Dell 1998 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.model, utilizing the following assumptions:

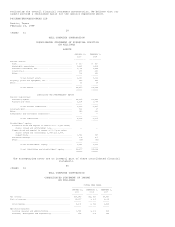

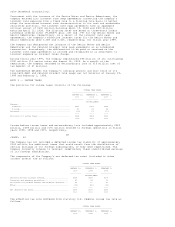

FISCAL YEAR ENDED

--------------------------------------------------------

JANUARY 29, 1999 FEBRUARY 1, 1998 FEBRUARY 2, 1997

---------------- ---------------- ----------------

Expected term:

Stock options............................ 5 years 5 years 5 years

Employee stock purchase plan............. 6 months 6 months 6 months

Interest rate.............................. 5.42% 6.28% 6.40%

Volatility................................. 52.12% 54.92% 56.54%

Dividends.................................. 0% 0% 0%

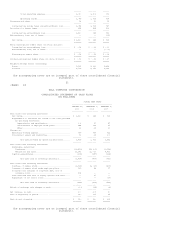

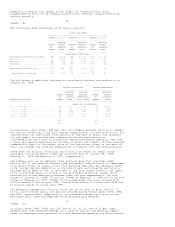

Had the Company accounted for its incentive plan and employee stock purchase

plan by recording compensation expense based on the fair value at the grant date

on a straight-line basis over the vesting period, stock-based compensation costs

would have reduced pretax income by $194 million ($136 million, net of taxes),

$100 million ($69 million, net of taxes) and $22 million ($16 million, net of

taxes) in fiscal years 1999, 1998 and 1997, respectively. The pro forma effect

on diluted earnings per common share would have been a reduction of $0.05, $0.02

and $0.01 for fiscal years 1999, 1998 and 1997, respectively. The pro forma

effect on basic earnings per common share would have been a reduction of $0.05,

$0.03 and $0.01 for fiscal years 1999, 1998 and 1997, respectively.

401(k) Plan -- The Company has a defined contribution retirement plan that

complies with Section 401(k) of the Internal Revenue Code. Substantially all

employees in the U.S. are eligible to participate in the plan. The Company

matches 100% of each participant's voluntary contributions, subject to a maximum

Company contribution of 3% of the participant's compensation. The Company's

contributions during fiscal years 1999, 1998 and 1997 were $21 million, $20

million and $13 million, respectively.

NOTE 8 -- PREFERRED SHARE PURCHASE RIGHTS

On November 29, 1995, the Board of Directors declared a dividend of one

Preferred Share Purchase Right (a "Right") for each outstanding share of common

stock. The distribution of the Rights was made on December 13, 1995, to the

stockholders of record on that date. Each Right entitles the holder to purchase

one thirty-two thousandth of a share of Junior Preferred Stock at an exercise

price of $225 per one-thousandth of a share.

If a person or group acquires 15% or more of the outstanding common stock, each

Right will entitle the holder (other than such person or any member of such

group) to purchase, at the Right's then current exercise price, the number of

shares of common stock having a market value of twice the exercise price of the

Right. If exercisable, the Rights contain provisions relating to merger or other

business combinations. In certain circumstances, the Board of Directors may, at

its option, exchange part or all of the Rights (other than Rights held by the

acquiring person or group) for shares of common stock at an exchange rate of one

share of common stock for each Right.

The Company will be entitled to redeem the Rights at $.001 per Right at any time

before a 15% or greater position has been acquired by any person or group.

Additionally, the Company may lower the 15% threshold to not less than the

greater of (a) any percentage greater than the largest percentage of common

stock known by the Company to be owned by any person (other than Michael S.

Dell) or (b) 10%. The Rights expire on November 29, 2005.

Neither the ownership nor the further acquisition of common stock by Michael S.

Dell will cause the Rights to become exercisable or nonredeemable or will

trigger the other features of the Rights.

42

<PAGE> 44

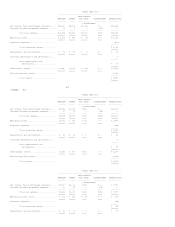

NOTE 9 -- COMMITMENTS, CONTINGENCIES AND CERTAIN CONCENTRATIONS

Lease Commitments -- The Company maintains master lease facilities providing the

capacity to fund up to $820 million. The combined facilities provide for the

ability of the Company to lease certain real property, buildings and equipment

(collectively referred to as the "Properties") to be constructed or acquired.

Rent obligations for the Properties commence on various dates. At January 29,

1999, $222 million of the combined facilities had been utilized.

The leases have initial terms of five years with an option to renew for two

successive years, subject to certain conditions. The Company may, at its option,

purchase the Properties during or at the end of the lease term for 100% of the

then outstanding amounts expended by the lessor to complete the Properties. If

the Company does not exercise the purchase option, the Company will guarantee a

residual value of the Properties as determined by the agreement (approximately

$189 million and $36 million at January 29, 1999 and February 1, 1998,

respectively).

The Company leases other property and equipment, manufacturing facilities and

office space under non-cancelable leases. Certain leases obligate the Company to