Comfort Inn 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

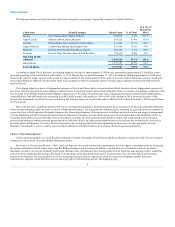

The lodging industry can be divided into chain scale categories or groupings of generally competitive brands as follows:

Luxury

Four Seasons, Ritz Carlton, W Hotel

108,077

2.2%

337.7

Upper Upscale

Marriott, Hilton, Hyatt, Sheraton

568,525

11.4%

359.4

Upscale

Hilton Garden Inn, Courtyard, Cambria Suites

631,245

12.7%

152.1

Upper Midscale

Comfort Inn, Holiday Inn, Hampton Inn

876,164

17.6%

97.9

Midscale

Quality, Best Western, Ramada, La Quinta

483,144

9.7%

85.6

Economy

Econo Lodge, Days Inn, Super 8, Red Roof Inn

774,363

15.6%

75.9

Independents

1,537,187

30.9%

68.1

According to Smith Travel Research, the lodging industry consisted of approximately 53,000 hotels representing approximately 5.0 million rooms

open and operating in the United States at December 31, 2014. During the year ended December 31, 2014, the industry added approximately 63,000 gross

rooms to the industry supply and net room growth was approximately 0.8%. Approximately, 49% of the new rooms opened during the year were positioned

in the Upper Midscale, Midscale and Economy chain scale segments in which we primarily operate. Overall, annual industry room growth remains below

historical levels.

The lodging industry consists of independent operators of hotels and those that have joined national hotel franchise chains. Independent operators of

hotels not owned or managed by major lodging companies have increasingly joined national hotel franchise chains as a means of remaining competitive with

hotels owned by or affiliated with national lodging companies. Over the years, the industry has seen a significant movement of hotels from independent to

chain affiliation, with affiliated hotels increasing from 46% of the rooms in the market in 1990 to 69% of the market in 2014. However, the pace of this

increase has moderated over the last several years and in 2014 the percentage of rooms in the market affiliated with a chain increased by 20 basis points from

68.9% to 69.1%.

Due to the fact that a significant portion of the costs of owning and operating a hotel are generally fixed, increases in revenues generated by affiliation

with a franchise lodging chain can improve a hotel’s financial performance. The large franchise lodging chains, including us, generally provide a number of

support services to hotel operators designed to improve the financial performance of their properties including central reservation and property management

systems, marketing and advertising programs, training and education programs, revenue enhancement services and relationships with qualified vendors to

streamline purchasing processes and make lower cost products available. We believe that national franchise chains with a large number of hotels enjoy

greater brand awareness among potential guests than those with fewer hotels, and that greater brand awareness can increase the desirability of a hotel to its

potential guests. Furthermore, we believe that hotel operators choose lodging franchisors based primarily on the perceived value and quality of each

franchisor’s brand and its services, and the extent to which affiliation with that franchisor may increase the hotel operator profitability.

Choice’s Franchising Business

Choice operates primarily as a hotel franchisor offering 11 brands. This family of well-known and diversified new construction and conversion brands

competes at various hotel consumer and developer price points.

Economics of Franchising Business. The fee and cost structure of our business provides opportunities for us to improve operating results by increasing

the number of franchised hotel rooms, improving RevPAR performance and increasing the effective royalty rates of our franchise contracts. As a hotel

franchisor, we derive our revenue primarily from various franchise fees. Our franchise fees consist primarily of an initial fee and ongoing royalty, marketing

and reservation system fees that are typically based on a percentage of the franchised hotel’s gross room revenues. The initial fee and on-going royalty

portion of the franchise fees are intended to cover our operating expenses, such as expenses incurred in business development, quality assurance,

administrative support, certain franchise services and to provide us with operating profits. The marketing and

8