Dell 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes -- The provision for income taxes is based on income before taxes

as reported in the accompanying consolidated statement of income. Deferred tax

assets and liabilities are determined based on the difference between the

financial statement and tax basis of assets and liabilities using enacted tax

rates in effect for the year in which the differences are expected to reverse.

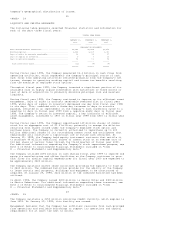

Earnings Per Common Share -- Basic earnings per share is based on the weighted

effect of all common shares issued and outstanding, and is calculated by

dividing net income by the weighted average shares outstanding during the

period. Diluted earnings per share is calculated by dividing net income by the

weighted average number of common shares used in the basic earnings per share

calculation plus the number of common shares that would be issued assuming

conversion of

35

<PAGE> 37

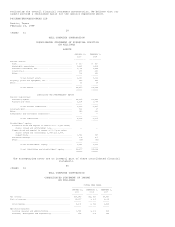

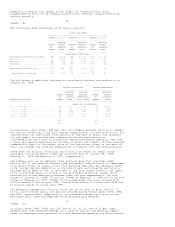

all potentially dilutive common shares outstanding. The following table sets

forth the computation of basic and diluted earnings per share for each of the

past three fiscal years:

FISCAL YEAR ENDED

---------------------------------------

JANUARY 29, FEBRUARY 1, FEBRUARY 2,

1999 1998 1997

----------- ----------- -----------

(IN MILLIONS, EXCEPT PER SHARE DATA)

Net income................................................ $1,460 $ 944 $ 518

Weighted average shares outstanding:

Basic................................................... 2,531 2,631 2,838

Employee stock options and other........................ 241 321 288

------ ------ ------

Diluted................................................. 2,772 2,952 3,126

====== ====== ======

Earnings per common share(a):

Basic................................................... $ 0.58 $ 0.36 $ 0.18

Diluted................................................. $ 0.53 $ 0.32 $ 0.17

---------------

(a) Includes extraordinary loss of $0.01 basic per common share for fiscal year

1997.

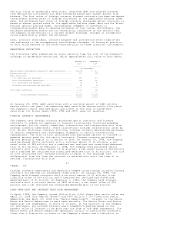

Comprehensive Income -- The Company adopted Statement of Financial Accounting

Standards ("SFAS") No. 130, "Reporting Comprehensive Income," in the fiscal year

ended January 29, 1999. The Company's comprehensive income is comprised of net

income, foreign currency translation adjustments and unrealized gains and losses

on marketable securities held as available-for-sale investments. Comprehensive

income of $1,459 million, $923 million and $517 million, respectively, for

fiscal years 1999, 1998 and 1997, was not materially different from reported net

income.

Segment Information -- The Company adopted SFAS No. 131, "Disclosures about

Segments of an Enterprise and Related Information," in the fiscal year ended

January 29, 1999. SFAS No. 131 supersedes SFAS No. 14, "Financial Reporting for

Segments of a Business Enterprise," replacing the "industry segment" approach

with the "management" approach. The management approach designates the internal

organization that is used by management for making operating decisions and

assessing performance as the source of the Company's reportable segments. SFAS

No. 131 also requires disclosures about products and services, geographic areas

and major customers. The adoption of SFAS No. 131 did not affect the Company's

results of operations or financial position, but did affect the disclosure of

segment information as illustrated in Note 11.

Recently Issued Accounting Pronouncement -- In June 1998, the Financial

Accounting Standards Board ("FASB") issued SFAS No. 133, "Accounting for

Derivative Instruments and Hedging Activities," which establishes accounting and

reporting standards for derivative instruments and hedging activities. SFAS No.

133 requires that an entity recognize all derivatives as either assets or

liabilities in the statement of financial position and measure those instruments

at fair value. SFAS No. 133 is effective for all fiscal quarters of fiscal years

beginning after June 15, 1999. The Company is assessing the impact of SFAS No.

133 on its consolidated financial statements.

Reclassifications -- Certain prior year amounts have been reclassified to

conform to the fiscal year 1999 presentation.

36

<PAGE> 38

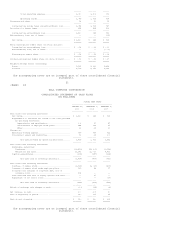

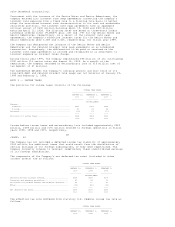

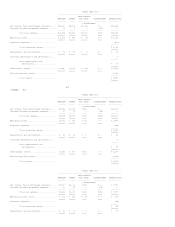

NOTE 2 -- FINANCIAL INSTRUMENTS

DISCLOSURES ABOUT FAIR VALUES OF FINANCIAL INSTRUMENTS