Carphone Warehouse 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report: Business Review

Chief Executive’s Review continued

8 The Carphone Warehouse Group PLC Annual Report 2008

“We see considerable scope

for further expansion in

Europe and the US”

Charles Dunstone, Chief Executive Officer

We aim to be a mass market provider

in our major business lines by driving

for volume ahead of margin. We

then use our increased presence in

the market to improve our supplier

terms and reinvest these benefits

in the customer proposition.

Our long-term approach to

investment creates sustainable

competitive advantage in our chosen

markets. Investment is not just about

capex – although our commitment

to store openings and exchange

unbundling is significant – it is also

about marketing, brand-building

and customer recruitment.

ScaleInvestment

We are absolutely committed to

delivering value to customers across

all our services. Investment in the

right platforms is key to our ability

to develop a compelling customer

proposition, as it allows us to build

scale, and offer greater value and

an improved customer experience.

Scale also creates significant

efficiencies for our business, through

leveraging our fixed cost store base

and telecoms infrastructure. We

seek to maintain our competitive

advantage by continued investment

across the business.

Proposition Efficiency

Our virtuous circle

of performance

better handset availability from vendors translates into the best value and

choice for our customers. It is a virtuous circle, with this reinvestment in

turn generating further market share gains.

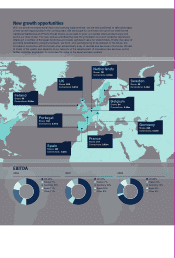

This year our store base grew by 267 net new stores. We opened 390,

closed or relocated 138, acquired a chain of 77 stores in Portugal at the

start of the year and sold our 62 Swiss stores just before the year end.

This shows how active we are in managing our portfolio – both with

respect to individual stores and also in relation to whole geographical

markets. Our store base has almost doubled in the last four years.

After five years of sustained growth in the European handset market, as

further penetration growth was supported by an accelerating replacement

cycle, many of our territories saw flat or negative market unit growth.

It is a testimony to the strength of our customer proposition that we

recorded mobile connections growth of 15% in this market environment.

In fact our retail chain did even better than these numbers suggest, with

total connections growth of 16% adjusting for a very weak year-on-year

performance from our “off-the-page” channel in the UK.

The key drivers of growth were the explosion in mobile broadband

modems, and a growing consumer interest in the “smartphone” category

of handsets that combine traditional calls and text messaging services

with email and other data functionality. This was a trend that we identified

early, and we added significant value to our network operator partners

by recruiting material volumes of high value data customers on their

behalf. These trends are set to continue in the coming year.

Best Buy Mobile, our US retail venture in partnership with Best Buy, has

comfortably exceeded our expectations. We have accelerated our roll-out

plans twice over the last 12 months and now intend to have a presence

in every Best Buy store in the US by the end of the current calendar year.

The customer response has been very positive and this has translated

into material sales uplifts. We are confident that, over time, this business

can become a meaningful “third leg” to the Group.

Looking forward, the next 12 months offer an exciting combination of

new growth opportunities and management challenges. We have chosen

to slow our rate of physical expansion temporarily, diverting more of our

resources towards the evolution of our retail proposition described in

the next section. Once we are satisfied that we have developed the right

formula of store format, product range and employee training to address

our changing marketplace, we will revert to the more aggressive space

growth demonstrated over the last four years. This year we plan to

open a net 120 new stores, but also invest in a large number of major

relocations and refits to maintain and improve the quality and relevance

of the estate.

There is no doubt that the consumer environment has been tougher

of late in a number of our markets, and we expect these conditions

to continue over the coming months. However, mobile phones have

long since passed from being a luxury item to an absolute necessity

in the eyes of most users; and the subsidised business model lessens

or removes the upfront cash cost. In addition, the new growth areas in

mobile data should lend support to our performance over the next year.

Developing our retail proposition

Last year I highlighted how the needs of our customers were changing.

Historically, The Carphone Warehouse and The Phone House have been

the places to go to find someone to guide you through the complexities

of the mobile phone market: to identify the right combination of handset,

network and tariff to suit your needs. We have never considered

ourselves to be retailers of hardware; our DNA is much more about

helping customers understand technology.

Our Strategy in Focus