Citrix 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Citrix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2014

The software-dened workplace

is enabling new ways to work better.

Citrix Systems, Inc. | Annual Report 2014

Table of contents

-

Page 1

Citrix Systems, Inc. | Annual Report 2014 The software-defined workplace is enabling new ways to work better. Annual Report 2014 -

Page 2

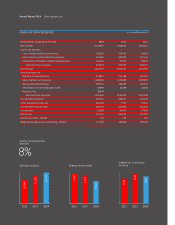

... share data) Net revenues Cost of net revenues: Cost of product and license revenues Cost of services and maintenance revenues Amortization of product related intangible assets Total cost of net revenues Gross margin Operating expenses: Research and development Sales, marketing and services General... -

Page 3

... of subscription revenue generated by service provider channels is ramping nicely - growing over 55% in 2014 to $45 million. Our non-GAAP gross margin declined to 85.0%, from 86.2% in the prior year, reflecting an acceleration of revenue mix from our Delivery Networking and SaaS-based Mobility Apps... -

Page 4

... clouds - accessible from any device or browser. • End-to-end information security innovations that eliminate the need for device management by leveraging our ability to encrypt, containerize and control any type of application or data. • Introduction of smart workplace technologies to get the... -

Page 5

.... We uniquely have the range of competencies, software assets, and offerings to lead in these areas. At the same time, we have the breadth of go-to-market partners, Citrix Ready ecosystem, and customer base to leverage them as growth engines. Strategy and Execution in 2015 We have a clear set of... -

Page 6

... contextual, and active on data at rest and in transit is essential in today's world, and is an essential aspect of our solutions. All of that is enabled with ultimate flexibility in terms of support for any device, any app and any cloud. While we have competitors that might compete on one of these... -

Page 7

... price of the registrant's Common Stock as of the last business day of the registrant's most recently completed second fiscal quarter (based on the last reported sale price on The Nasdaq Global Select Market as of such date) was $9,946,348,781. As of February 13, 2015 there were 159,825,741 shares... -

Page 8

... Schedules 69 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions and Director Independence Principal Accounting Fees and Services... -

Page 9

... people to work better. Citrix solutions power business mobility through secure, mobile workspaces that provide people with instant access to apps, desktops, data and communications on any device, over any network or cloud. We market and license our products directly to customers, over the Web, and... -

Page 10

...XenDesktop Enterprise and Platinum editions, customers also receive the industry-leading Citrix XenApp to manage and mobilize Windows applications. Citrix XenApp® is a widely deployed solution that allows Windows applications to be delivered as cloud services to Android and iOS mobile devices, Macs... -

Page 11

... Cloud products, adding a toll-free number to online sessions. ShareFile® is a secure, cloud-based file sharing and storage solution built for business. ShareFile enables business professionals to manage and share data securely and easily and solves the mobility and collaboration needs of users. It... -

Page 12

..., mobile devices and apps. GoToAssist's integrated toolset is built specifically for IT managers, consultants and managed service providers. License Updates and Maintenance We provide several ways for customers to receive upgrades, support and maintenance for products. • Subscription Advantage... -

Page 13

... one of the largest multicast overlay data networks in the world using the Internet. It provides proprietary screen-sharing technology that separately optimizes screen transmission for each endpoint device (such as a remote PC during an online meeting or remote access session). Citrix PSTN/VoIP... -

Page 14

... license usage. Our Mobility Apps products are accessed over the Internet for usage during the subscription period. Our hardware appliances come pre-loaded with software for which customers can purchase perpetual licenses and annual support and maintenance. Technology Relationships We have a number... -

Page 15

...services. In addition, our Mobility Apps division provides our collaboration and data sharing offerings through direct corporate sales, our partner community, and direct through our web sites. In 2014, we worked closely with partners to benefit from changes to our global partner program made in 2013... -

Page 16

... Services solutions, Delivery Networking products and related license updates and maintenance, support and professional services and from our Mobility Apps division's Communications Cloud, Documents Cloud and Workflow Cloud products. The Enterprise and Service Provider division and the Mobility Apps... -

Page 17

...and financial condition. See "-Technology Relationships" and Part I-Item 1A entitled "Risk Factors" included in this Annual Report on Form 10-K for the year ended December 31, 2014. Workspace Services Our Desktop and Application Virtualization products are based on an alternative technology platform... -

Page 18

...Internet startups. In addition, new remote access features in desktop operating systems like Microsoft Windows and Macintosh OSX provide alternatives to our solution. We endeavor to differentiate our products by continuing our focus on security, ease-of-use and support for multiple desktop operating... -

Page 19

..., knowledge and innovative skill of our management and technical personnel, our technology relationships, name recognition, the timeliness and quality of support services provided by us and our ability to rapidly develop, enhance and market software products could be more significant in maintaining... -

Page 20

... sales channels, our partners and other strategic or technology relationships, financial information and results of operations for future periods, product and price competition, strategy and growth initiatives, seasonal factors, natural disasters, stock-based compensation, licensing and subscription... -

Page 21

...for business-related computer appliances and software, which fluctuates based on numerous factors, including capital spending levels, the spending levels and growth of our current and prospective customers, and general economic conditions. Moreover, the purchase of our products and services is often... -

Page 22

...-market strategies and train our sales team and channel partners in order to effectively market offerings in product categories in which we have less experience than our competitors; we may not be able to develop effective pricing strategies for our new products and services; hardware, software and... -

Page 23

... delivery network, workspace services and mobility apps markets, these companies continue to seek to deliver comprehensive IT solutions to end users and combine enterprise-level hardware and software solutions that may compete with our virtualization, mobility and collaboration and data sharing... -

Page 24

...greater fees or taxes on Web-based services, such as collaboration and data sharing services and audio services, or restricting information exchange over the Web, could result in a decline in the use and adversely affect sales of our products and our results of operations. Our Mobility Apps products... -

Page 25

... affect our financial condition and operating results. The increasing user traffic and complexity of our Mobility Apps products, specifically those using Voice over Internet protocol and high-definition video conferencing features, and Delivery Networking products demands more computing power. We... -

Page 26

... our operating margins. Moreover, if our quarterly financial results or our predictions of future financial results fail to meet the expectations of securities analysts and investors, our stock price could be negatively affected. Sales and renewals of our license updates and maintenance products... -

Page 27

... condition. We are in the process of diversifying our base of channel relationships by adding and training more channel partners with abilities to reach larger enterprise customers and to sell our newer products and services. We are also in the process of building relationships with new types... -

Page 28

..., and our new initiatives may not generate sufficient revenue to recoup our investments in them. We may experience a decline in gross margin as the mix of our revenue may include more products with a hardware component and increased sales of our services, both of which have a higher cost than our... -

Page 29

... effect on our business, results of operations and financial condition. Further, our 2015 operating plan assumes a significant level of financial performance from our acquisitions that were completed during 2013 and 2014 and if these acquired companies or technologies do not perform as we expect... -

Page 30

... of reasons, including: • • the expansion of our product lines, such as our Workspace Services and Delivery Networking products, and related technical services and expansion of our Mobility Apps products, through product development and acquisitions; an increase in patent infringement litigation... -

Page 31

... works under the terms of the particular open source license. In addition to risks related to license requirements, usage of open source software can lead to greater risks than use of third-party commercial software, as open source licensors generally do not provide technology support, maintenance... -

Page 32

.... See "Management's Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies and Estimates" and Notes 12 and 13 to our consolidated financial statements included in this Annual Report on Form 10-K for the year ended December 31, 2014 for information... -

Page 33

... our reported or future financial results. In addition, under certain circumstances, convertible debt instruments (such as the Convertible Notes) that may be settled entirely or partly in cash are currently accounted for utilizing the treasury stock method, the effect of which is that the shares... -

Page 34

... not be able to take advantage of strategic opportunities, develop new products, respond to competitive pressures, repurchase outstanding stock or repay our outstanding indebtedness. In any such case, our business, operating results or financial condition could be adversely impacted. Our portfolios... -

Page 35

...,000 square feet of office space used for our corporate headquarters, approximately 40,000 square feet of office space in Goleta, California related to our Mobility Apps division, and 42,000 square feet of office space in EMEA related to our Enterprise and Service Provider division. We believe that... -

Page 36

... we willfully infringe the '011 patent through the sale and use of certain products. The jury awarded SSL Services $10.0 million. In September 2012, the court issued a final judgment confirming the jury award of $10.0 million in damages and added $5.0 million in enhanced damages and approximately... -

Page 37

... to repurchase common stock pursuant to the stock repurchase program. All shares repurchased are recorded as treasury stock. The following table shows the monthly activity related to our stock repurchase program for the quarter ended December 31, 2014. Total Number of Shares Purchased as Part of... -

Page 38

... Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations. Year Ended December 31, 2014 2013 2012 2011 (In thousands, except per share data) 2010 Consolidated Statements of Income Data: Net revenues Cost of net revenues(a) Gross margin Operating expenses Income... -

Page 39

... people to work better. Citrix solutions power business mobility through secure, mobile workspaces that provide people with instant access to apps, desktops, data and communications on any device, over any network or cloud. We market and license our products directly to customers, over the Web, and... -

Page 40

...On January 8, 2014, we acquired all of the issued and outstanding securities of Framehawk, Inc., or Framehawk. The Framehawk solution, which optimizes the delivery of virtual desktops and applications to mobile devices, was combined with HDX technology in the Citrix XenApp and XenDesktop products to... -

Page 41

... of operations prospectively from the date of each acquisition. 2013 Acquisitions Zenprise In January 2013, we acquired all of the issued and outstanding securities of Zenprise, a privately-held leader in mobile device management. Zenprise became part of our Enterprise and Service Provider division... -

Page 42

... licensing agreements to have occurred when the related products are shipped and the end-user has been electronically provided the software activation keys that allow the end-user to take immediate possession of the product. For hardware appliance sales, our standard delivery method is free... -

Page 43

...different sales channels and competitor pricing strategies. For our non-software transactions we allocate the arrangement consideration based on the relative selling price of the deliverables. For our hardware appliances we use ESP as our selling price. For our support and services, we generally use... -

Page 44

... from acquisitions and other third party agreements. We allocate the purchase price of acquired intangible assets acquired through third party agreements based on their estimated relative fair values. We allocate a portion of purchase price of acquired companies to the product related technology... -

Page 45

... revenues are derived from sales of our Enterprise and Service Provider division products, which include our Workspace Services solutions, Delivery Networking products and related license updates and maintenance and from sales of our Mobility Apps division's Communications Cloud, Documents Cloud and... -

Page 46

.... Changes that impact provision estimates include such items as jurisdictional interpretations on tax filing positions based on the results of tax audits and general tax authority rulings. Due to the evolving nature of tax rules combined with the large number of jurisdictions in which we operate... -

Page 47

... percentage of change from year-to-year (in thousands other than percentages): Year Ended December 31, 2014 2013 2012 2014 Compared to 2013 2013 Compared to 2012 Revenues: Product and licenses Software as a service License updates and maintenance Professional services Total net revenues Cost of net... -

Page 48

... by increased sales of maintenance and support contracts across all of our Enterprise and Service Provider division's products and an increase in sales and renewals of our Subscription Advantage product of $79.7 million. We currently are targeting that License updates and maintenance revenue will... -

Page 49

... are derived from sales of Enterprise and Service Provider division products which primarily include Workspace Services solutions, Delivery Networking products and related License updates and maintenance and Professional services and from our Mobility Apps division's Communications Cloud, Documents... -

Page 50

... of product related intangible assets. Cost of product and license revenues increased during 2014 when compared to 2013 and during 2013 when compared to 2012 primarily due to increased sales of our Delivery Networking products, as described above, many of which contain hardware components... -

Page 51

..., including stock-based compensation and employee-related costs, primarily related to increased headcount from strategic hiring and acquisitions. Sales, Marketing and Services Expenses Year Ended December 31, 2014 2013 2012 (In thousands) 2014 Compared to 2013 2013 Compared to 2012 Sales, marketing... -

Page 52

... the increase in General and administrative expense when comparing 2013 to 2012 is an increase in stock-based compensation expense of $10.7 million related to retention-focused stock-based awards granted to new and existing employees and assumed in connection with acquisitions. These increases were... -

Page 53

...Internal Revenue Service, or IRS, concluded its field examination of our 2009 and 2010 tax years and issued proposed adjustments primarily related to transfer pricing and the research and development tax credit. In June 2014, we finalized our tax deficiency calculations and formally closed the audit... -

Page 54

... of warrants of $101.8 million and the issuance of common stock under our employee stock-based compensation plans of $46.6 million. During 2013, we generated operating cash flows of $928.3 million. These operating cash flows related primarily to net income of $339.5 million, adjusted for, among... -

Page 55

... included in this Annual Report on Form 10-K for the year ended December 31, 2014 for additional details on our Credit Agreement. Historically, significant portions of our cash inflows were generated by our operations. We currently expect this trend to continue throughout 2015. We believe that... -

Page 56

... either directly or indirectly; and Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. Available-for-sale securities included in Level 2 are valued utilizing inputs obtained from an independent pricing service... -

Page 57

... cost method investments. Additional Disclosures Regarding Fair Value Measurements As of December 31, 2014, the fair value of the Convertible Notes, which was determined based on inputs that are observable in the market (Level 2) based on the closing trading price per $100 as of the last day... -

Page 58

... the year ended December 31, 2014. A portion of the funds used to repurchase stock over the course of the program was provided by net proceeds from the Convertible Notes offering, as well as proceeds from employee stock option exercises and the related tax benefit. In April 2014, in connection with... -

Page 59

... consolidated financial statements included in this Annual Report on Form 10-K for the year ended December 31, 2014 for detailed information on the Convertible Notes offering and the transactions related thereto. Purchase obligations represent non-cancelable commitments to purchase inventory ordered... -

Page 60

... STATEMENTS AND SUPPLEMENTARY DATA Our consolidated financial statements and related financial statement schedule, together with the report of independent registered public accounting firm, appear at pages F-1 through F-41 of this Annual Report on Form 10-K for the year ended December 31, 2014. 54 -

Page 61

... Vice President, Chief Operating Officer and Chief Financial Officer concluded that, as of December 31, 2014, our disclosure controls and procedures were effective in ensuring that material information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded... -

Page 62

... balance sheets of Citrix Systems, Inc. as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, equity, and cash flows for each of the three years in the period ended December 31, 2014 and our report dated February 19, 2015 expressed an unqualified... -

Page 63

ITEM 9B. OTHER INFORMATION Not applicable. 57 -

Page 64

... Company's definitive proxy statement pursuant to Regulation 14A, which proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after the close of the Company's fiscal year ended December 31, 2014. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND... -

Page 65

... December 31, 2011) Amendment to Amended and Restated 2005 Employee Stock Purchase Plan (incorporated by reference herein to Exhibit 10.17 to the Company's Annual Report on Form 10-K for the year ended December 31, 2012) Citrix Systems, Inc. Executive Bonus Plan (incorporated by reference herein... -

Page 66

... Exhibit 10.3 to the Company's Current Report on Form 8-K filed on April 30, 2014) List of Subsidiaries Consent of Independent Registered Public Accounting Firm Power of Attorney (included in signature page) Rule 13a-14(a) / 15d-14(a) Certification of Principal Executive Officer Rule 13a-14(a) / 15d... -

Page 67

... has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in Fort Lauderdale, Florida on the 19th day of February, 2015. CITRIX SYSTEMS, INC. By: /s/ MARK B. TEMPLETON Mark B. Templeton President and Chief Executive Officer POWER OF ATTORNEY AND... -

Page 68

... Officer) Executive Vice President, Chief Operating Officer and Chief Financial Officer (Principal Financial Officer) /S/ DAVID J. HENSHALL David J. Henshall /S/ DAVID ZALEWSKI David Zalewski Vice President, Chief Accounting Officer and Corporate Controller (Principal Accounting Officer... -

Page 69

... Schedule The following consolidated financial statements of Citrix Systems, Inc. are included in Item 8: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets - December 31, 2014 and 2013 Consolidated Statements of Income - Years ended December 31, 2014, 2013 and 2012... -

Page 70

...), Citrix Systems Inc.'s internal control over financial reporting as of December 31, 2014, based on criteria established in Internal ControlIntegrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated February 19, 2015... -

Page 71

... BALANCE SHEETS December 31, 2014 December 31, 2013 (In thousands, except par value) Assets Current assets: Cash and cash equivalents Short-term investments, available-for-sale Accounts receivable, net of allowances of $5,976 and $5,354 at December 31, 2014 and 2013, respectively Inventories, net... -

Page 72

... Ended December 31, 2014 2013 2012 (In thousands, except per share information) Revenues: Product and licenses Software as a service License updates and maintenance Professional services Total net revenues Cost of net revenues: Cost of product and license revenues Cost of services and maintenance... -

Page 73

... INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Ended December 31, 2014 2013 (In thousands) 2012 Net income Other comprehensive (loss) income: Change in foreign currency translation adjustment Available for sale securities: Change in net unrealized gains Less: reclassification adjustment... -

Page 74

... plans Stock-based compensation expense Common stock issued under employee stock purchase plan Tax benefit from employer stock plans Stock repurchases, net Restricted shares turned in for tax withholding Other Other comprehensive income, net of tax Net income Balance at December 31, 2012 366... -

Page 75

... Purchases of cost method investments Cash paid for acquisitions, net of cash acquired Cash paid for licensing agreements and product related intangible assets Other Net cash used in investing activities Financing Activities Proceeds from issuance of common stock under stock-based compensation... -

Page 76

... to work better. Citrix solutions power business mobility through secure, mobile workspaces that provide people with instant access to apps, desktops, data and communications on any device, over any network or cloud. Citrix markets and licenses its products directly to customers, over the Web, and... -

Page 77

... be disposed of are reported at the lower of carrying amount or fair value less costs to sell. For the year ended December 31, 2014, the Company identified certain intangible assets that were impaired within our Enterprise and Service Provider division and recorded non-cash impairment charges of $59... -

Page 78

... the Company's reportable segments during 2014 and 2013 (in thousands): Balance at January 1, 2014 Balance at December 31, 2014 Balance at January 1, 2013 Balance at December 31, 2013 Additions Other Additions Other Enterprise and Service Provider division $ 1,402,156 Mobility Apps division 366... -

Page 79

... materials and services and internal costs such as payroll and benefits of those employees directly associated with the development of new functionality in internal use software and software developed related to its Mobility Apps products. The amount of costs capitalized in 2014 and 2013 relating to... -

Page 80

...licensing agreements to have occurred when the related products are shipped and the end-user has been electronically provided the software activation keys that allow the end-user to take immediate possession of the product. For hardware appliance sales, the Company's standard delivery method is free... -

Page 81

... to use certain software code in its products or in the development of future products in exchange for the payment of fixed fees or amounts based upon the sales of the related product. The licensing agreements generally have terms ranging from one to five years, and generally include renewal options... -

Page 82

... that may exist with any single financial institution at a time. Pension Liability The Company provides retirement benefits to certain employees who are not U.S. based. Generally, benefits under these programs are based on an employee's length of service and level of compensation. The majority of... -

Page 83

... optimizes the delivery of virtual desktops and applications to mobile devices, was combined with Citrix HDX technology in the Citrix XenApp and XenDesktop products to deliver an improved user experience under adverse network conditions. Framehawk became part of the Company's Enterprise and Service... -

Page 84

...assumed in connection with the 2014 Acquisitions consisted of long-term debt, which was paid in full subsequent to the respective acquisition date. Goodwill from the 2014 Acquisitions was assigned to the Enterprise and Service Provider and Mobility Apps division segments. The goodwill related to the... -

Page 85

... Provider division. Citrix has integrated the Zenprise offering for mobile device management into its XenMobile Enterprise edition. The total consideration for this transaction was approximately $324.0 million, net of $2.9 million of cash acquired, and was paid in cash. Transaction costs associated... -

Page 86

... FINANCIAL STATEMENTS 4. INVESTMENTS Available-for-sale Investments Investments in available-for-sale securities at fair value were as follows for the periods ended (in thousands): December 31, 2014 Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Amortized Cost December 31, 2013 Gross... -

Page 87

... either directly or indirectly; and Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. Available-for-sale securities included in Level 2 are valued utilizing inputs obtained from an independent pricing service... -

Page 88

..., the Company utilized a discounted cash flow model using a discount rate reflecting the market risk inherent in holding securities of an early-stage enterprise, adjusted by the probability-weighted exit possibilities associated with the convertible debt securities. This methodology required the... -

Page 89

..., the fair value of the Convertible Notes, which was determined based on inputs that are observable in the market (Level 2) based on the closing trading price per $100 as of the last day of trading for the year ended December 31, 2014, and carrying value of debt instruments (carrying value excludes... -

Page 90

... detail of the total stock-based compensation recognized by income statement classification is as follows (in thousands): Income Statement Classifications 2014 2013 2012 Cost of services and maintenance revenues Research and development Sales, marketing and services General and administrative Total... -

Page 91

...order to model the stock price movements. The volatilities used were calculated over the most recent 2.76 year period, which was the remaining term of the performance period at the date of grant. The risk free interest rate was based on the implied yield available on U.S. Treasury zero-coupon issues... -

Page 92

...the Company's service based and market performance non-vested stock unit activity for the year ended December 31, 2014: WeightedAverage Fair Value at Grant Date Number of Shares Non-vested stock units at December 31, 2013 Granted Assumed from acquisitions Vested Forfeited Non-vested stock units at... -

Page 93

... the program was provided by net proceeds from the Convertible Notes offering, as well as proceeds from employee stock option exercises and the related tax benefit. The Company is authorized to make open market purchases of its common stock using general corporate funds through open market purchases... -

Page 94

..., for 2014, 2013 and 2012, respectively. These shares are reflected as treasury stock in the Company's consolidated balance sheets and statements of equity and the related cash outlays reduce the Company's total stock repurchase authority. Preferred Stock The Company is authorized to issue 5,000... -

Page 95

... willfully infringes the '011 patent through the sale and use of certain products. The jury awarded SSL Services $10.0 million. On September 17, 2012, the court issued a final judgment confirming the jury award of $10.0 million in damages and added $5.0 million in enhanced damages and approximately... -

Page 96

...FINANCIAL STATEMENTS 10. INCOME TAXES The United States and foreign components of income before income taxes are as follows: 2014 2013 (In thousands) 2012... income taxes are as follows: 2014 2013 (In thousands) 2012 Current: Federal Foreign State Total current Deferred: Federal Foreign State Total ... -

Page 97

... FINANCIAL STATEMENTS The significant components of the Company's deferred tax assets and liabilities consisted of the following: December 31, 2014 (In thousands) 2013 Deferred tax assets: Accruals and reserves Deferred revenue Tax credits Net operating losses Other Stock based compensation... -

Page 98

...tax benefits may change significantly over the next 12 months due to the possible closing of an ongoing examination. In July 2013, the FASB issued an accounting standard update that provides explicit guidance on the financial statement presentation of an unrecognized tax benefit when a net operating... -

Page 99

... its Enterprise and Service Provider division products and Mobility Apps division products. Segment profit for each segment includes certain research and development, sales, marketing, general and administrative expenses directly attributable to the segment as well as other corporate costs allocated... -

Page 100

...FINANCIAL STATEMENTS Identifiable assets classified by the Company's reportable segments are shown below. Long-lived assets consist of property and equipment, net, and are shown below. December 31, 2014 (In thousands) 2013 Identifiable assets: Enterprise and Service Provider division Mobility Apps... -

Page 101

... Workspace Services revenues are primarily comprised of sales from the Company's desktop and application virtualization products, XenDesktop and XenApp, and the Company's Mobility products, which include XenMobile and related license updates and maintenance and support. Delivery Networking revenues... -

Page 102

...product of the last reported sale price of the common stock and the conversion rate on each such trading day; or (3) upon the occurrence of specified corporate events. On or after October 15, 2018 until the close of business on the second scheduled trading day immediately preceding the maturity date... -

Page 103

...over the term of the Convertible Notes using the effective interest method with an effective interest rate of 3.0 percent per annum. The equity component is not remeasured as long as it continues to meet the conditions for equity classification. In accounting for the transaction costs related to the... -

Page 104

... the pricing of the Convertible Notes, on April 24, 2014, the Company entered into convertible note hedge transactions relating to approximately 13.9 million shares of common stock (the "Initial Bond Hedges"), with JPMorgan Chase Bank, National Association, London Branch; Goldman, Sachs & Co.; Bank... -

Page 105

... of future cash flows caused by changes in currency exchange rates, the Company has established a program that uses foreign exchange forward contracts to hedge its exposure to these potential changes. The terms of these instruments, and the hedged transactions to which they relate, generally do not... -

Page 106

...Portion) 2014 2013 Derivatives in Cash Flow Hedging Relationships Foreign currency forward contracts $ (11,197) $ 2,862 Operating expenses $ 2,123 $ (2,929) There was no material ineffectiveness in the Company's foreign currency hedging program in the periods presented. For the Year ended... -

Page 107

... income per share (in thousands, except per share information): Year Ended December 31, 2014 2013 2012 Numerator: Net income $ Denominator: Denominator for basic earnings per share - weighted-average shares outstanding Effect of dilutive employee stock awards: Employee stock awards Denominator for... -

Page 108

... completed during the first quarter 2015. Restructuring charges related to the reduction of the Company's headcount by segment consists of the following (in thousands): Year ended December 31, 2014 Enterprise and Service Provider division Mobility Apps division Total restructuring charges $ $ 14... -

Page 109

... related to the 2015 Restructuring Program are anticipated to be completed by the end of 2015. 18. RECENT ACCOUNTING PRONOUNCEMENTS In May 2014, the Financial Accounting Standards Board issued an accounting standard update on revenue recognition. The new guidance creates a single, principle-based... -

Page 110

CITRIX SYSTEMS, INC. SUPPLEMENTAL FINANCIAL INFORMATION QUARTERLY FINANCIAL INFORMATION (UNAUDITED) First Quarter Second Third Fourth Quarter Quarter Quarter (In thousands, except per share amounts) Total Year 2014 Net revenues Gross margin Income from operations Net income Earnings per share - ... -

Page 111

... against revenues. Uncollectible accounts written off, net of recoveries. Adjustments from acquisitions. Credits issued for returns. Related to deferred tax assets on unrealized losses and acquisitions. Related to deferred tax assets on foreign tax credits, net operating loss carryforwards, and... -

Page 112

...'s Current Report on Form 8-K filed on May 29, 2013) Specimen certificate representing Common Stock (incorporated herein by reference to Exhibit 4.1 to the Company's Registration Statement on Form S-1 (File No. 33-98542), as amended) Indenture, dated as of April 30, 2014, between Citrix Systems... -

Page 113

... Exhibit 10.3 to the Company's Current Report on Form 8-K filed on April 30, 2014) List of Subsidiaries Consent of Independent Registered Public Accounting Firm Power of Attorney (included in signature page) Rule 13a-14(a) / 15d-14(a) Certification of Principal Executive Officer Rule 13a-14(a) / 15d... -

Page 114

-

Page 115

... in this Annual Report reconciled to the most directly comparable GAAP financial measures. Twelve Months Ended December 31, 2014 Twelve Months Ended December 31, 2013 GAAP gross margn Add: stock-based compensation Add: amortization of product related intangible assets Non-GAAP gross margin 80... -

Page 116

... operational trends. • Amortization costs and the related tax effects are fixed at the time of an acquisition, are then amortized over a period of several years after the acquisition and generally cannot be changed or influenced by management after the acquisition. • Although stock-based... -

Page 117

... or technology relationships, financial information and results of operations for future periods, operating plans, product and price competition, strategy and growth initiatives, seasonal factors, natural disasters, stock-based compensation, licensing and subscription renewal programs, international... -

Page 118

... 152.01 180.44 192.62 159.95 Years ending Dec 14 153.33 205.14 221.02 181.66 Peer Group consists of companies with an SIC code of 7372 COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN $250 $200 $150 $100 $50 $0 2009 2010 2011 2012 2013 2014 Nasdaq Index S&P 500 Index Peer Group... -

Page 119

... and people to work better. Citrix solutions power business mobility through secure, mobile workspaces that provide people with instant access to apps, desktops, data and communications on any device, over any network and cloud. With annual revenue in 2014 of $3.14 billion, Citrix solutions are in... -

Page 120

Citrix Systems, Inc. | Annual Report 2014