Comfort Inn 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

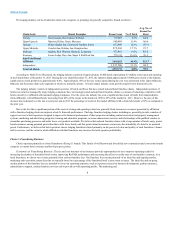

The following table presents key worldwide system size statistics as of and for the year ended December 31, 2013:

Comfort 1,824

141,220

120

9,528

55

(37)

(80)

Comfort

Suites 604

47,375

55

4,187

15

(2)

(21)

Quality 1,595

139,703

71

5,724

122

36

(81)

Ascend Hotel

Collection 123

12,196

22

1,894

53

4

(6)

Clarion 321

44,888

22

2,479

32

(3)

(28)

Sleep Inn 391

28,518

55

3,579

13

(5)

(13)

MainStay

Suites 45

3,549

36

2,491

2

—

—

Econo Lodge 914

54,434

32

1,860

65

3

(53)

Rodeway Inn 441

24,800

39

1,748

55

6

(33)

Suburban 64

7,256

26

2,224

3

(2)

(2)

Cambria

Suites 18

2,119

25

3,243

1

—

(2)

Totals 6,340

506,058

503

38,957

416

—

(319)

Franchise Sales

Brand growth is important to our business model. We have identified key market areas for hotel development based on supply/demand relationships

and our strategic objectives. Development opportunities are typically offered to: (i) existing franchisees; (ii) developers of hotels; (iii) owners of independent

hotels and motels; (iv) owners of hotels leaving other franchisors’ brands; and, (v) franchisees of non-hotel related products such as restaurants.

Our franchise sales organization is structured to support the Company’s efforts to leverage its core strengths in order to take advantage of opportunities

for further growth. The franchise sales organization employs both sales managers as well as franchise sales directors. This organization emphasizes the

benefits of affiliating with the Choice system, our commitment to improving hotel profitability, our central reservation delivery services, our marketing and

customer loyalty programs, our training and support systems (including our proprietary property management systems) and our Company’s track record of

growth and profitability to potential franchisees. Franchise sales directors are assigned to specific brands to leverage their brand expertise to enhance product

consistency and deal flow. Our sales managers ensure each prospective hotel is placed in the appropriate brand, facilitate teamwork and information sharing

amongst the sales directors and provide better service to our potential franchisees. The structure of this organization supports the Company’s efforts to leverage

its core strengths in order to take advantage of opportunities for further growth. Integrating our brands and strategies allow our brand teams to focus on

understanding, anticipating and meeting the unique needs of our customers.

Our objective is to continue to grow our portfolio by continuing to sell our existing brands, creating extensions of our existing brands and introducing

new brands, either organically or via acquisition, within the various lodging chain categories. Based on market conditions and other circumstances, we may

offer certain incentives to developers to increase development of our brands such as discounting various fees such as the initial franchise fee and royalty rates

as well as provide financing for property improvements and other purposes.

Because retention of existing franchisees is important to our growth strategy, we have a formal impact policy. This policy offers existing franchisees

protection from the opening of a same-brand property within a specified distance, depending upon the market in which the property is located.

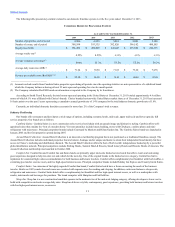

Investment, Financing and Guaranty Franchisee Support

Our board of directors authorized a program which permits us to offer financing, investment, and guaranty support to qualified franchisees as well as

allows us to acquire and resell real estate to incent franchise development for certain brands in strategic markets. We expect to deploy capital pursuant to this

program opportunistically to promote growth of our emerging brands. The amount and timing of the investment in this program will be dependent on market

and other conditions. Our current expectation is that our annual investment in this program will range from $20 million to $40 million per year and we

generally expect to recycle these investments within a five year period. However, our actual investment in this program will be dependent on market and other

conditions.

18