Dell 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The fair value of marketable securities, long-term debt and related interest

rate derivative instruments has been estimated based upon market quotes from

brokers. The fair value of foreign currency forward contracts has been estimated

using market quoted rates of foreign currencies at the applicable balance sheet

date. The estimated fair value of foreign currency purchased option contracts is

based on market quoted rates at the applicable balance sheet date and the Black-

Scholes options pricing model. Considerable judgment is necessary in

interpreting market data to develop estimates of fair value. Accordingly, the

estimates presented herein are not necessarily indicative of the amounts that

the Company could realize in a current market exchange. Changes in assumptions

could significantly affect the estimates.

Cash, accounts receivable, accounts payable and accrued and other liabilities

are reflected in the accompanying consolidated statement of financial position

at fair value because of the short-term maturity of these financial instruments.

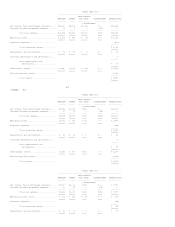

MARKETABLE SECURITIES

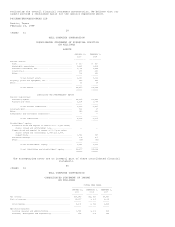

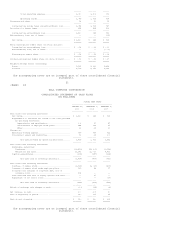

The following table summarizes by major security type the cost of the Company's

holdings of marketable securities, which approximates fair value on both dates.

JANUARY 29, FEBRUARY 1,

1999 1998

----------- -----------

(IN MILLIONS)

Mutual funds, principally invested in debt securities....... $1,298 $ 800

Preferred stock............................................. 270 172

Debt securities:

U.S. corporate and bank debt.............................. 689 307

State and municipal securities............................ 328 190

U.S. government and agencies.............................. 33 40

International corporate and bank debt..................... 43 15

------ ------

Total debt securities....................................... 1,093 552

------ ------

Total marketable securities....................... $2,661 $1,524

====== ======

At January 29, 1999, debt securities with a carrying amount of $831 million

mature within one year; the remaining debt securities mature within five years.

The Company's gross realized gains and losses on the sale of marketable

securities for fiscal years 1999, 1998 and 1997, were not material.

FOREIGN CURRENCY INSTRUMENTS

The Company uses foreign currency purchased option contracts and forward

contracts to reduce its exposure to currency fluctuations involving probable

anticipated, but not firmly committed, transactions and transactions with firm

foreign currency commitments. These transactions include international sales by

U.S. dollar functional currency entities, foreign currency denominated purchases

of certain components and intercompany shipments to certain international

subsidiaries. The risk of loss associated with purchased options is limited to

premium amounts paid for the option contracts. Foreign currency purchased

options generally expire in 12 months or less. At January 29, 1999, the Company

held purchased option contracts with a notional amount of $1 billion, a net

asset value of $48 million and a combined net realized and unrealized deferred

loss of $21 million. At February 1, 1998, the Company held purchased option

contracts with a notional amount of $2 billion, a net asset value of $69 million

and a combined net realized and unrealized deferred loss of $2 million. The risk

of loss associated with forward contracts is equal to the exchange rate

differential from the time the contract is entered into until the time it is

settled. Transactions with firm

37

<PAGE> 39

foreign currency commitments are generally hedged using foreign currency forward

contracts for periods not exceeding three months. At January 29, 1999, the

Company held forward contracts with a notional amount of $1 billion, a net

liability value of $24 million and a combined net realized and unrealized

deferred gain of $1 million. At February 1, 1998, the Company held forward

contracts with a notional amount of $800 million, a net asset value of $26

million and a net realized and unrealized deferred gain of $10 million.

LONG-TERM DEBT AND INTEREST RATE RISK MANAGEMENT

In April 1998, the Company issued $200 million 6.55% fixed rate senior notes due

April 15, 2008 (the "Senior Notes") and $300 million 7.10% fixed rate senior

debentures due April 15, 2028 (the "Senior Debentures"). Interest on the Senior

Notes and Senior Debentures is paid semi-annually. The Senior Notes and Senior

Debentures are redeemable, in whole or in part, at the election of the Company

for principal, any accrued interest and a redemption premium based on the

present value of interest to be paid over the term of the debt agreements. The

Senior Notes and Senior Debentures generally contain no restrictive covenants,

other than a limitation on liens on the Company's assets and a limitation on