Comfort Inn 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company expects to continue to return value to its shareholders through a combination of share

repurchases and dividends. Market conditions and our financial performance will dictate the amounts and

allocation between these vehicles.

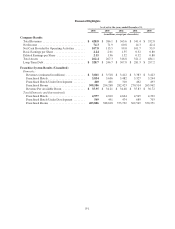

The following table summarizes our contractual obligations as of December 31, 2004

Payment due by period

Contractual Obligations Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

(in millions)

Long-term debt (1) .................................. $352.5 $17.3 $14.6 $320.6 $ —

Operating lease obligations ........................... 43.0 10.8 10.3 7.8 14.1

Purchase obligations ................................ 2.2 2.2 — — —

Other long-term liabilities ............................ 38.8 — 19.1 2.0 17.7

Total contractual cash obligations ...................... $436.5 $30.3 $44.0 $330.4 $31.8

(1) Long-term debt amounts include interest on fixed rate debt obligations.

The Company believes that cash flows from operations and available financing capacity are adequate to

meet expected future operating, investing and financing needs of the business.

Off Balance Sheet Arrangements: The Company has a $3.0 million letter of credit issued as support for

construction and permanent financing of a franchisee’s Sleep Inn and Mainstay Suites located in Atlanta,

Georgia. No amounts were drawn against this letter of credit as of December 31, 2004. The letter of credit

expires in April 2005.

Inflation:Inflation has been moderate in recent years and has not had a significant impact on our business.

Critical Accounting Policies

Our accounting policies comply with principles generally accepted in the United States. We have described

below those policies that we believe are critical and require the use of complex judgment or significant estimates

in their application. Additional discussion of these policies is included in Note 1 to our consolidated financial

statements.

Revenue Recognition.

We recognize continuing franchise fees, including royalty, marketing and reservations fees, when earned

and receivable from our franchisees. Franchise fees are typically based on a percentage of gross room revenues

of each franchisee. Our estimate of the allowance for uncollectible royalty fees is charged to selling, general and

administrative expense.

Initial franchise and relicensing fees are recognized, in most instances, in the period the related franchise

agreement is executed because the initial franchise fee is non-refundable and the Company has no continuing

obligations related to the franchisee. We defer the initial franchise fee revenue related to franchise agreements

which include incentives until the incentive criteria are met or the agreement is terminated, whichever occurs first.

We account for partner services revenues from endorsed vendors in accordance with Staff Accounting

Bulletin No. 104, (“SAB 104”) “Revenue Recognition.” SAB 104 provides guidance on the recognition,

presentation and disclosure of revenue in financial statements. Pursuant to SAB 104, the Company recognizes

partner services revenues when the services are performed or the product delivered, evidence of an arrangement

F-11