Carphone Warehouse 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report: Business Review

Chief Executive’s Review

This has been a very successful year for The Carphone Warehouse.

Financially we have performed very well, with 12% growth in revenues

and 75% growth in headline pre-tax profit. Perhaps more importantly,

our operational performance has improved significantly. The additional

investment in our telecoms customer service we highlighted last year has

started to pay off, and our network investment is delivering better speeds

and reliability to an ever increasing proportion of the population.

Ultimately all of this has a direct financial payback: it improves the worth

of the brand in the marketplace, making customer recruitment easier;

and it drives down customer churn, increasing customer lifetime value.

We have grown strongly but we have also invested heavily: in our

telecoms network, our IT infrastructure, our stores and customer

recruitment. We are confident that this is all money well spent and

will generate a good return for shareholders over time. Weighing capital

structure considerations against opportunities to invest and grow is

always a difficult balance to strike. However, as always we place the

potential for long-term value creation above the shorter-term vagaries

of stock market fashions.

As a result net debt has increased substantially this year, affected also

by the weakness of sterling. But we will continue to invest in areas

which deliver competitive advantage: store growth, network capacity

and resilience and broadband market share, where we see good future

returns. We believe that our shareholders will continue to support us in

this strategy for as long as we explain our investment strategy coherently

and demonstrate value creation.

After the year end, we announced one of the most important

developments in the Group’s history: the formation of a new company

with Best Buy, one of the world’s leading consumer electronics retailers

and our partner in the US market. Under the terms of the deal, we are

to receive £1.1 billion in cash, and Best Buy will become 50% owners of

our retail chain and related assets. The newly formed company will not

only accelerate the evolution of our existing store proposition, as

described below, but also look to seize the significant opportunity

presented by the European consumer electronics market.

I make no apology for the short-term negative impact on our earnings

that this transaction creates. It should be seen in the context of the

long-term growth opportunities it presents, both for our core business

and new areas of retail where we have no current expertise but where

Best Buy are global leaders. I believe we have entered a new and very

exciting growth phase for the business.

Strategic context

Our strategic approach is built on three primary objectives. The first and

third of these objectives have been consistent for a number of years; the

second objective has changed over time to reflect the proposed evolution

of the retail business:

• To continue to grow mobile handset market share in all our geographical

markets, by investing in new store openings, achieving increased

productivity from our existing estate, and developing additional

distribution channels;

• To develop our retail proposition to meet the changing needs of

customers and suppliers, so that we offer the widest range of mobile

and fixed line broadband services and associated hardware alongside

the core mobile phone offer; and

• To become the leading alternative provider of fixed line

telecommunications services in the UK.

Through organic growth and acquisition, we have built up a unique set

of assets: a network of stores that act as the focal point of our interaction

with customers, both mobile and fixed line; a comprehensive fixed line

telecoms network covering the whole of the UK, delivering a mass market

all-IP platform that no-one else in the UK has yet replicated on the same

scale; and significant customer bases, creating valuable annuity revenue

streams to improve the quality of our earnings. Our strategic objectives

aim to leverage these assets to deliver long-term growth and value

creation to shareholders.

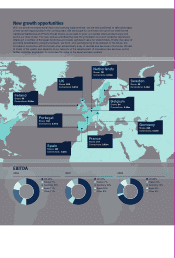

Growing our retail presence

Our core business of helping customers with their choice of mobile

handset, network and tariff remains one with attractive financial returns

and ongoing growth opportunities. Although Western European markets

are quite saturated, we believe that our constantly evolving proposition

can allow us to continue to grow market share, and establish ourselves

as the leading independent distributor in all of our geographical markets.

We see no structural barrier to reaching a similar share in our other

European markets as we see in the UK over time.

Why is market share important? Firstly, it makes us the independent

distributor of choice for network operators and handset vendors. Our

scale can influence their share of the market, and our trading terms

reflect this. Furthermore, our focus on handset range and availability

is supported by a regular supply of exclusive and first-to-market

models which differentiates us from our competitors.

Secondly, our growing market share allows us to reinvest the benefits of

scale into our customer proposition: improved terms from networks and

“As always, we place the

potential for long-term

value creation above the

shorter-term vagaries of

stock market fashions”

www.cpwplc.com 7

Business Review

Headline Financials

2008 2007

£m £m

Revenue 4,474.4 3,991.5

Distribution 3,116.2 2,917.8

UK Fixed Line 1,399.6 1,084.3

Eliminations (41.4) (10.6)

EBIT 258.3 149.5

Distribution 175.0 176.9

UK Fixed Line 125.6 19.7

PLC costs (36.2) (37.2)

JVs (6.1) (9.9)

Business Review

Charles Dunstone, Chief Executive Officer