Comfort Inn 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Growing Brands, Growing Stronger.

2004 Annual Report

Table of contents

-

Page 1

Growing Brands, Growing Stronger. 2004 Annual Report -

Page 2

... Inn, Comfort Suites, Quality, Sleep Inn, Clarion, MainStay Suites, Econo Lodge and Rodeway Inn brand names. To that family of nearly 5,000 hotels in more than 40 countries and territories, we welcome a new member, Cambria Suites, to help continue our company's proud heritage of superior franchise... -

Page 3

... build greater guest loyalty. I am very pleased to report that we made significant progress in each of these key areas in 2004. New domestic hotel franchise contracts were up 17% in 2004 to a record 552, while we also exceeded the 400,000 rooms open worldwide mark. For the year, Choice Hotels earned... -

Page 4

... airport and destination leisure business. At the same time, we are giving more than 1,400 Comfort Inn hotels a new look to compete more effectively for the mid-scale traveler. We are working with Comfort Inn owners to implement new brand amenities and standards that will support the promise offered... -

Page 5

... Suites and the re-imaging of Comfort Inn are two solid examples of how we are addressing this issue. System growth: We continue to build our sales capability through experienced, dedicated sales forces to support each brand. Our success in recent years in driving more rapid franchise development... -

Page 6

... Choice's 10th airline partner, allowing Aeroplan members to earn Aeroplan Miles when staying at any of Choice's properties. • The Comfort Inn brand introduces its re-imaged logo at Fall Regional Meetings (held in Ocean City, Md., Atlanta, Las Vegas and Chicago), revealing a vibrant new design... -

Page 7

...'s Discussion and Analysis of Financial Condition and Results of Operation ...Management's Report on Internal Control Over Financial Reporting ...F-1 F-2 F-14 Report of Independent Registered Public Accounting Firm ...F-15 Consolidated Financial Statements ...Notes to Consolidated Financial... -

Page 8

-

Page 9

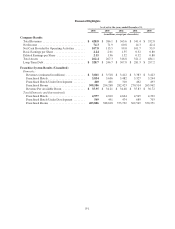

... 2004 As of or for the years ended December 31, 2003 2002 2001 (in millions, except per share data) 2000 Company Results Total Revenues ...Net Income ...Net Cash Provided by Operating Activities ...Basic Earnings per Share ...Diluted Earnings per Share ...Total Assets ...Long-Term Debt ...Franchise... -

Page 10

...of products and services designed to increase business delivery to and/or reduce operating and development costs for our franchisees. These products and services include national marketing campaigns, a central reservation system, property and yield management systems, quality assurance standards and... -

Page 11

...effective royalty rate achieved; and our ability to manage costs. The number of rooms at franchised properties and occupancy and room rates at those properties significantly affect the Company's results because our fees are based upon room revenues at franchised hotels. The key industry standard for... -

Page 12

... benefit plan assets. Summarized financial results for the years ended December 31, 2004 and 2003 are as follows: 2004 2003 (In thousands) REVENUES: Royalty fees ...Initial franchise and relicensing fees ...Partner services ...Marketing and reservation ...Hotel operations ...Other ...Total revenues... -

Page 13

...management personnel, costs related to retirement of a board member, adoption of the fair value method of accounting for stock compensation and increased professional fees related to Sarbanes-Oxley compliance efforts. Marketing and Reservations: The Company's franchise agreements require the payment... -

Page 14

... of investment income attributable to non-qualified employee benefit plan assets. Income Taxes: The Company's effective income tax provision rate was 35.08% for the year ended December 31, 2004, a decrease of 99 basis points from the effective income tax provision rate of 36.07% for the year... -

Page 15

... results for the years ended December 31, 2003 and 2002 are as follows: 2003 2002 (In thousands) REVENUES: Royalty fees ...Initial franchise and relicensing fees ...Partner services ...Marketing and reservation ...Hotel operations ...Other ...Total revenues ...OPERATING EXPENSES: Selling, general... -

Page 16

...of the fair value method of accounting for stock options, performance based incentive compensation for sales and other management personnel, retirement plan costs and the consolidation of Flag Choice Hotels upon acquisition of a controlling interest on July 1, 2002. Marketing and Reservations: Total... -

Page 17

...years ended December 31, 2004 and 2003, respectively. The decrease is attributable to higher payments related to income taxes and lower cash flow from marketing and reservation activities partially offset by improvements in operating results. During 2002 and 2001, the Company realigned its corporate... -

Page 18

... of the Company and the loan type. The Old Credit Facility required the Company to pay annual fees ranging, based upon the credit rating of the Company, between 1/15 of 1% to 1/2 of 1% of the aggregate available commitment under the revolving credit facility. In July 2004, the Company entered into... -

Page 19

... policies is included in Note 1 to our consolidated financial statements. Revenue Recognition. We recognize continuing franchise fees, including royalty, marketing and reservations fees, when earned and receivable from our franchisees. Franchise fees are typically based on a percentage of gross room... -

Page 20

... in affiliated partners' programs, such as those offered by credit card companies. The points may be redeemed for free accommodations or other benefits. Points cannot be redeemed for cash. The Company collects a percentage of program members' room revenue from participating franchises. Revenues are... -

Page 21

.... 25, "Accounting for Stock Issued to Employees," and all stock options granted in those years had an exercise price equal to the market value of the underlying common stock on the date of grant. The effect on net income and earnings per share as if the Company had applied the fair value recognition... -

Page 22

...business strategies and their intended results; the balance between supply of and demand for hotel rooms; our ability to obtain new franchise agreements; our ability to develop and maintain positive relations with current and potential hotel owners; the effect of international, national and regional... -

Page 23

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Choice Hotels International, Inc. and subsidiaries: We have completed an integrated audit of Choice Hotels International, Inc. and subsidiaries' 2004 consolidated financial statements and of its ... -

Page 24

... with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized... -

Page 25

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Years Ended December 31, 2004 2003 2002 (In thousands, except per share amounts) REVENUES: Royalty fees ...Initial franchise and relicensing fees ...Partner services ...Marketing and reservation ...Hotel operations... -

Page 26

... cash equivalents ...Receivables (net of allowance for doubtful accounts of $5,956 and $6,743, respectively) ...Deferred income taxes ...Other current assets ...Total current assets ...Property and equipment, at cost, net ...Goodwill ...Franchise rights, net ...Receivable-marketing and reservation... -

Page 27

... information: Cash payments during the year for: Income taxes, net of refunds ...Interest ...Non-cash investing activities: Conversion of note receivable into Flag equity interest ...Non-cash financing activities: Declaration of dividends ...Non-cash financing activities related to employee stock... -

Page 28

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' DEFICIT AND COMPREHENSIVE INCOME (In thousands, except share amounts) Common Common Accumulated Stock Stock - Additional Other Shares Par Paid-in- Comprehensive Deferred Treasury Comprehensive Retained ... -

Page 29

... business of hotel franchising. As of December 31, 2004, the Company had franchise agreements representing 4,977 open hotels and 569 hotels under development in 49 states and more than 40 countries and territories outside the United States under the brand names: Comfort Inn, Comfort Suites, Quality... -

Page 30

... partners' programs, such as those offered by credit card companies. The points, which we accumulate and track on the members' behalf, may be redeemed for free accommodations, airline frequent flier program miles or other benefits. Points cannot be redeemed for cash. We provide Choice Privileges... -

Page 31

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) Advertising Costs. The Company expenses advertising costs as the advertising occurs in accordance with American Institute of Certified Public Accountants, Statement of Position 93-7, "Reporting ... -

Page 32

.... 25, "Accounting for Stock Issued to Employees," and related interpretations. No stock-based employee compensation cost is reflected in 2002 or prior years' net income related to the grant of stock options, as all options granted under those plans had an exercise price equal to the market value of... -

Page 33

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) Therefore, the cost related to stock-based employee compensation included in the determination of net income for each of the three years ended December 31, 2004 is less than that which would ... -

Page 34

... foreign corporations. In December 2004, the Financial Accounting Standards Board ("FASB") issued a FASB Staff Position ("FSP") regarding "Accounting and Disclosure Guidance for the Foreign Earnings Repatriation Provision within the AJCA" ("FSP 109-2"). FSP 109-2 allows the Company time beyond... -

Page 35

... SFAS No. 142, the Company is not required to amortize goodwill. Franchise rights represent the unamortized purchase price assigned to acquire long-term franchise contracts. As of December 31, 2004 and 2003, the unamortized balance relates primarily to the Econo Lodge and Flag franchise rights. The... -

Page 36

... to pay for the marketing and reservation services the Company has procured for the benefit of the franchise system, including fees to reimburse the Company for past services rendered. The Company has the contractual authority to require that the franchisees in the system at any given point repay... -

Page 37

... statements of income. Of this $5.3 million, $5.1 million related to severance and termination benefits for 64 employees (consisting of brand management and new hotels support, reservation sales and administrative personnel and franchise sales and operations support) and $0.2 million relates... -

Page 38

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) 8. Accrued Expenses and Other Accrued expenses and other consisted of the following at: December 31, 2004 2003 (In thousands) Deferred loyalty program revenue ...Accrued salaries and benefits ... -

Page 39

..., at one of several rates, at the option of the Company, including LIBOR plus 0.60% to 2.0%, based upon the credit rating of the Company and the loan type. The Old Credit Facility required the Company to pay annual fees ranging, based upon the credit rating of the Company, between 1/15 of 1% to... -

Page 40

... agreement with a third party that included the right to franchise the Choice brands in New Zealand was terminated. At that time, Flag obtained the rights to the Choice brands in New Zealand. Pursuant to the Flag Transaction, the Company converted an existing $1.1 million convertible note due from... -

Page 41

..., including royalty, marketing, reservation fees and other franchise revenues from CHC. 11. Pension, Profit Sharing, and Incentive Plans The Company sponsors a 401(k) retirement plan for all eligible employees. For the years ended December 31, 2004, 2003 and 2002, the Company recorded compensation... -

Page 42

... ...Service cost ...Interest cost ...Amendments ...Actuarial (gain)/loss ...Projected benefit obligation, ending ... $3,283 416 205 121 340 $4,365 $1,980 259 139 - 905 $3,283 The Company sponsors two non-qualified retirement savings and investment plans for certain employees and senior executives... -

Page 43

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) 12. Income Taxes Income before income taxes was derived from the following: Years ended December 31, 2004 2003 2002 (In thousands) Income before income taxes: Domestic operations ...Foreign ... -

Page 44

... $22.3 million. The related potential range of income tax is between zero and $1.2 million. A reconciliation of income tax expense at the statutory rate to income tax expense included in the accompanying consolidated statements of income follows: Years ended December 31, 2004 2003 2002 (In thousands... -

Page 45

... to officers, key employees and non-employee directors. Restricted Stock. The following table is a summary of activity related to restricted stock grants to non-employee directors and key employees for the year ended December 31, 2004 2003 2002 Restricted Shares Granted ...204,460 Weighted Average... -

Page 46

CHOICE HOTELS INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) Stock Options. A summary of the stock option activity under the Company's stock option plan is as follows as of December 31, 2004, 2003 and 2002: 2004 Weighted Average Exercise Price 2003 ... -

Page 47

... its holder, other than the acquiring person or group, to purchase common stock of either the Company or the acquirer having a value of twice the exercise price of the right. On February 14, 2005, the Company's board of directors voted to terminate this rights agreement. 15. Comprehensive Income The... -

Page 48

... and average market prices during the period. In 2002, the Company excluded 50,000 anti-dilutive options from the computation of diluted earnings per share. 17. Leases The Company enters into operating leases primarily for office space and computer equipment. Rental expense under non-cancelable... -

Page 49

... 18. Reportable Segment Information The Company has a single reportable segment encompassing its franchising business. Revenues from the franchising business include royalty fees, initial franchise and relicensing fees, marketing and reservation fees, partner services revenue and other revenue. The... -

Page 50

...a Sleep Inn and a MainStay Suites located in Atlanta, Georgia. No amounts were drawn against this letter of credit as of December 31, 2004. The letter of credit expires in April 2005. In the ordinary course of business, the Company enters into numerous agreements that contain standard guarantees and... -

Page 51

... instruments issued. Effective, January 1, 2003, the Company adopted the fair value recognition provisions of SFAS No. 123, "Accounting for Stock-Based Compensation," for all employee awards granted, modified, or settled after January 1, 2003. SFAS No. 123R will require the Company to apply fair... -

Page 52

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 53

-

Page 54

-

Page 55

..., University of Virginia Darden Graduate School of Business Director: OnLine Resources Corporation Select Comfort Corporation Gordon A. Smith President, Consumer Card Services Group American Express Travel Related Services, Inc. William L. Jews* President and Chief Executive Officer CareFirst... -

Page 56

10750 Columbia Pike Silver Spring, MD 20901 www.choicehotels.com