Dell 1998 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SALES OF UNREGISTERED SECURITIES

The Company has an active stock repurchase program, which is more fully

described in Note 6 of Notes to Consolidated Financial Statements included in

"Item 8 -- Financial Statements and Supplementary Data." One element of such

program is the sale of put obligations. During fiscal year 1999, the Company

sold 200,000 put obligations to a financial institution and received proceeds of

$1.5 million in connection with such sale. The put obligations entitle each

holder to sell to the Company, by physical delivery, cash delivery or net-share

settlement, at the Company's option, one share of common stock at a specified

price. The put obligations expire on January 7, 2000 and have an exercise price

of $40 per share. The transaction was exempt from registration under Section

4(2) of the Securities Act of 1933, as amended. The transaction was privately

negotiated and the purchaser of the put options was an accredited investor and

qualified institutional buyer. No public offering or public solicitation was

made by the Company in the placement of these securities.

18

<PAGE> 20

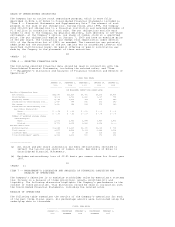

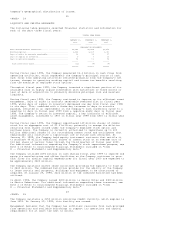

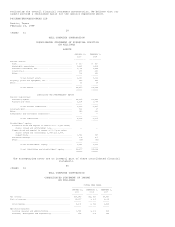

ITEM 6 -- SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with the

Consolidated Financial Statements, including the related notes, and "Item

7 -- Management's Discussion and Analysis of Financial Condition and Results of

Operations."

FISCAL YEAR ENDED

-------------------------------------------------------------------

JANUARY 29, FEBRUARY 1, FEBRUARY 2, JANUARY 28, JANUARY 29,

1999 1998 1997 1996 1995

----------- ----------- ----------- ----------- -----------

(IN MILLIONS, EXCEPT PER SHARE DATA)

Results of Operations Data:

Net revenue........................ $18,243 $12,327 $7,759 $5,296 $3,475

Gross margin....................... 4,106 2,722 1,666 1,067 738

Operating income................... 2,046 1,316 714 377 249

Income before extraordinary loss... 1,460 944 531 272 149

Net income......................... 1,460 944 518 272 149

Income before extraordinary loss

per common share(a)(b):

Basic......................... $ 0.58 $ 0.36 $ 0.19 $ 0.09 $ 0.06

Diluted....................... $ 0.53 $ 0.32 $ 0.17 $ 0.08 $ 0.05

Number of weighted average shares

outstanding(a):

Basic......................... 2,531 2,631 2,838 2,863 2,473

Diluted....................... 2,772 2,952 3,126 3,158 3,000

Balance Sheet Data:

Working capital.................... $ 2,644 $ 1,215 $1,089 $1,018 $ 718

Total assets....................... 6,877 4,268 2,993 2,148 1,594

Long-term debt..................... 512 17 18 113 113

Total stockholders' equity......... 2,321 1,293 806 973 652

---------------

(a) All share and per share information has been retroactively restated to

reflect the two-for-one splits of common stock. See Note 6 of Notes to

Consolidated Financial Statements.

(b) Excludes extraordinary loss of $0.01 basic per common share for fiscal year

1997.

19

<PAGE> 21

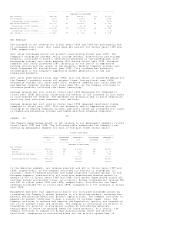

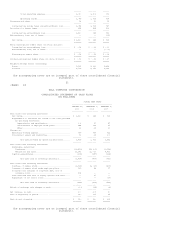

ITEM 7 -- MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The Company's objective is to maximize stockholder value by executing a strategy

that focuses on a balance of three priorities: growth, profitability and

liquidity. The following discussion highlights the Company's performance in the

context of these priorities. This discussion should be read in conjunction with

the Consolidated Financial Statements, including the related notes.

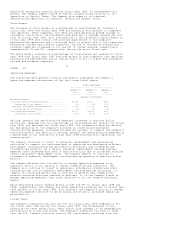

RESULTS OF OPERATIONS

The following table summarizes the results of the Company's operations for each

of the past three fiscal years. All percentage amounts were calculated using the

underlying data in thousands.

FISCAL YEAR ENDED

-----------------------------------------------------------------

JANUARY 29, PERCENTAGE FEBRUARY 1, PERCENTAGE FEBRUARY 2,

1999 INCREASE 1998 INCREASE 1997