and intrastate transportation and storage operations are... -

Page 174

... the energy industry, and other issues. Results from the midstream segment are determined primarily by the volumes of natural gas gathered, compressed, treated, processed, purchased and sold through our pipeline and gathering systems and the level of natural gas and NGL prices. We generate midstream... -

Page 175

... gas producers and other supply points and sell that natural gas to utilities, industrial consumers, other marketers and pipeline companies, thereby generating gross margins based upon the difference between the purchase and resale prices. Terminalling and storage revenues are recognized at the time... -

Page 176

...Corporation insurance limit. The net change in operating assets and liabilities (net of effects of acquisitions and deconsolidations) included in cash flows from operating activities is comprised as follows: Years Ended December 31, 2015 Accounts receivable Accounts receivable from related companies... -

Page 177

... with Regency's acquisitions Long-term debt assumed or exchanged in Regency's acquisitions Redemption of Common Units in connection with the Bakken Pipeline Transaction Redemption of Common Units in connection with the Sunoco LP Exchange Redemption of Common Units in connection with the Lake Charles... -

Page 178

... to customers after a review of various credit indicators. Depending on the type of customer and its risk profile, security in the form of a cash deposit, letter of credit or mortgages may be required. Management records reserves for bad debt by computing a proportion of average write-off activity... -

Page 179

... depreciation. When entire pipeline systems, gas plants or other property and equipment are retired or sold, any gain or loss is included in our consolidated statements of operations. Property, plant and equipment is reviewed for impairment whenever events or changes in circumstances indicate that... -

Page 180

... for by the equity method. In general, we use the equity method of accounting for an investment for which we exercise significant influence over, but do not control, the investee's operating and financial policies. Other Non-Current Assets, net Other non-current assets, net are stated at cost less... -

Page 181

... consisted of restricted cash held in our wholly-owned captive insurance companies. Intangible Assets Intangible assets are stated at cost, net of amortization computed on the straight-line method. The Partnership removes the gross carrying amount and the related accumulated amortization for... -

Page 182

... in the Transwestern reporting unit due primarily to the market declines in current and expected future commodity prices in the fourth quarter of 2015 and (ii) $106 million in the Lone Star Refinery Services reporting unit due primarily to changes in assumptions related to potential future revenues... -

Page 183

... use of natural gas in industrial and power generation activities, management expects supply and demand to exist for the foreseeable future. We have in place a rigorous repair and maintenance program that keeps the pipelines and the natural gas gathering and processing systems in good working order... -

Page 184

... for natural gas deliveries in the following month. Prepayments and security deposits may also be required when customers exceed their credit limits or do not qualify for open credit. Redeemable Noncontrolling Interests The noncontrolling interest holders in one of Sunoco Logistics' consolidated... -

Page 185

... Forward Physical Swaps Power: Forwards Futures Options - Puts Options - Calls Natural Gas Liquids - Forwards/Swaps Refined Products - Futures Crude - Futures Total commodity derivatives Total assets Liabilities: Interest rate derivatives Embedded derivatives in the ETP Preferred Units Commodity... -

Page 186

...Swaps/Futures Forward Physical Swaps Power: Forwards Futures Natural Gas Liquids - Forwards/Swaps Refined Products - Futures Total commodity derivatives Total assets Liabilities: Interest rate derivatives Embedded derivatives in the ETP Preferred Units Commodity derivatives: Natural Gas: Basis Swaps... -

Page 187

... statutory requirement. The Partnership conducts certain activities through corporate subsidiaries which are subject to federal, state and local income taxes. These corporate subsidiaries include ETP Holdco, Oasis Pipeline Company and until July 31, 2015, Susser Holding Corporation. The Partnership... -

Page 188

... by including changes in the fair value of the derivative in net income for the period. If we designate a commodity hedging relationship as a fair value hedge, we record the changes in fair value of the hedged asset or liability in cost of products sold in our consolidated statements of operations... -

Page 189

... Sunoco GP, the general partner of Sunoco LP, and all of the IDRs of Sunoco LP from ETP, and in exchange, ETP repurchased from ETE 21 million ETP common units owned by ETE (the "Sunoco LP Exchange"). In connection with ETP's 2014 acquisition of Susser, ETE agreed to provide ETP a $35 million annual... -

Page 190

... Pipeline system to deliver crude oil from the Bakken/Three Forks production area in North Dakota to the Gulf Coast. ETP transferred the Bakken Membership Interest to Sunoco Logistics in exchange for approximately 9.4 million Class B Units representing limited partner interests in Sunoco Logistics... -

Page 191

... revenue and net income related to Susser of $2.32 billion and $105 million, respectively. No pro forma information has been presented, as the impact of these acquisitions was not material in relation to ETP's consolidated results of operations. MACS to Sunoco LP In October 2014, Sunoco LP acquired... -

Page 192

... in PEI Power II, LLC, Regency (31.4 million common units and 6.3 million Class F Units, all of which have subsequently converted into ETP common units), and ETP (2.2 million Common Units). Regency's Acquisition of PVR Partners, L.P. On March 21, 2014, Regency acquired PVR for a total purchase price... -

Page 193

..., including the income and market approaches. 2013 Transactions Sale of Southern Union's Distribution Operations In December 2012, Southern Union entered into a purchase and sale agreement with The Laclede Group, Inc., pursuant to which Laclede Missouri agreed to acquire the assets of Southern Union... -

Page 194

... intrastate pipeline system. Our investment in HPC is reflected in the intrastate transportation and storage segment. Sunoco LP Effective July 1, 2015, ETE acquired 100% of the membership interests of Sunoco GP, the general partner of Sunoco LP, and all of the IDRs of Sunoco LP from the Partnership... -

Page 195

...2,687 14,096 $ $ Current liabilities Non-current liabilities Equity Total liabilities and equity $ 1,517 10,428 7,797 19,742 $ 1,983 7,359 4,754 14,096 $ $ Years Ended December 31, 2015 Revenue Operating income Net income $ 20,961 1,620 894 $ 2014 4,925 1,071 577 $ 2013 4,695 1,197 699 In... -

Page 196

... from continuing operations Class I Unitholder's interest in income from continuing operations Common Unitholders' interest in income (loss) from continuing operations Additional earnings allocated to General Partner Distributions on employee unit awards, net of allocation to General Partner Income... -

Page 197

... Notes due December 15, 2045 Floating Rate Junior Subordinated Notes due November 1, 2066 ETP $3.75 billion Revolving Credit Facility due November 2019 Unamortized premiums, discounts and fair value adjustments, net Deferred debt issuance costs Transwestern Debt 5.54% Senior Notes due November 17... -

Page 198

... with ETE's acquisition of Sunoco GP, the general partner of Sunoco LP, on July 1, 2015, ETP deconsolidated Sunoco LP. As discussed below, the Regency senior notes were redeemed and/or assumed by the Partnership. On April 30, 2015, in connection with the Regency Merger, the Regency Revolving Credit... -

Page 199

... notes due March 2045. ETP used the $2.48 billion net proceeds from the offering to repay outstanding borrowings under the ETP Credit Facility, to fund growth capital expenditures and for general partnership purposes. At the time of the Regency Merger, Regency had outstanding $5.1 billion principal... -

Page 200

... extended to $3.25 billion under certain conditions. The Sunoco Logistics Credit Facility is available to fund Sunoco Logistics' working capital requirements, to finance acquisitions and capital projects, to pay distributions and for general partnership purposes. The Sunoco Logistics Credit F - 39 -

Page 201

...in such credit agreement); engage in business substantially different in nature than the business currently conducted by the Partnership and its subsidiaries; engage in transactions with affiliates; and enter into restrictive agreements. The credit agreement relating to the ETP Credit Facility also... -

Page 202

... credit agreement, of 5.0 to 1, which can generally be increased to 5.5 to 1 during an acquisition period. Sunoco Logistics' ratio of total consolidated debt, excluding net unamortized fair value adjustments, to consolidated Adjusted EBITDA was 3.6 to 1 at December 31, 2015, as calculated in... -

Page 203

...used to repay amounts outstanding under the ETP Credit Facility and for general partnership purposes. Equity Distribution Program From time to time, we have sold Common Units through equity distribution agreements. Such sales of Common Units are made by means of ordinary brokers' transactions on the... -

Page 204

... and general partner interest in Sunoco Logistics held by Sunoco Partners for such quarter and, to the extent not previously distributed to holders of the Class H Units, for any previous quarters. Bakken Pipeline Transaction In March 2015, ETE transferred 30.8 million Partnership common units, ETE... -

Page 205

... during the year ended December 31, 2015, we recognized increases in partners' capital of $300 million. In 2014, Sunoco Logistics entered into equity distribution agreements pursuant to which Sunoco Logistics may sell from time to time common units having aggregate offering prices of up to $1.25... -

Page 206

..., including distributions on Class I Units: Total Year 2016 2017 2018 2019 Sunoco Logistics Quarterly Distributions of Available Cash Distributions declared during the periods presented were as follows: Quarter Ended December 31, 2012 March 31, 2013 June 30, 2013 September 30, 2013 December 31, 2013... -

Page 207

... benefits Total 9. UNIT-BASED COMPENSATION PLANS: ETP Unit-Based Compensation Plan We have issued equity incentive plans for employees, officers and directors, which provide for various types of awards, including options to purchase ETP Common Units, restricted units, phantom units, Common Units... -

Page 208

... price of ETP Common Units at December 31, 2015, the Partnership expects to recognize $7 million of unit-based compensation expense related to non-vested cash restricted units over a period of 1.3 years. Sunoco Logistics Unit-Based Compensation Plan Sunoco Logistics' general partner has a long-term... -

Page 209

... Pipeline Company and West Texas Gulf Pipeline Company. Susser Holding Corporation, Susser Petroleum Property Company LLC and Aloha Petroleum Ltd. were deconsolidated from these financial statements in July 2015 due to the contribution of Susser Holding Corporation to Sunoco LP and the acquisition... -

Page 210

... of Susser Holding Corporation, Susser Petroleum Property Company LLC and Aloha Petroleum Ltd. in July 2015 due to the contribution of Susser Holding Corporation to Sunoco LP and the acquisition by ETE of 100% of the membership interest of Sunoco GP, the general partner of Sunoco LP (see... -

Page 211

... 31, 2015, we have interest and penalties accrued of $5 million, net of tax. Sunoco, Inc. has historically included certain government incentive payments as taxable income on its federal and state income tax returns. In connection with Sunoco, Inc.'s 2004 through 2011 open statute years, Sunoco, Inc... -

Page 212

... business, revenues and cash flow. Transwestern Rate Case On October 1, 2014, Transwestern filed a general NGA Section 4 rate case pursuant to a 2011 settlement agreement with its shippers. On December 2, 2014, the FERC issued an order accepting and suspending the rates to be effective April 1, 2015... -

Page 213

..., Sea Robin made refunds to customers totaling $11 million, including interest. Commitments In the normal course of our business, we purchase, process and sell natural gas pursuant to long-term contracts and we enter into long-term transportation and storage agreements. Such contracts contain terms... -

Page 214

... of Dallas County, Texas (the "Engel Lawsuit"). The lawsuit names as defendants the Regency General Partner, the members of the Regency General Partner's board of directors, ETP, ETP GP, ETE, and, as a nominal party, Regency. The Engel Lawsuit alleges that (1) the Regency General Partner's directors... -

Page 215

...of Dallas County, Texas transferred and consolidated the Yeager and Coggia Lawsuits into the Engel Lawsuit and captioned the consolidated lawsuit as Engel v. Regency GP, LP, et al. (the "Consolidated State Lawsuit"). On March 30, 2015, Leonard Cooperman, a purported Regency unitholder, filed a class... -

Page 216

... of time and expense that will be required to resolve it. The Defendants intend to vigorously defend the lawsuit. Enterprise Products Partners, L.P. and Enterprise Products Operating LLC Litigation On January 27, 2014, a trial commenced between ETP against Enterprise Products Partners, L.P. and... -

Page 217

... and processing systems are responsible for soil and groundwater remediation related to releases of hydrocarbons. Currently operating Sunoco, Inc. retail sites. Legacy sites related to Sunoco, Inc., that are subject to environmental assessments include formerly owned terminals and other logistics... -

Page 218

... were not operated in a manner consistent with good air pollution control practice for minimizing emissions and/or in conformance with their design, and that Sunoco, Inc. submitted semi-annual compliance reports in 2010 and 2011 and EPA that failed to include all of the information required by the... -

Page 219

... sales of NGL and condensate equity volumes we retain for fees in our midstream segment whereby our subsidiaries generally gather and process natural gas on behalf of producers, sell the resulting residue gas and NGL volumes at market prices and remit to producers an agreed upon percentage of the... -

Page 220

...,287,500 2015 2015 2015 Includes aggregate amounts for open positions related to Houston Ship Channel, Waha Hub, NGPL TexOk, West Louisiana Zone and Henry Hub locations. Interest Rate Risk We are exposed to market risk for changes in interest rates. To maintain a cost effective capital structure... -

Page 221

... consist of a diverse portfolio of customers across the energy industry, including petrochemical companies, commercial and industrials, oil and gas producers, municipalities, gas and electric utilities, midstream companies and independent power generators. Our overall exposure may be affected... -

Page 222

...assets (liabilities) Broker cleared derivative Other current assets contracts Offsetting agreements: Counterparty netting Payments on margin deposit Total net derivatives December 31, 2015 $ - December 31, 2014 $ 3 Liability Derivatives December 31, 2015 December 31, 2014 $ (176) $ (171) 57 391 448... -

Page 223

... 31, 2015 2014 2013 Derivatives not designated as hedging instruments: Commodity derivatives - Trading Commodity derivatives - Non-trading Commodity contracts - Non-trading Interest rate derivatives Embedded derivatives Total Cost of products sold Cost of products sold Deferred gas purchases Gains... -

Page 224

... to union employees. Sunoco, Inc. Sunoco, Inc. sponsors a defined benefit pension plan, which was frozen for most participants on June 30, 2010. On October 31, 2014, Sunoco, Inc. terminated the plan, and paid lump sums to eligible active and terminated vested participants in December 2015. Sunoco... -

Page 225

...years an employee provides services. The following table contains information at the dates indicated about the obligations and funded status of pension and other postretirement plans on a combined basis: December 31, 2015 Pension Benefits Funded Plans Change in benefit obligation: Benefit obligation... -

Page 226

... Plans 65 65 - Components of Net Periodic Benefit Cost December 31, 2015 Pension Benefits Net periodic benefit cost: Interest cost Expected return on plan assets Prior service cost amortization Actuarial loss amortization Settlements Net periodic benefit cost Assumptions The weighted-average... -

Page 227

... expectations concerning future returns in the marketplace for both equity and fixed income securities. Current market factors such as inflation and interest rates are evaluated before long-term market assumptions are determined. Peer data and historical returns are reviewed to ensure reasonableness... -

Page 228

... of December 31, 2014. The Level 1 plan assets are valued based on active market quotes. The Level 2 plan assets are valued based on the net asset value per share (or its equivalent) of the investments, which was not determinable through publicly published sources but was calculated consistent with... -

Page 229

... revenues $ 417 $ 2014 965 $ 2013 1,442 The following table summarizes the related company balances on our consolidated balance sheets: December 31, 2015 Accounts receivable from related companies: Sunoco LP ETE PES FGT Lake Charles LNG Trans-Pecos Pipeline, LLC Comanche Trail Pipeline, LLC... -

Page 230

... statements currently reflect the following reportable segments, which conduct their business in the United States, as follows intrastate transportation and storage; interstate transportation and storage; midstream; liquids transportation and services; investment in Sunoco Logistics; retail... -

Page 231

... revenues Interstate transportation and storage: Revenues from external customers Intersegment revenues Midstream: Revenues from external customers Intersegment revenues Liquids transportation and services: Revenues from external customers Intersegment revenues Investment in Sunoco Logistics... -

Page 232

... $ 2013 122 244 335 91 265 114 125 1,296 $ $ $ Years Ended December 31, 2015 Equity in earnings (losses) of unconsolidated affiliates: Intrastate transportation and storage Interstate transportation and storage Midstream Liquids transportation and services Investment in Sunoco Logistics Retail... -

Page 233

... Interstate transportation and storage Midstream Liquids transportation and services Investment in Sunoco Logistics Retail marketing All other Total Segment Adjusted EBITDA Depreciation, depletion and amortization Interest expense, net of interest capitalized Gain on sale of AmeriGas common units... -

Page 234